Inflation Data Quality Hits Record Low: A Closer Look at Core CPI Estimation and Its Implications

In recent months, the quality of consumer price inflation data has drawn heightened scrutiny from economists, policymakers, and market participants. A new report indicates that the quality of core Consumer Price Index (CPI) data has deteriorated to an unprecedented degree, with a record 40% of core CPI items estimated in October. This shift, driven in large part by gaps in price observations, has sparked a broader conversation about the reliability of inflation measures, the methods used to fill missing data, and the potential implications for monetary policy, financial markets, and household decision-making.

Context and what the data shows

The Bureau of Labor Statistics (BLS) compiles CPI by tracking roughly 90,000 monthly price observations across about 200 distinct categories of goods and services. Under normal circumstances, this process relies on actual price data collected from outlets, online retailers, and other sources. When price observations are unavailable for a given item or category, the BLS employs estimation techniques to fill the gaps. Historically, estimated entries have represented about 10% of total price observations, a manageable share that still allows the data to retain a high degree of fidelity to actual price movements.

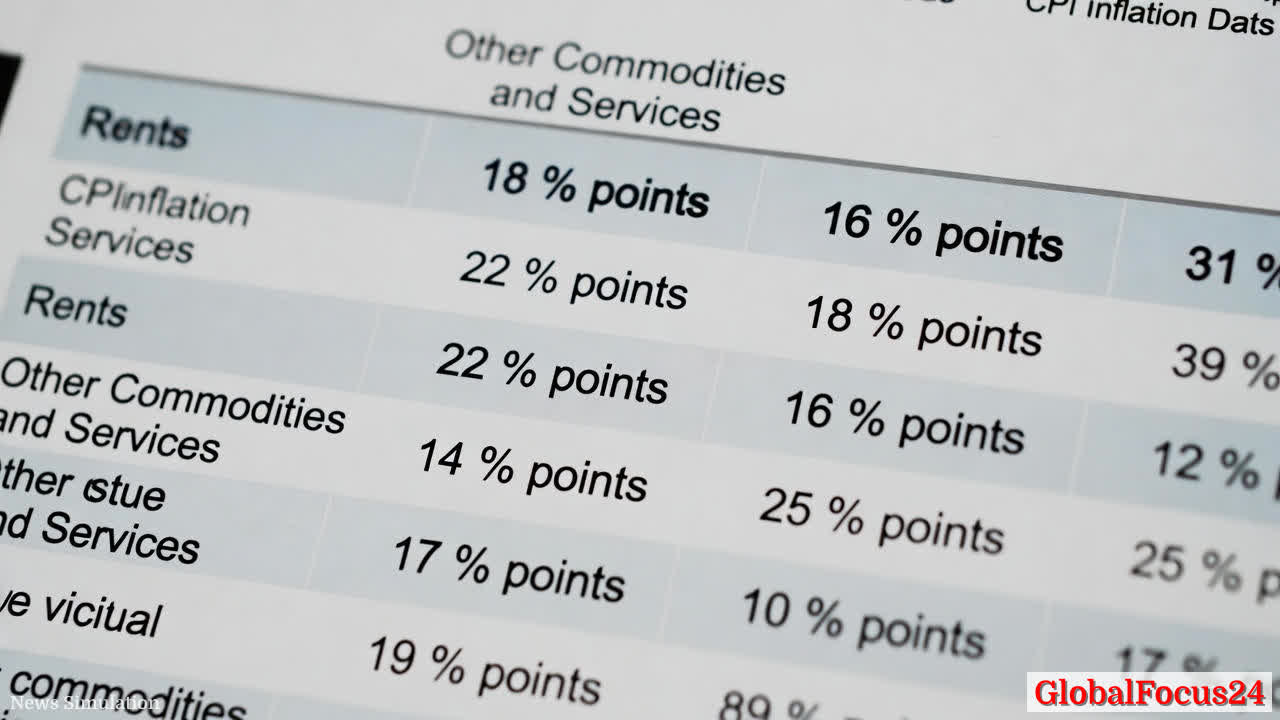

The October report, however, reveals a striking departure from typical practice. About 34% of all inflation components were estimated using data from other items or geographies. More alarmingly, 40% of core CPI items relied on estimation rather than actual observed prices. Within this estimated portion, rents accounted for a substantial share—22 percentage points—while other commodities and services contributed an additional 18 points. The combination of a high estimation rate with a concentration in housing-related components underscores a structural vulnerability: when real-time price signals are sparse in a sector as large and economically consequential as housing, the signal-to-noise ratio for inflation can deteriorate quickly.

