US Consumer Spending Concentration: Wealthier Households Drive Majority of Expenditure, New-Vehicle Demand

In the United States, consumer spending patterns reveal a striking concentration of purchasing power among the wealthiest households. New analyses show that the top quintile of income earners accounts for a sizable share of overall consumption, with even greater dominance in big-ticket purchases such as new vehicles. This pattern, observed through data syntheses that combine economic projections and official statistics, underscores how income distribution shapes demand across the economy and how shifts in wealth can ripple through industries, labor markets, and regional growth.

Historical context: a long arc of rising inequality and consumer behavior The recent findings fit within a longer historical arc in which income concentration and consumer choices evolved in tandem with broader economic changes. After the mid-20th century, robust middle-class expansion gave way to more pronounced wage divergence, productivity gains, and financialization. In periods of strong job growth and rising asset values, higher-income households typically demonstrated faster growth in discretionary spending, including durable goods, travel, and automotive purchases. During economic downturns or periods of tightened credit, the burden of reduced expenditures frequently falls on lower-income households, even as the wealthiest groups retain some resilience through diversified portfolios or access to higher credit limits.

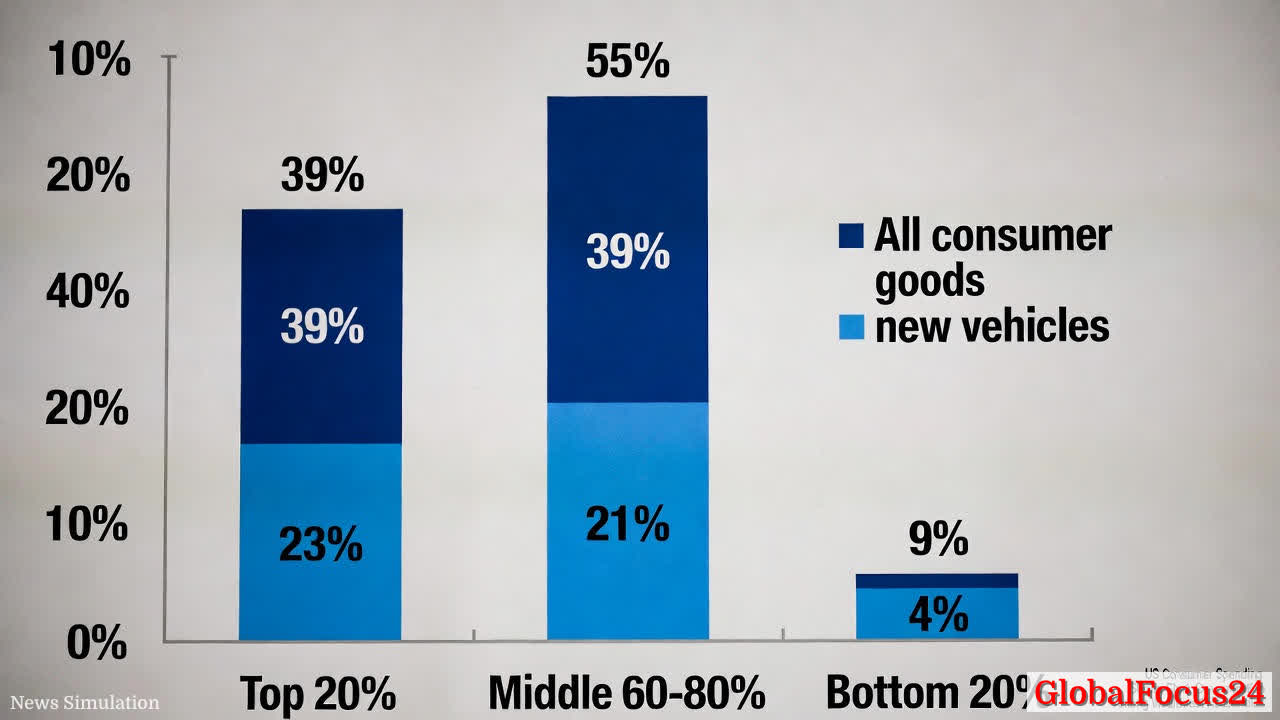

In this context, the current data illuminate how a small share of households can disproportionately influence demand for certain products and services. New vehicles, for example, have historically been a product with high sensitivity to income levels and credit conditions. Access to financing, favorable interest rates, and perceptions of reliability in job markets contribute to a readiness to purchase or upgrade vehicles. The latest numbers indicate that the top earners—roughly the leading 20 percent of households by income—drive nearly two-fifths of total consumer spending on goods and services and more than half of new-vehicle purchases.

Economic impact: echo effects across industries and regions The concentration of spending among wealthier households has several meaningful implications for the broader economy. First, demand for durable goods like vehicles, appliances, and electronics can strengthen or weaken more quickly based on shifts in high-income consumption. When top-tier households adjust their spending, downstream sectors—manufacturers, dealers, logistics networks, and even maintenance services—feel the impact through production schedules, inventory management, and employment.

