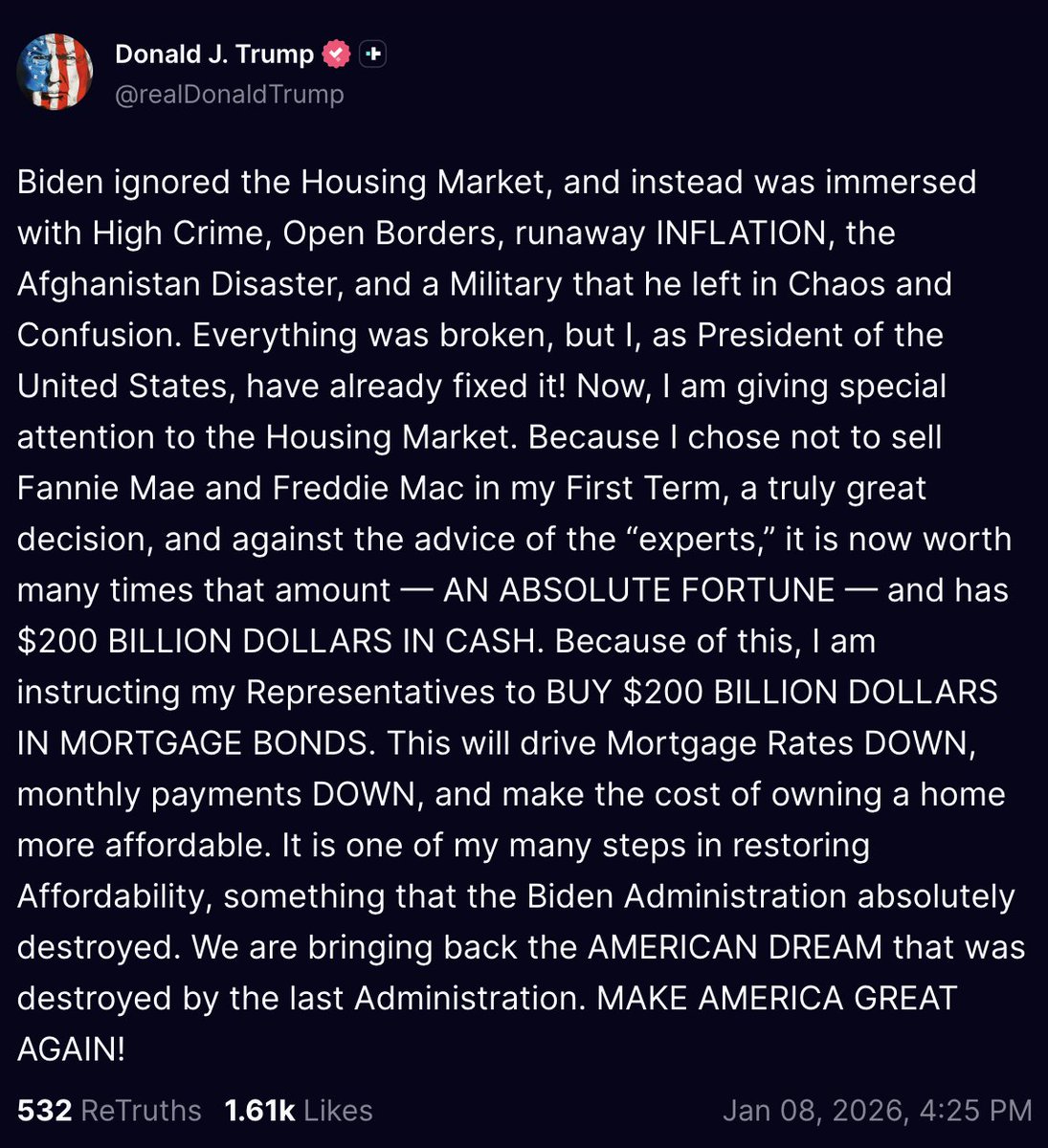

Trump Administration Announces $200 Billion Mortgage Bond Purchase to Boost Housing Affordability

A new policy initiative aimed at lowering mortgage costs and expanding homeownership opportunities has been unveiled, signaling a significant federal effort to influence the housing market through coordinated debt purchases. The plan, valued at $200 billion, would involve the government acquiring mortgage-backed securities as a mechanism to influence interest rates and monthly payments for American families seeking to buy homes.

Historical context and policy rationale The concept of using government balance-sheet interventions to affect mortgage markets is not new. In the wake of the 2008 financial crisis, federal agencies and the Federal Reserve undertook measures to stabilize housing finance, including actions involving Fannie Mae and Freddie Mac, government-sponsored enterprises that undergird the secondary mortgage market. Over time, policymakers debated the optimal form of government involvement, balancing the desire for affordable housing with considerations about market distortions, fiscal risk, and long-term reforms of housing finance.

Proponents of the current plan argue that stabilizing and lowering mortgage rates can help households facing rising costs, especially in regions where housing affordability has deteriorated due to rapid demand, supply constraints, and inflationary pressures. Supporters suggest that a targeted purchase program could reduce monthly payments for new borrowers, stimulate home construction and related sectors, and support broader economic activity linked to homeownership, such as home improvements, furniture, and local services.

