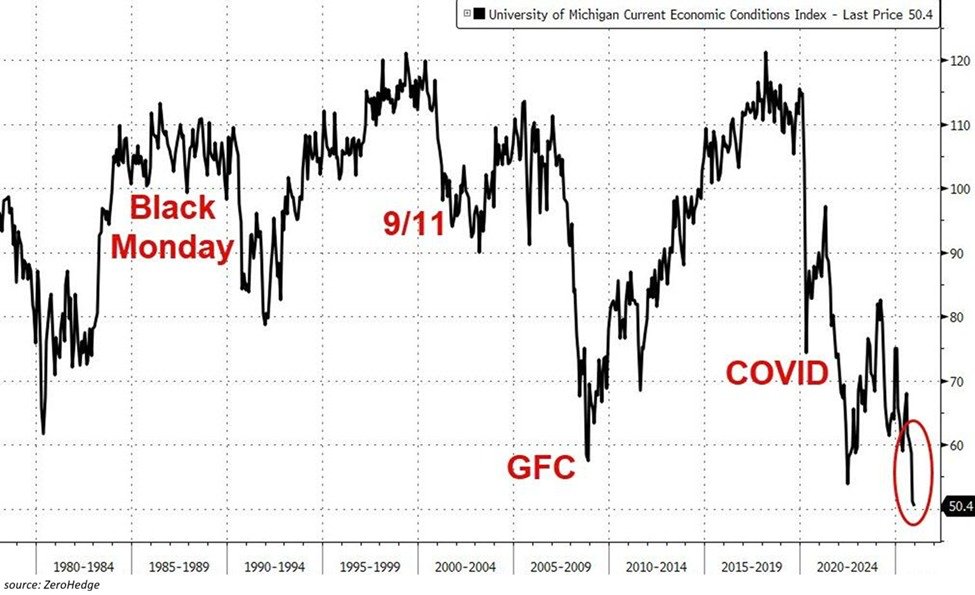

U.S. Consumer Sentiment Collapses to Record Low 50.4, Prompting Widespread Economic Ripples

The University of Michigan’s latest Current Economic Conditions Index has fallen to a historic low of 50.4, signaling the steepest drop in consumer confidence since the series began. The reading, which aggregates judgments about personal finances, business conditions, and the buying climate, underscores a broad-based erosion of American households’ sense of financial security and economic momentum. In practical terms, the figure points to a pervasive perception that the near-term horizon is fraught with difficulty, even as the longer-term outlook remains unsettled for many families and businesses alike.

Historical context and the arc of consumer mood Since the inception of the Michigan index, periods of acute financial stress have typically mirrored sharp declines in confidence. The current report resonates with the memory of mid-2000s turbulence and the early days of the COVID-19 shock, yet it stands out for the breadth of factors weighed by households. Economists note that the index’s current subcomponents—finances, business conditions, and buying conditions—have all moved in negative directions, with consumers particularly unsettled about large purchases such as homes, automobiles, and durable goods.

The severity of this read accompanies a complex policy and macroeconomic backdrop. Inflation persistence, higher interest rates, and a cautious labor market have combined to tighten household budgets. The result is a notable shift in consumer behavior: diminished willingness to commit to long-term expenditures, increased caution around discretionary spending, and a greater preference for saving in response to perceived economic fragility. This dynamic can slow momentum in consumer-driven sectors and create a feedback loop that reinforces the very conditions that weigh on sentiment.

Regional variations and perspectives Economists emphasize that sentiment is not uniform across the country. Regions with stronger housing markets, diverse industry bases, and more robust labor markets often display relatively resilient mood compared with areas facing manufacturing downturns, energy-price volatility, or seasonal employment fluctuations. The divergence underscores the importance of local context: a consumer may feel confident in job prospects in one city while experiencing soft demand for autos or home improvements in another.

Historical comparisons illuminate the magnitude of today’s decline. While downturns tied to the Great Recession, the dot-com bust, and shocks like the COVID-19 pandemic disrupted confidence, the current drop is notable for its breadth and continuity across multiple survey measures. The data suggest that the energy of household balance sheets—savings rates, debt levels, and liquidity buffers—will be critical in assessing the resilience of consumption in the coming quarters.

Economic impact and spillover effects A sagging consumer sentiment index frequently foreshadows softer retail sales, slower housing activity, and tempered demand for durable goods. Retailers and manufacturers monitor sentiment closely because it often translates into revised earnings expectations and investment plans. When households feel less confident about their short-term finances, they are more likely to delay significant purchases, which can reduce fourth-quarter revenue streams and complicate forward-looking guidance for consumer-focused businesses.

