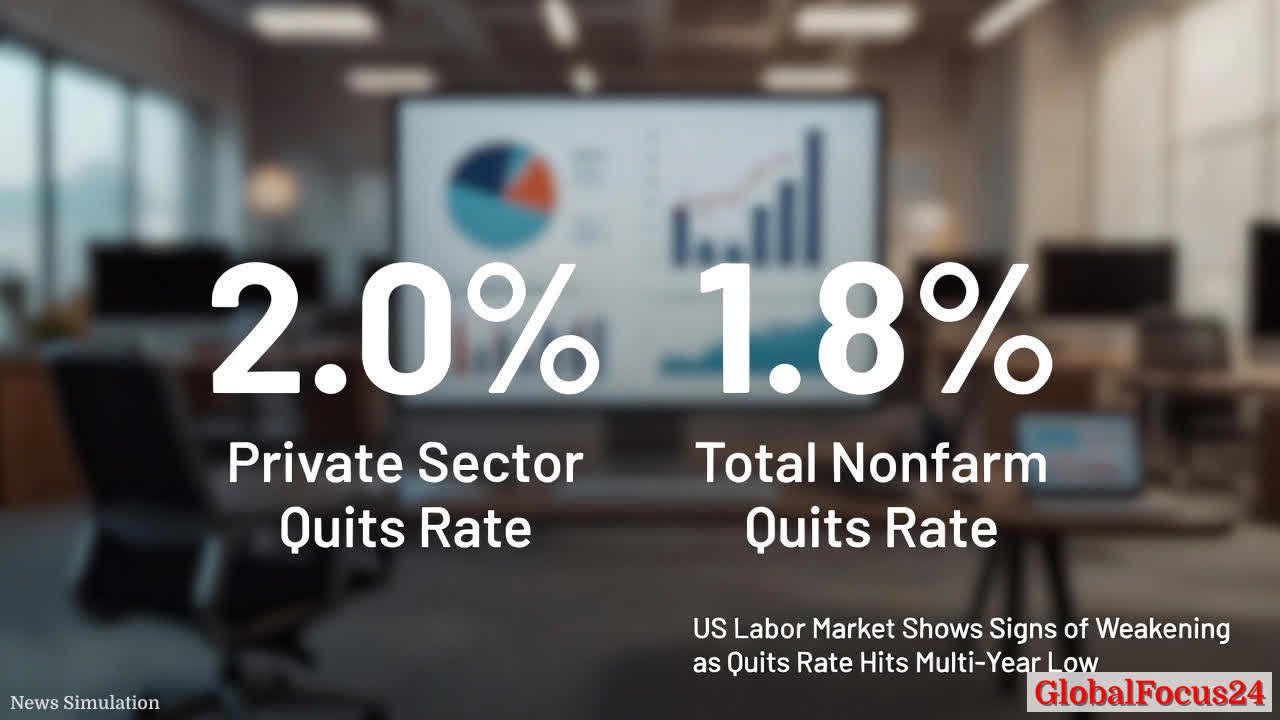

US Labor Market Shows Signs of Weakening as Quits Rate Declines to Multi-Year Lows

In a developing shift for the American labor market, new data indicate a cooling of voluntary job exits across the private sector, with the quits rate landing at 2.0% in October—the lowest since the early days of the COVID-19 pandemic. The broader nonfarm quits rate also slipped to 1.8%, a level not seen since May 2020. Together, the figures suggest a marked change from the frenetic labor market that characterized much of the post-recovery period, raising questions about the trajectory of employment, wage growth, and monetary policy in the months ahead.

Historical context helps frame the current moment. The United States has navigated a complex labor landscape over the past decade, marked by periods of robust job openings and high turnover, followed by the disruptive shocks of a global health crisis, rapid wage gains in certain sectors, and renewed volatility as policy rates moved to combat inflation. The recent downshift in quits rates aligns with a broader deceleration in hiring activity, a sign that workers may face fewer readily available opportunities as employers recalibrate labor needs in a slower-growing economy.

Economic implications flow from this shift. A declining quits rate often signals a reduction in workers’ confidence to switch jobs, which can dampen wage pressure and reduce the urgency for employers to raise compensation to attract talent. In the current environment, where hiring has slowed and vacancies have tightened, both workers and firms appear to be adjusting to a more cautious outlook. For policymakers, the data provide a nuanced signal: while labor market resilience remains in many sectors, the softening pace of labor turnover could temper wage escalation and influence models of inflation and growth.