Why estimation rose and how it is conducted

Several factors have contributed to the surge in estimations. Market segmentation, supply chain disruptions, regional price variation, and data collection hurdles can all yield gaps in observed prices. In such cases, the BLS uses established estimation frameworks that draw on related items, adjacent geographies, or historical relationships to infer plausible price movements. The goal is to maintain timely inflation indicators that reflect broad economic conditions, even when perfect price information is unavailable.

Estimation methods typically involve cross-item correlations, hedonic adjustments, and geographic extrapolation. For example, if direct rent data is missing for a city, the BLS might interpolate using rents from similar metropolitan areas or apply known rent trends from national or regional indices. While these techniques help preserve the cadence of inflation reporting, they also introduce additional layers of approximation that may amplify uncertainty, particularly when the underlying data environment is shifting rapidly.

Implications for accuracy, reliability, and confidence

The integrity of inflation data is foundational to macroeconomic analysis and policy. Core CPI—stripped of volatile energy and food prices—provides a lens into persistent price pressures and underlying inflation dynamics. When a sizable share of core items are estimated rather than observed, several implications arise:

- Measurement error risk increases. Estimations rely on assumptions and patterns that may diverge from actual price movements, especially in periods of economic transition or sector-specific shocks.

- Confidence may erode. Markets and households depend on CPI as a gauge of cost-of-living changes. Widespread estimation can feed skepticism about how accurately inflation signals reflect real experiences.

- Policy signaling could be affected. Central banks and fiscal authorities rely on reliable metrics to calibrate interest rates, wage negotiations, and social program adjustments. A data quality headwind can complicate policy communication and expectations management.

Beyond thestatistic, the geographic and sectoral composition of estimated prices matters. If rent-related estimates dominate the estimated portion, it could magnify concerns about housing affordability metrics, rental inflation, and the broader housing market cycle. In turn, this has knock-on effects for mortgage rates, rental markets, and urban planning considerations.

Historical context: inflation data quality over time

Inflation data quality has always been a balancing act between timeliness and completeness. The BLS and its international peers have long wrestled with the challenge of collecting comprehensive price data in a timely fashion. In periods of rapid price evolution, such as spikes in energy costs or food markets, real-time data can be sparse in certain categories, triggering a reliance on estimates. Over the past decade, statistical agencies have increasingly embraced sophisticated modeling techniques and richer data sources, including scanner data, online price feeds, and alternative data streams, to supplement traditional observation networks.

Historically, the inflation reporting framework has undergone refinements to improve accuracy without sacrificing timeliness. Revisions to methodology, periodic recalibration of weightings, and periodic methodological notes are standard practice in inflation reporting. Yet the current situation marks an outlier in the share of estimated values for core CPI, raising questions about how quickly data infrastructure strings can adapt to evolving price landscapes and how these adaptations should be communicated to the public.

Economic impact: what estimation means for households and markets

For households, inflation data informs cost-of-living assessments, wage negotiations, and financial planning. When core inflation measures are perceived as less precise due to estimation, households may experience greater uncertainty about future price trajectories. This uncertainty can influence spending, saving, and borrowing behavior, particularly for durable goods, housing, and services subject to rental dynamics.

From a market perspective, investors and traders scrutinize CPI releases as key anchors for inflation expectations, bond yields, and real interest rates. A higher share of estimated data can introduce additional variance into the inflation signal, potentially widening short-term dispersion in expectations and unsettling markets that operate on tight data-driven cues. Over the medium term, if estimation introduces systematic biases—such as consistently under- or overestimating rent inflation—the risk to policy credibility and to asset pricing models increases.

Regional comparisons: housing markets, rents, and price signals

Comparing inflation data quality across regions reveals meaningful distinctions in housing markets and price dynamics. Regions with highly volatile rental markets or substantial housing stock turnover may present more frequent data gaps, necessitating greater estimation. Conversely, areas with robust price reporting infrastructure and more standardized rental markets may exhibit lower reliance on estimation.

Historical housing cycles add another layer of context. In regions that experienced rapid rent growth during urban revival phases or, conversely, rent stabilization in cooling markets, the accuracy of rental components can have outsized effects on theinflation picture. Policymakers and researchers often blend inflation data with regional housing statistics, such as vacancy rates, construction activity, and income growth, to form a more nuanced understanding of affordability pressures.

Policy considerations and communications

While the core functions of inflation measurement lie in statistical accuracy and methodological transparency, the broader implications touch policy and public communication. Central banks and fiscal authorities may consider several avenues to address data quality concerns without compromising the usefulness of inflation metrics:

- Transparent methodology updates. When data quality shifts, clear explanations of estimation practices, their limitations, and the expected timeline for data quality restoration help maintain credibility.

- Supplementary indicators. Policymakers may lean on complementary inflation gauges—such as trimmed-mean measures, median CPI, or region-specific price indices—to triangulate inflation trends when core CPI data face estimation challenges.