The broader economy could experience a ripple effect beyond retail. Weaker consumer demand tends to drag down services that rely on discretionary spending, such as travel, entertainment, and hospitality. Conversely, sectors tied to essential goods and services may see steadier performance, as households reallocate budgets toward necessities. Policy responses and monetary conditions will also shape the trajectory of consumption by influencing credit availability, mortgage rates, and loan terms for households and small businesses.

Labor market dynamics and household finances Labor market health plays a crucial role in consumer confidence. While unemployment rates may improve or hold steady, the perceived quality of jobs—wage growth versus price increases, hours worked, and job security—often weighs more heavily on sentiment thanunemployment figures. In an environment where inflation remains stubborn and interest rates are elevated, even workers with secure employment can judge their financial futures through a more cautious lens.

Household balance sheets are another focal point. A high savings rate can cushion downturns, but it may also reflect a preference to delay expenditures rather than a sign of robust financial health. Conversely, elevated debt burdens can amplify concerns when interest costs rise or when variable-rate loans reset at higher rates. The current reading suggests households are recalibrating expectations about future purchasing power, which could have lasting consequences if confidence does not rebound in tandem with improvements in inflation and wage growth.

Regional resilience and adaptation Despite the gloom in aggregate sentiment, pockets of resilience persist. Regions that have diversified economies, access to high-skilled labor markets, and strong export opportunities may demonstrate greater steadiness in consumer expectations. Investments in infrastructure, energy transition initiatives, and technology adoption can bolster local employment prospects and support consumer confidence over time. Policymakers and business leaders may focus on targeted measures to strengthen regional economies, cultivate job opportunities, and stabilize household budgets.

Implications for policymakers and markets The record-low confidence reading adds another layer to the policy debate surrounding inflation, growth, and financial stability. Central banks and fiscal authorities face a delicate balancing act: cooling inflation without triggering a harsher downturn that could further erode confidence. Market participants will parse the data for signals about the timing of policy shifts, the trajectory of interest rates, and the pace of quantitative easing or tightening. In a sentiment-driven environment, expectations can become self-fulfilling, amplifying the effects of any policy announcement on financial markets, consumer credit, and business investment.

Strategic implications for businesses For companies reliant on consumer spending, the current mood calls for prudent planning and agile execution. Firms might prioritize core offerings, value-oriented products, and flexible financing options to ease consumer constraints. Marketing strategies that emphasize practicality, durability, and long-term savings can resonate in a climate where shoppers are discerning and cautious. Supply chains, too, may need to adapt to softer demand, with a focus on inventory discipline and cost efficiency to preserve margins.

Historical context for investors Investors analyze sentiment as part of a broader framework that includes leading indicators like job growth, inflation trends, and consumer credit conditions. A record-low sentiment reading does not automatically predict a recession, but it does raise the probability of slower growth in the near term. Diversified portfolios, risk management, and a focus on quality earnings become especially relevant in an environment where consumer behavior could sway a wide range of sectors.

Regional comparisons offer additional insight. In economies with high consumer confidence, consumer-driven growth can sustain expansions even when external conditions tighten. In contrast, regions with greater exposure to interest rate-sensitive sectors may experience amplified effects from shifts in sentiment, underscoring the importance of tailoring economic policy and business strategies to local realities.

Public reaction and social context Public sentiment about the economy often intersects with daily life in tangible ways. Delays in big-ticket purchases, longer planning horizons for home improvements, and heightened caution around debt can color social attitudes and community planning. Families may re-evaluate priorities, shifting from expansion to maintenance and optimization of existing assets. The emotional dimension of economic anxiety—while not a standalone predictor—can influence consumer behavior in ways that reinforce the measured declines in confidence.

The road ahead Economists expect the trajectory of consumer sentiment to hinge on several intertwined factors: persistent inflation or its deceleration, the pace of wage growth relative to living costs, the strength of the labor market, and the effectiveness of policy measures aimed at stabilizing prices and supporting household finances. If inflation cools and job prospects remain solid, sentiment could stabilize and gradually improve. If costs remain elevated or if financial conditions tighten further, optimism may lag, extending the period of cautious consumer behavior.

In sum, the record-setting Michigan index near 50.4 encapsulates a moment of pronounced caution across the U.S. economy. While it signals potential headwinds for consumer spending and growth, it also highlights areas where resilience persists and opportunities for policy intervention exist. As households recalibrate, businesses adjust, and policymakers respond, the coming quarters will reveal how deeply this mood shift will reshape economic performance and regional dynamics across the nation.