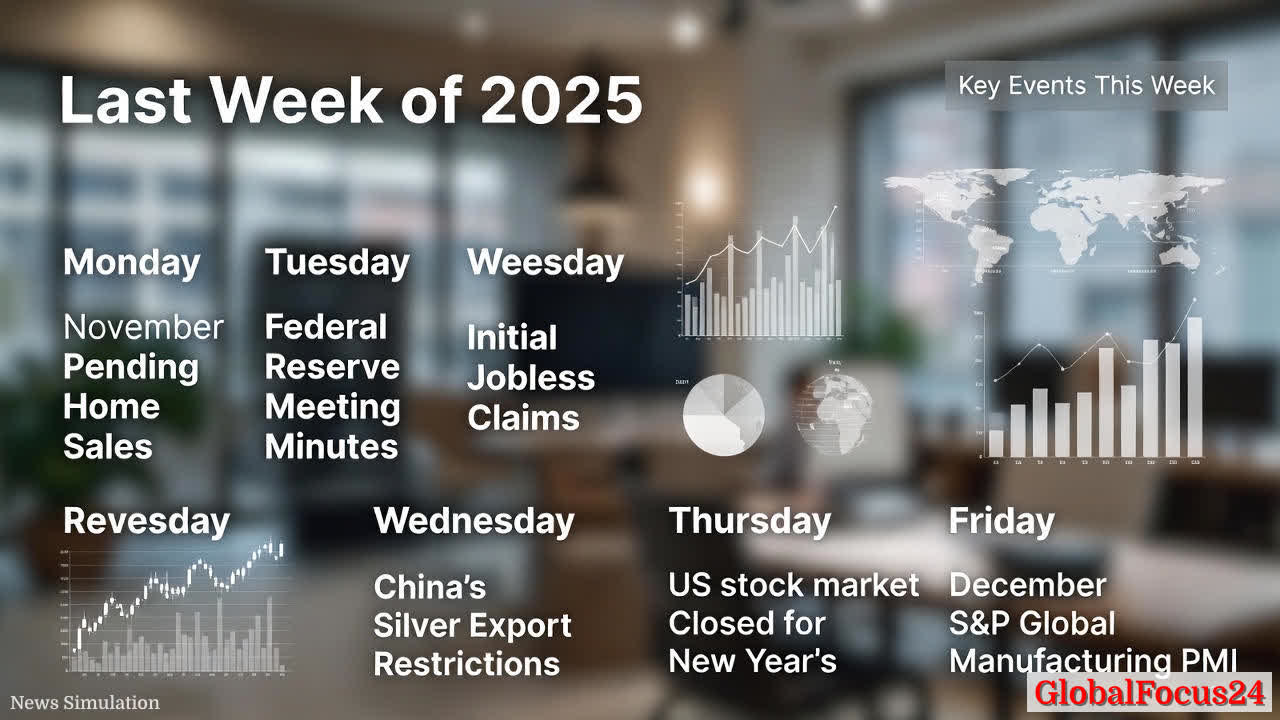

Economic Calendar in Focus: The Last Week of 2025 and Global Economic Implications

The final week of 2025 unfolds as a condensed but consequential period for markets, policy makers, and households alike. With several key data releases and policy discussions on the docket, the week offers a pulse check on the health of the economy, the trajectory of monetary policy, and the resilience of labor markets. From housing indicators to central bank communications, investors and analysts will parse the signals for clues about 2026’s economic climate, while regional comparisons reveal how different engines of growth are performing as the year closes.

November Pending Home Sales: Housing Demand in a Shifting Landscape

The week begins with the release of November Pending Home Sales data, a forward-looking gauge of housing demand that reflects contracts signed but not yet closed. This indicator provides a window into buyer sentiment, affordability dynamics, and the impact of mortgage rates on activity. In 2025, housing has continued to navigate a landscape of higher end costs and evolving financing conditions, with regional disparities shaping the national tone. The Pending Home Sales report will be scrutinized for whether buyers remain willing to lock in purchases amid fluctuating interest rates and price appreciation.

Housing data has historically acted as a bellwether for consumer confidence and construction momentum. A robust showing in pending sales can signal tentative strength in the housing market, which in turn supports related industries such as home improvement, furnishings, and local services. Conversely, a softer reading could reinforce concerns about housing affordability constraints and the drag on household wealth linked to real estate valuations. In comparing regions, coastal markets that have grappled with limited supply and higher prices may reveal contrasting trends against inland and southern markets where affordability and development dynamics differ. The outcome will feed into broader assessments of household balance sheets and the potential spillovers into consumer spending.

Fed Meeting Minutes: Interpreting Monetary Policy Pathways

Tuesday brings the release of the Federal Reserve’s Meeting Minutes, a document that can illuminate the deliberations behind policy decisions, the balance of risks to inflation, and the path forward for interest rates. Market participants will look for nuances on how policymakers weigh sticky inflation, labor market strength, and financial conditions. The minutes often reveal the intensities of concerns among policymakers about inflation persistence, the severity of labor market tightness, and the degree of confidence required to adjust the federal funds rate trajectory.