- Data quality monitoring. Regular audits and public dashboards documenting data gaps, estimation shares, and revisions can improve investor and consumer confidence.

- Public education. Explaining how estimation works and why it is necessary during data gaps can reduce misinterpretation and undue panic about inflation readings.

Regional and international comparisons

Looking beyond national borders, many advanced economies rely on comparable price indices to guide policy. The degree of reliance on estimated data varies with the maturity of data collection systems, the prevalence of digital price data, and the regulatory environment governing statistical agencies. Some economies with more centralized housing markets or standardized rental agreements may experience fewer estimation gaps in rent components, while others with diverse housing markets and decentralized data collection might confront similar challenges to those facing the United States.

International comparisons underscore the importance of methodological consistency. Although cross-country differences in price-setting, tenant rights, and rent indexing can complicate direct comparisons, the overarching concern remains: timely, accurate inflation data supports informed policy and prudent financial planning. When one nation's inflation data quality deteriorates relative to its peers, it tends to attract attention in financial markets and among international investors assessing relative growth and risk profiles.

Historical precedents in data quality issues

The inflation data ecosystem has faced episodic challenges before. Past episodes of data gaps—whether due to market volatility, natural disasters, or disruptions in data collection networks—have tested the resilience of standard inflation metrics. In many instances, agencies responded with methodological clarifications, revisions to data collection processes, and the development of alternative indicators to supplement the primary index. These responses often aimed to preserve the integrity and usefulness of inflation data while acknowledging the realities of imperfect observed price information.

Public reaction and market sentiment

Public sentiment surrounding inflation data quality can be as influential as the numbers themselves. If households, businesses, and investors perceive inflation measures as less reliable, confidence in economic projections may waver. Media outlets, analysts, and commentators might emphasize the uncertainty embedded in estimates, potentially amplifying concerns about price stability and the efficacy of monetary policy. Central banks, in turn, must balance the need for clarity with the humility that comes from acknowledging data limitations, ensuring that communications preserve credibility and guide expectations effectively.

The road ahead

As the data ecosystem adapts to evolving price dynamics, several questions will shape the next phase of inflation reporting. How quickly can price observation networks recover from gaps in housing and other key sectors? Will methodological refinements or new data sources reduce reliance on estimation without sacrificing timeliness? How will policymakers calibrate monetary stance in an environment where the inflation signal may carry greater uncertainty?

Analysts will be watching for revisions to October figures, the trajectory of estimated components in subsequent months, and any shifts in the behavior of core inflation under alternative measurement approaches. In parallel, researchers will likely delve into the sensitivities of rent components to macroeconomic variables, such as wage growth, migration patterns, and construction activity. The interplay between housing markets and inflation metrics remains a central thread in the broader narrative of price stability and economic resilience.

Regional contrasts in policy responses

Different regions have approached inflation reporting and policy communication with varying degrees of emphasis on data quality. Some jurisdictions have prioritized rapid updates and flexible guidance, accepting higher estimation shares as a temporary trade-off for timeliness. Others have emphasized methodological rigor and transparent disclosures, even if it means longer lags or more conservative interpretations. These divergent approaches reflect broader differences in institutional frameworks, public trust, and the perceived role of statistical agencies in shaping economic policy.

Public confidence, trust, and the inflation narrative

Trust in inflation metrics hinges on transparency, consistency, and demonstrated reliability over time. When data quality indicators reveal sustained estimation shares at elevated levels, public confidence can be influenced by how clearly agencies articulate the reasons for estimation, the steps being taken to improve data collection, and the consistency of revisions. Clear communication about limitations does not undermine credibility; it can, in fact, bolster it by showing that statistical agencies are actively managing data quality and providing context for consumers and markets to interpret the numbers.

Conclusion: balancing timeliness, accuracy, and transparency

The record-high reliance on estimated data within core CPI marks a pivotal moment for inflation measurement. It calls for a careful balance between maintaining timely inflation signals and preserving the fidelity of the data that underpins monetary policy, financial markets, and household financial planning. While estimation is a necessary tool in the statistical toolbox, its prominence underscores the need for ongoing investment in price data infrastructure, methodological innovation, and clear developer and public communication.

As observers digest the October figures and await forthcoming releases, the broader takeaway is not simply a statistic about data quality. It is a signal about the evolving landscape of inflation measurement in an era of rapid price shifts, diverse channels of price discovery, and heightened demand for timely, trustworthy economic indicators. The resilience of inflation reporting will hinge on how well statistical agencies can adapt, how clearly they can communicate uncertainties, and how effectively policymakers incorporate these nuances into their decisions in service of stable prices and economic confidence.