Second, the distributional pattern can influence inflation dynamics and monetary policy transmission. If higher-income segments sustain robust demand for durable goods, hospitality, and services, price pressures in those sectors may persist, shaping how policymakers calibrate interest rates and credit conditions. Conversely, stronger spending concentrated among the top 20 percent may not translate into broad-based wage growth for lower-income groups, potentially affecting consumer confidence and the speed at which typical households adjust to evolving economic realities.

Regional comparisons: urban hubs vs. broader geographies Regional dynamics offer an instructive lens for understanding how this spending concentration manifests on the ground. Metropolitan areas with high concentrations of high-earning professionals—such as finance, technology, and professional services sectors—tend to exhibit stronger new-vehicle demand and elevated expenditures on discretionary goods. These regions often benefit from durable-goods retailer networks, car dealerships, and maintenance ecosystems that are tightly integrated with local employment concentrations.

In contrast, regions with larger shares of middle- and lower-income households may display a different spending rhythm. While overall consumer activity remains robust in many of these areas, the composition of purchases often tilts toward essentials and services, with more restrained purchases of big-ticket items like new vehicles. An accurate regional read of spending patterns requires assessing labor market structure, credit access, transportation infrastructure, and cost-of-living differences, all of which shape household decisions about large expenditures.

Industrial implications: manufacturing, supply chains, and auto markets The outsized role of high-income households in new-vehicle demand has direct implications for auto manufacturers, suppliers, and dealership networks. When a smaller, wealthier segment is responsible for a large share of purchases, manufacturers may adjust production planning to align with the expected cadence of demand from that segment. This can influence supplier orders, investment in innovation, and the pace of model refresh cycles. It can also affect regional investment, as auto plants and component suppliers may prefer locations with a workforce that aligns with customer demand profiles in those markets.

Beyond autos, the pattern of spending concentration touches sectors including housing, travel, and consumer electronics. Higher-income households tend to have a greater propensity to upgrade homes, purchase premium appliances, finance vacations, and invest in experiences that sustain ongoing demand for services and luxury goods. Retailers and service providers may respond with targeted product assortments, premium customer experiences, and financing options designed to appeal to households with greater discretionary capacity.

Public reaction and policy considerations: how societies respond to unequal consumption patterns Public sentiment around spending concentration often intersects with debates about economic opportunity and social mobility. When a sizable majority of consumption is concentrated within a shrinking share of households, concerns about widening divides can intensify, even as overall GDP growth remains positive. Policymakers may weigh measures that expand access to credit and improve job opportunities for lower- and middle-income families, as well as policies that encourage broad-based investment in education and skills training. The objective is not to dampen demand among high-earning households but to support a more inclusive growth trajectory that broadens participation in durable goods markets and related services.

Methodological notes: data sources and interpretation The reported figures draw on an apples-to-apples synthesis of domestic expenditure data, using official sources for household income distribution and consumer outlays, cross-referenced with contemporaneous analytics from reputable financial data firms. While the specifics may vary slightly depending on the exact year and method, the underlying pattern remains consistent: a relatively small portion of households accounts for a disproportionately large share of total spending, with even greater concentration in big-ticket purchases such as new vehicles.

This approach provides a nuanced view of demand dynamics without conflating consumption with overall wealth. Wealth and consumption do not move in lockstep, but persistent patterns emerge when income, access to credit, and consumer preferences intersect over time. The resulting narrative helps businesses, policymakers, and researchers understand where and how spending power concentrates, and what that means for markets, employment, and regional development.

Competitive landscape: implications for retailers and manufacturers For retailers, distinguishing high-potential segments is essential for growth strategy. Market segmentation, premium branding, and financing programs can be tailored to high-income households while maintaining accessibility for broader customer bases. For manufacturers, aligning production capacity and product development with the anticipated cadence of demand from wealthier consumers may improve efficiency and inventory management. Automotive brands, in particular, may continue to innovate in areas such as electrification, safety features, and connected-car technologies to appeal to discerning buyers who prize performance, status, and long-term value.

At the same time, mid- and lower-income segments remain vital for sustained market vitality. These households drive essential consumption and provide volume that supports economies of scale, competitive pricing, and employment across retail and manufacturing ecosystems. Businesses that balance premium offerings with accessible options can help broaden market participation while maintaining healthy margins.

Societal implications: investing in opportunity to diversify demand A resilient economy benefits from a broad-based consumer foundation. Efforts to increase wage growth, expand affordable credit access, and reduce the cost of essential goods can help widen participation in durable-goods markets over time. Investments in infrastructure, education, and workforce retraining can lift household earnings, enabling more families to engage with high-value purchases such as newer vehicles, home improvements, and advanced electronics.

Conclusion: a snapshot of a broader economic tapestry The concentration of US consumer spending among the wealthiest households, particularly in new-vehicle purchases, underscores how income distribution shapes demand across sectors and regions. While high-income households currently shoulder a larger portion of discretionary outlays, the implications extend beyond immediate sales figures. They touch employment, production planning, regional growth, and the pace of innovation in industries that rely on durable goods and consumer services.

As the economy evolves—amid shifting credit conditions, evolving vehicle technologies, and changing retirement and saving patterns—the balance of spending will continue to adapt. Observers, policymakers, and industry leaders will watch closely how income dynamics influence consumption and how strategies can foster broader participation in a dynamic, globally connected marketplace.