Historically, minutes influence market expectations by highlighting shifts in the policy stance, even whendecisions remain unchanged. Traders will parse language surrounding the tapering of asset purchases, language about quantitative tightening, and any references to the lagged effects of prior rate increases. For the broader economy, the implications depend on how the minutes frame expectations for credit conditions, household borrowing costs, and corporate financing. Regional reflections may emerge as well, with sectors such as manufacturing, real estate, and consumer goods exhibiting sensitivity to the anticipated path of policy rates.

Initial Jobless Claims: A Fresh Pulse on Labor Market Health

Wednesday’s Initial Jobless Claims release will offer a timely glimpse into the labor market’s short-term momentum. This data series captures filings for unemployment insurance and is often interpreted as a barometer of labor market resilience. In late 2025, the labor market has shown a degree of steadiness amid a diverse set of industry dynamics, including automation, outsourcing pressures, and sectoral shifts in demand. Analysts watch for sustained claims at or near historic lows, which would reinforce the notion of continued payroll expansion and wage growth moderation.

The implications of the claims data extend beyondunemployment figures. They influence perceptions of consumer spending power, as tighter job markets support household incomes and confidence. Regions with concentrated manufacturing or service-sector strengths may exhibit divergent patterns in claims, underscoring the uneven rhythm of the national labor market. A softer-than-expected reading could renew conversations about economic cooling, while a robust result would reinforce the view that labor demand remains resilient even as other indicators pulse with mixed signals.

China’s Silver Export Restrictions and Global Trade Dynamics

Thursday marks the start of China’s Silver Export Restrictions, a policy posture that intersects with global commodity flows, precious metals markets, and international trade perceptions. While not thecurrency story, such restrictions can influence price signals, supply chain strategies, and risk assessments for manufacturers reliant on silver as an input or hedge. The timing coincides with the US market’s observance of the New Year holiday, which often means thinner liquidity and more pronounced moves in currency and commodity markets as participants adjust positions ahead of the holiday window.

From a broader vantage point, China’s trade and policy actions continue to shape regional and global economic tempo. The restrictions could feed into discussions about global inventory cycles, manufacturing costs, and the borrowing conditions faced by exporters who rely on metal inputs. In comparative terms, nations with diversified material inputs or with lower exposure to silver-sensitive production lines may experience less direct impact, while economies with heavy reliance on electronics, jewelry, or solar technology—sectors that use silver extensively—could see more pronounced effects on input costs and margins.

December S&P Global Manufacturing PMI: Tracing the Pulse of Global Production

The week concludes with the release of December S&P Global Manufacturing Purchasing Managers’ Index (PMI), a widely watched barometer of manufacturing health and expectations for the year ahead. The PMI data synthesize surveys of business leaders on output, new orders, supplier delivery times, employment, and inventories, providing a composite snapshot of the manufacturing sector's vitality. In 2025, the global manufacturing landscape has navigated a mix of supply chain normalization, energy price volatility, and demand fluctuations across regions. The December PMI will help determine whether manufacturing is stabilizing after earlier volatility or continuing to tread a cautious path.

A positive PMI reading commonly signals expansion and optimism about demand, while a contraction or sub-50 reading points to a slowdown in production and potential headwinds for export-oriented economies. Comparing regions reveals significant variance: advanced economies with resilient services-led growth may see manufacturing as a lagging or stabilizing component, whereas emerging markets tied to commodity exports or global electronics supply chains might exhibit more pronounced cyclical sensitivity. The PMI’s direction can influence stock valuations, currency movements, and policy discussions around industrial policy, labor costs, and productivity investments.

Historical Context: A Year of Tightening, Balancing, and Adjustment

To understand the moment, it helps to place the week within a broader arc of 2025. The year has been characterized by a balancing act as economies adjust to a post-pandemic normal and navigate the complexities of inflation, wage growth, and productivity. Central banks in many regions have pursued measured policy normalization, seeking to curb inflation without stifling growth. The labor market, while robust in many sectors, has shown signs of cooling in others, prompting policymakers to weigh the timing and magnitude of rate adjustments carefully.

Housing markets have responded to shifting mortgage costs and supply dynamics, with price movements varying widely by location. Health of consumer balance sheets has been a central concern, as households grapple with a mix of debt service costs, savings depletion in some demographics, and continued consumer demand in service sectors. Global trade patterns have remained nuanced, with supply chain realignments and regional initiatives shaping the flow of goods and components across borders. Against this backdrop, the final week of 2025 serves as both a reflection point and a forward-looking barometer for 2026.

Economic Impact: What the Week’s Data Could Mean for Growth and Policy

The confluence of pending home sales, monetary policy minutes, labor market indicators, trade policy signals, and manufacturing sentiment can influence near-term growth expectations and policy calibration. Several channels stand out:

- Housing and household wealth: If Pending Home Sales show resilience, it can support household wealth, drive consumer spending, and sustain construction activity, contributing to GDP growth in the first quarter of 2026. A softer reading could intensify concerns about housing affordability and dampen consumer sentiment, potentially prompting more cautious spending patterns.