Regional comparisons illuminate the uneven nature of the labor market’s cooling. In parts of the Midwest and certain sunbelt economies, industries such as manufacturing and logistics have faced persistent demand fluctuations, contributing to volatility in job separations. Coastal urban regions, long characterized by strong demand for specialized skills, have shown pockets of resilience, though even these areas are not immune to the broader slowdown in hiring momentum. The regional mosaic underscores that the health of the U.S. labor market is not uniform and is increasingly influenced by sector-specific dynamics, supply chain adjustments, and local economic cycles.

Industry-by-industry dynamics reveal a nuanced picture. Sectors that had previously benefited from high turnover and rapid job switching—such as hospitality, retail, and some service-oriented professions—are experiencing a recalibration as consumer demand patterns shift and labor costs become more constrained. Meanwhile, higher-skilled industries that rely on skilled trades and technical roles continue to navigate hiring freezes or more selective recruitment. This divergence contributes to a broader trend: the labor market appears to be moving from a phase of aggressive labor mobility toward a more deliberate matching of workers with roles that fit evolving business needs.

The labor market’s trajectory also intersects with monetary policy and inflation expectations. As wage growth cools in tandem with fewer voluntary quits, the pressure for rapid interest rate reductions may ease, though policymakers must balance the need to sustain economic momentum with the goal of anchoring inflation expectations. Market participants are watching for signs that the softening in labor turnover translates into slower wage inflation without triggering a broader slowdown that could hinder recovery efforts post-pandemic.

Historical benchmarks help contextualize today’s data. The current private-sector quits rate of 2.0% sits below peak levels seen during earlier economic expansions when job hopping served as a sign of robust demand for labor. Yet, it remains higher than the most subdued readings in recessions, illustrating a still-fragile balance between available opportunities and worker mobility. When compared to the 2008 financial crisis era, the present figures reflect a different mechanism at work: structural changes in labor markets, evolving skill requirements, and the lingering effects of policy interventions implemented in the wake of recent economic disruptions.

The public reaction to these developments is mixed but cautious. Employees watching for better opportunities in a volatile macroeconomic environment might interpret the lower quits rate as a signal to re-evaluate risk, potentially delaying career moves until more clarity emerges about wage growth and job security. Employers, on the other hand, are adjusting hiring expectations, emphasizing retention strategies, training investments, and more selective recruitment to align payroll costs with evolving demand.

From a policy perspective, the trend invites a careful examination of labor market levers. If the declines in quits and hiring pace persist, central banks and fiscal authorities may prioritize measures that support economic stability without reigniting inflationary pressures. The balance between encouraging productivity, supporting consumer spending, and maintaining price stability remains delicate, particularly as regional disparities and sectoral differences complicate a one-size-fits-all approach.

The road ahead is uncertain, with several potential scenarios shaping the outlook. A continued deceleration in labor market turnover could indicate a cooling economy, with potential spillovers into consumer confidence and spending patterns. Alternatively, if hiring activity stabilizes and wage growth remains contained, the economy could maintain a steady rhythm with moderate growth and reduced labor-market volatility. Analysts emphasize that outcomes will hinge on a mix of demand recovery, supply chain normalization, and policy responses that adapt to evolving conditions.

In the broader context of the labor market, the latest data underscore the evolving relationship between job openings, quits, and unemployment. The quits rate acts as a proxy for workers’ confidence in finding favorable opportunities, while hiring trends reflect employers’ readiness to onboard new talent. As these signals interact with inflation dynamics and broader economic indicators, the public and investors will remain attentive to forthcoming releases that could reshape expectations for growth, wages, and the tempo of the recovery.

Regional voices add texture to the national narrative. In manufacturing hubs, plant closures or production adjustments have tightened labor markets, while service centers in metropolitan areas have faced a mix of seasonal demand and regulatory considerations. In agricultural communities, seasonal fluctuations interact with labor supply constraints, illustrating how local conditions influence national statistics. Across the country, the pace of economic renewal remains uneven, reinforcing the importance of resilient policies that support both workers’ mobility and firms’ capacity to attract and retain talent.

Overall, the latest quits data mark a notable shift in the U.S. labor market’s rhythm. The private-sector quits rate at 2.0% and the overall nonfarm quits rate at 1.8% reflect a cooling of job switching that could ease wage pressure and contribute to a more balanced nonfarm payroll picture. While not a signal of an imminent recession, the figures emphasize caution for both employers and policymakers as they navigate a landscape of slower hiring, evolving skill demands, and regional disparities. The coming months will be pivotal in determining whether the labor market maintains its resilience or slides into a softer ground in the face of external shocks and shifting policy settings.