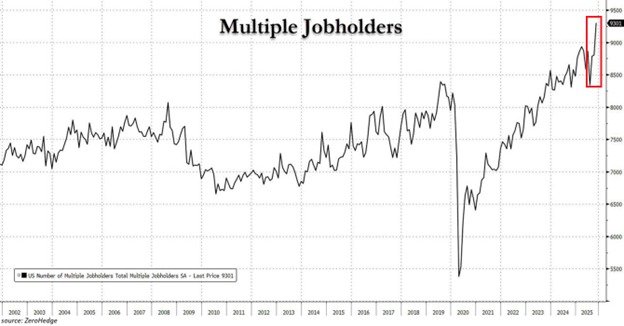

Record Surge in Multiple Jobholders Reflects Deepening Cost-of-Living Pressures

A sustained rise in Americans taking on more than one job has emerged as a defining feature of the current labor market, signaling ongoing economic strain even as job openings remain robust in many sectors. Fresh data show a sharp uptick in the number of people holding multiple jobs, with October and November collectively pushing the total to a record 9.3 million individuals. The surge, measured against earlier benchmarks, underscores the persistent pressures households face from rising prices for housing, healthcare, energy, and everyday goods.

Historical context: a long arc of labor-market resilience and household constraint The latest figures place the prevalence of multiple jobholders at 5.8% of total employment, a share that approaches the highest levels recorded over the past 25 years. This metric has fluctuated in the past two decades in response to macroeconomic cycles, shifts in wage growth, and changes in work arrangements. The current level exceeds previous peaks seen during earlier economic recoveries and sits well above the lows seen during the depths of the 2020 pandemic shock. While the labor market has shown elasticity—evidenced by a low unemployment rate and steady job growth—the composition of work has grown more complex for many households.

The data point to two complementary narratives. First, a portion of workers are leveraging multiple roles to bridge gaps between stubbornly high living costs and stagnant wage growth. Second, employers in certain industries continue to rely on gig or part-time staffing models, creating pathways for workers to piece together earnings across distinct jobs. Taken together, these factors illuminate how households are adapting to a evolving cost structure that tightens monthly budgets.

Economic impact: ripple effects across pay, productivity, and consumer behavior Economists note several channels through which a rising pool of double-job earners affects the broader economy. On the micro level, households juggling multiple roles often manage tighter schedules, with potential implications for sleep, health, and family life. From a macro perspective, the aggregate income of these workers helps sustain consumer demand, particularly for essentials and discretionary goods in periods of inflation. Yet the dynamic can also intensify wage-pressure competition, as workers weigh the value of adding hours or taking on additional roles against the trade-offs of time and fatigue.

Labor-force participation remains a central theme. The growth in multiple jobholding aligns with a broader pattern of heightened labor-market activity that has persisted despite price pressures. Businesses in sectors such as retail, hospitality, healthcare, and professional services have reported ongoing staffing needs, which, in some cases, facilitate more flexible scheduling and, for some workers, the opportunity to piece together a portfolio of roles rather than a single full-time position. This flexibility can help maintain labor supply and support household consumption, even as households manage debt, rent or mortgage payments, and rising utility costs.

Regional comparisons: variance in cost pressures and employment opportunities Geographic disparities in cost of living and wage dynamics help explain why some regions experience stronger growth in multiple jobholding than others. Urban areas with elevated housing costs, high transit expenses, and steep healthcare premiums have historically shown a higher propensity for workers to supplement income through additional roles. In contrast, regions with more affordable housing markets and competitive wage levels may see slower growth in multiple job arrangements, even when overall unemployment remains low. The regional mosaic reflects a complex interplay between local industries, cost structures, and the availability of part-time or flexible positions.

Sectoral analysis: which industries feed the trend?

- Retail and hospitality: The nature of service-sector work often accommodates part-time shifts and supplemental roles, which can attract workers seeking to bolster earnings amid inflationary pressures.

- Healthcare: Fluctuating demand and staffing shortages in certain specialties can lead professionals to take on additional shifts, particularly in hospitals and clinics experiencing high patient volumes.

- Professional and administrative services: Flexible work arrangements and freelance or contract roles enable skilled workers to assemble multiple income streams without committing to a single employer.

- Transportation and logistics: As supply chains recalibrate, drivers and warehouse workers may pursue secondary roles to capitalize on peak demand periods or to diversify earnings.

Notable contrasts with historical crises The current trajectory differs in meaningful ways from past shocks. During the 2008 financial crisis, rising unemployment and tighter credit constrained household budgets, leading to slower gains in secondary employment. The present environment features a more dynamic job market with persistent demand in many sectors, even as households face higher costs. This combination has encouraged a diversity of work arrangements, including hybrid and flexible schedules that can accommodate multiple jobs without sacrificing family responsibilities. The result is a labor-market landscape that is simultaneously adaptable and pressure-filled for households managing everyday expenses.

Public reaction and social implications Public sentiment around the rise in multiple jobholding is mixed. Many workers express a pragmatic approach to meeting essential needs, while others report stress associated with juggling schedules, caregiving responsibilities, and fatigue. Employers, for their part, are increasingly mindful of the burn-and-turn cycle in labor supply and may experiment with scheduling and benefits designed to improve retention and attract workers who seek flexibility. Community organizations and policy advocates are highlighting the importance of affordable housing, accessible healthcare, and energy assistance as they monitor how households navigate the broader cost-of-living environment.

Policy considerations: addressing root causes without stifling opportunity Policymakers face a balancing act. On one hand, strengthening wage growth in line with or above inflation can help reduce the need for supplementary employment, while on the other hand, ensuring that labor markets remain flexible and open to diverse work arrangements is essential for growth. Targeted measures to ease cost burdens—such as affordable housing initiatives, energy subsidies, and healthcare affordability programs—could alleviate the pressures that drive workers to pursue multiple jobs. Data-driven approaches to assessing regional disparities can help tailor interventions to communities most affected by rising costs.

Outlook: what comes next for workers and markets Looking ahead, the trajectory of multiple jobholding will depend on a mix of wage dynamics, inflation trajectories, and the pace of housing and energy cost movements. If inflation continues to ease and wages rise in a sustainable manner, some households may consolidate earnings into fewer roles. However, if price pressures persist or intensify, more workers may find that maintaining several income streams remains a practical necessity. Employers will likely continue to adapt with scheduling innovations and compensation models designed to attract and retain talent in a competitive labor market.

Conclusion: a living picture of economic strain and resilience The record surge in multiple jobholders stands as a telling indicator of how American households are navigating a complex economic landscape. It reflects resilience in the face of rising living costs, a willingness to adapt work arrangements, and the ongoing role of the labor market in sustaining consumer demand. As communities, businesses, and policymakers respond to these developments, the focus remains clear: aligning earnings with the cost of living while maintaining opportunities for flexible, productive work.