- Monetary policy trajectory: The Fed Minutes can shape expectations about interest rate paths, which in turn affect borrowing costs for consumers and businesses. Even small shifts in language about inflation, labor market slack, or asset purchases can move bond yields and stock valuations, influencing investment decisions and capital expenditure planning.

- Labor market resilience: Initial Jobless Claims alongside payroll data provide a cross-check on labor dynamics. A steady or improving claims picture supports the case for continued consumer spending strength, while a pickup in claims could signal softening demand and potential revisions to growth forecasts.

- Global trade frictions and inputs: China’s silver restrictions highlight how policy actions ripple through supply chains and input costs. For manufacturers and exporters, such developments can alter cost structures, inventory strategies, and pricing power, reinforcing the importance of diversified sourcing and risk management.

- Manufacturing momentum: The December PMI crystallizes the health of production sectors and the expectations for expansion or contraction. For policymakers and investors, PMI trends inform views on demand resilience, productivity, and the status of regional manufacturing clusters.

Regional Comparisons: Distinct Patterns Across Economies

- United States: Housing affordability, regional wage differentials, and the durability of consumer spending will be central to interpreting the week’s data. A steady housing market coupled with resilient labor demand could sustain a positive growth trajectory into 2026, though the pace of rate normalization remains a key uncertainty.

- Europe: The European economy continues to navigate divergent recovery paths, with manufacturing and services sectors responding to energy prices, supply chain normalization, and consumer demand. PMI readings in late 2025 have shown pockets of strength in manufacturing, while services activity remains sensitive to domestic policy and inflation dynamics.

- Asia-Pacific: Regional dynamics include robust manufacturing hubs, export-driven growth, and ongoing adjustments in policy stance to balance growth with inflation control. Trade-sensitive industries will be attentive to any shifts in input costs and currency movements arising from global policy developments.

- Emerging markets: Countries with diversified export bases and resilient domestic demand may fare better against a backdrop of global rate normalization. Yet commodity-price shocks, capital flows, and debt servicing costs will continue to influence growth trajectories in many regions.

Operational Outlook for Markets and Households

For investors, traders, and households, the week’s events are a reminder that the economy remains in a state of calibrated transition. Whileindicators provide snapshots, the underlying story lies in the interplay between demand strength, policy signals, and external shocks. Market participants will likely respond to data that either reinforces confidence in a soft landing and gradual normalization or raises questions about the durability of growth in the face of tighter financial conditions.

Businesses planning capital expenditure, hiring, and inventory management will be watching the PMI and labor data closely, adjusting forecasts accordingly. Homebuyers and homeowners will gauge the implications of housing data for mortgage rates and affordability. Policymakers will interpret the full set of numbers as they refine communications around future rate moves, inflation targets, and financial stability considerations.

Public Reaction and Sentiment: A Cautious Optimism

Public sentiment around the economy has been characterized by cautious optimism, with households balancing frugal spending with a willingness to invest in durable goods and services that improve living standards. The week’s data has the potential to either reinforce this sentiment or introduce new questions about the pace of growth, the trajectory of interest rates, and the resilience of the labor market. In communities with exposure to manufacturing or construction, the mood can hinge on local indicators such as home sales, employment trends, and wage growth, which in turn influence consumer confidence.

Forward-Looking Considerations: Preparing for 2026

As the year closes, policymakers, investors, and business leaders are weighing scenarios for the first half of 2026. Potential themes include:

- The balance between inflation control and growth support: If inflation continues to ease, central banks may pace rate cuts or pause adjustments to assess lagged effects on the economy.

- The role of housing as an anchor for household wealth: Stable or improving housing markets can underpin consumer spending, while continued affordability challenges may necessitate policy responses aimed at supporting homeownership and construction.

- The durability of manufacturing and supply chain resilience: PMI trends and input cost dynamics will shape production strategies and competitive positioning in global markets.

- Currency and commodity price dynamics: Liquidity flows during holiday periods and policy expectations can drive volatility, affecting pricing strategies for importers and exporters.

Conclusion: A Moment of calibrated assessment as 2025 Winds Down

The last week of 2025 offers a compact but meaningful set of data points that collectively illuminate the state of the economy as a year ends. The Pending Home Sales report, the Fed Minutes, Initial Jobless Claims, China’s Silver Export Restrictions, and the December PMI together create a mosaic of demand, policy expectations, labor market health, and global trade conditions. The strength or softness of these indicators will influence conversations among economists, policymakers, and market participants about the trajectory of growth, interest rates, and economic resilience into 2026.

As regions compare experiences and sectors adjust to evolving macro conditions, the week underscores the interconnected nature of modern economies. A housing market that hints at stability, a labor market that remains resilient, and a global trade environment that tests supply chains all contribute to a nuanced outlook: one that favors cautious optimism, informed planning, and vigilant monitoring of forthcoming numbers that will help shape the next chapter of economic policy and investment strategy.