Economic impact and channels The proposed $200 billion program would operate primarily through the secondary mortgage market, where mortgage-backed securities are bought and sold by investors. By expanding demand for these securities, the plan aims to compress yields, potentially lowering mortgage rates across a range of loan sizes and borrower profiles. In theory, more affordable financing could translate into lower monthly payments, greater housing turnover, and increased buyer confidence.

- Mortgage rate transmission: If the program successfully reduces long-term interest rates, borrowers with conventional and government-backed loans could see noticeable reductions in monthly payments, depending on loan-to-value ratios, credit scores, and loan programs.

- Housing demand and construction: Lower financing costs can boost demand for homes, potentially supporting new construction activity and associated jobs in real estate, construction, and trades.

- Regional effects: Housing markets are highly regional. Areas with elevated prices, tight supply, or strong rental demand may experience more pronounced affordability improvements, while regions with softer markets could see more subdued responses.

- Fiscal and balance-sheet considerations: A program of this scale requires careful attention to potential impacts on the federal balance sheet, future borrowing costs, and the risk of unintended distortions in credit availability or asset prices.

Regional comparisons and market dynamics Housing affordability varies widely across the United States. Coastal urban centers have historically faced higher price-to-income ratios, while many inland markets offer more favorable price-to-income dynamics, albeit with varying levels of supply constraints. The effectiveness of a mortgage-bond purchase program can differ based on regional lending ecosystems, the maturity structure of existing mortgage books, and the depth of credit markets.

- High-cost metros: In markets with housing shortages and high prices, even modest reductions in mortgage rates could unlock a larger number of transactions and reduce monthly payments by a meaningful percentage for certain loan types.

- Mid-sized and growing regions: Areas experiencing population growth and expanding employment opportunities may see stronger housing activity if financing costs decline, though supply constraints still pose a risk to price trajectories.

- Slow markets: In regions where demand is weak or inventory is abundant, rate reductions may have a more modest effect on transaction volumes and affordability metrics.

Public reaction and social considerations Public responses to government interventions in the housing market typically reflect a mix of enthusiasm for improved affordability and concern about long-term consequences. Key considerations include the transparency of program design, the distribution of benefits across income groups, and the potential for market distortions or moral hazard if investors anticipate ongoing government support for mortgage financing. Historians and economists often advise balancing short-term relief with sustainable reform of housing finance, including expanding supply, improving zoning and permitting processes, and encouraging private capital to participate in affordable housing initiatives.

Comparison with historical benchmarks Analysts will likely compare the current proposal to past interventions that sought to stabilize or influence mortgage lending. Historical benchmarks include coordinated central-bank actions during housing-market crises, long-run reforms in government-sponsored mortgage enterprises, and stimulus-era policies that blended monetary and fiscal tools to support housing activity. Observers will assess whether the current approach yields durable reductions in borrowing costs, how it affects credit access for first-time buyers, and whether gains are sustained once policy support wanes.

Implications for homeowners and future policymakers For current homeowners, the program could influence refinancing dynamics and housing equity—if mortgage rates fall, homeowners with existing adjustable-rate or high-rate loans might consider refinancing to lock in lower payments. For first-time buyers, more favorable financing terms could reduce barriers to entry and expand access to homeownership opportunities that have been constrained by price growth and debt aversion.

From a policymaking perspective, the plan underscores the ongoing debate over the proper role of government in housing finance. Proponents argue that targeted interventions can support affordability and economic vitality, while critics warn that reliance on balance-sheet tools may crowd out private capital, shift risk to taxpayers, or create dependency cycles that complicate long-term reform.

Broader macroeconomic context Affordability is just one facet of a broader housing market dynamic that includes supply-side constraints, wage growth, inflation, and mortgage-accessibility. Market observers will watch for concurrent indicators such as housing starts, permit issuance, rental-market trends, and consumer sentiment regarding housing stability. The interplay between mortgage financing costs and labor market conditions will also inform assessments of the policy’s effectiveness and sustainability.

Final considerations and outlook As with any large-scale policy intervention, the ultimate success of a $200 billion mortgage-bond purchase program will depend on its design specifics, execution, and the evolving economic environment. Transparency, careful calibration to avoid unintended consequences, and clear sunset provisions are widely regarded as essential elements of responsible implementation. Policymakers will also need to monitor for spillover effects in related financial markets and ensure that opportunities to improve housing affordability reach a broad cross-section of Americans, including first-time buyers and underserved communities.

In sum, the initiative represents a significant lever in the ongoing discussion about housing policy and affordability. By mobilizing government-backed assets to influence financing costs, the plan seeks to unlock homeownership opportunities, support economic activity tied to housing, and address affordability concerns that have persisted in many regions. The coming months will reveal how this approach interacts with market dynamics, regional housing patterns, and the broader economic trajectory as households weigh their options in a shifting financial landscape.