Investors Channel Record Inflows Into Money Market Funds as Market Uncertainty Lingers

Strong Start to 2026 Marks Historic Shift Toward Cash Equivalents

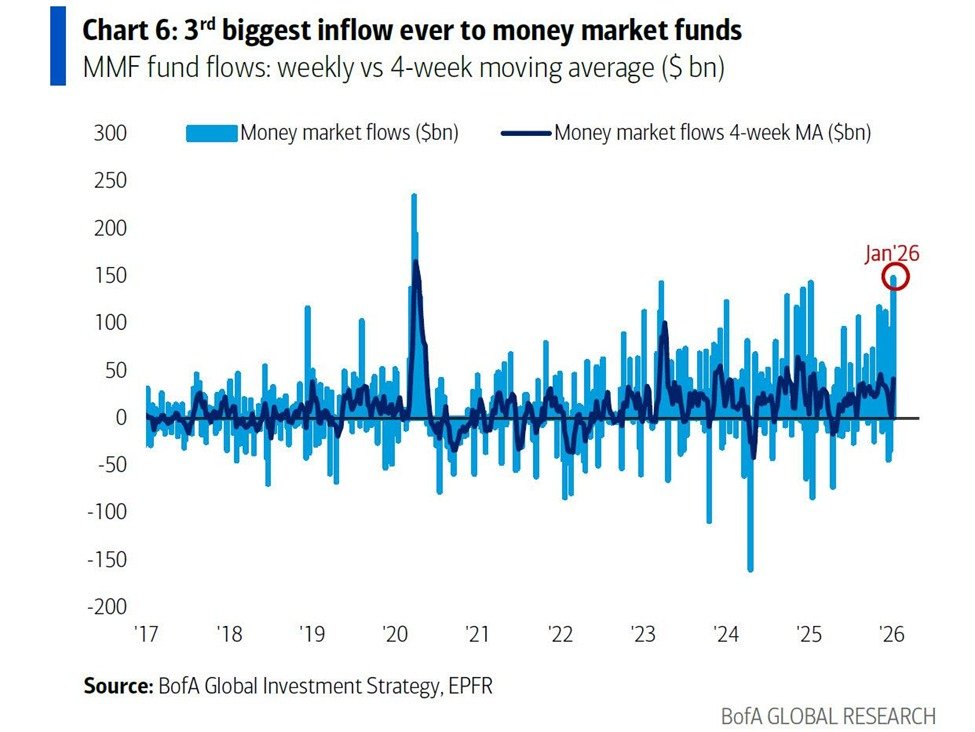

Investors poured the third-largest weekly inflow on record into money market funds in early January 2026, underscoring a growing demand for safety and liquidity amid persistent uncertainty about the global economic outlook. The surge marked one of the most aggressive reallocations into cash-like assets in recent memory, rivaling periods of historic market tension and monetary tightening.

The latest data shows a sharp acceleration in weekly flows compared to the four-week moving average, pushing total assets in money market funds to new highs. This trend reflects renewed caution from both institutional and retail investors who view these funds as stable havens offering attractive short-term yields while mitigating exposure to volatile asset classes.

Historical Context: A Familiar Pivot Toward Safety

The current spike in inflows recalls similar episodes following major economic turning points. In 2020, investors flocked to money market funds during the initial shock of the pandemic, seeking refuge from stock volatility. In 2022 and 2023, heightened inflation and aggressive central bank rate hikes again drew capital toward cash, driving record levels of fund holdings.

By comparison, the January 2026 inflow ranks just below the surges seen during those crises, but it is notable for occurring in a period of relative financial stability rather than outright turmoil. The move suggests that a cautious sentiment continues to shape portfolio strategies even as markets adjust to a softer inflation backdrop and clearer monetary policy guidance.

Rising Yields Reignite Demand for Cash-Like Assets

Money market funds have regained prominence largely because they offer competitive yields without the price risks associated with longer-term securities. With central banks maintaining policy rates near their multi-decade highs, yields on short-term instruments remain elevated. This has made cash equivalents an appealing component for investors looking to earn steady returns while avoiding the volatility that characterized much of the previous two years.

The average annualized yield on U.S. government and prime money market funds has hovered between 4.8% and 5.2% since late 2025, significantly above the levels seen from 2010 to 2021, when ultra-low interest rates dominated. This rate environment has particularly benefited retail savers and institutional treasurers aiming to optimize liquidity portfolios without extending duration risk.

Market Forces Driving the Shift

Several factors have converged to drive the surge into money market vehicles:

- Cautious monetary policy expectations. Investors anticipate that central banks will proceed gradually in reducing interest rates, with most maintaining restrictive stances well into 2026. This environment sustains the appeal of short-term instruments over riskier assets.

- Equity market consolidation. After multiple strong quarters of broad-based equity gains in 2025, many portfolio managers are locking in profits and rebalancing toward lower-risk allocations.

- Geopolitical uncertainty and trade realignment. Structural changes in global supply chains, recurrent geopolitical flashpoints, and slowing trade growth have all reinforced the desire for flexibility and liquidity in allocation decisions.

- Wealth management strategies. Private wealth clients, pension managers, and corporate treasurers continue to treat money market funds as strategic liquidity buffers, using them as holding pools during transition phases between asset purchases.

The convergence of these dynamics has created a potent feedback loop sustaining elevated inflows as investors weigh opportunities across a complex market landscape.

A Closer Look at Regional Trends

The surge in money market fund assets has been particularly pronounced in the United States, where institutional demand accounts for the bulk of recent inflows. However, the phenomenon extends beyond U.S. borders. In Europe, similar vehicles have absorbed billions in new cash over recent weeks as investors navigate uncertainty around the European Central Bank’s rate trajectory.

In Asia, regional funds have seen slower but steady growth, buoyed by corporate cash management needs and renewed exporter confidence. Japan’s ultra-accommodative stance has limited comparable inflows domestically, but global Japanese investors have nevertheless increased allocations to foreign currency-denominated money market instruments that offer higher yields.

Comparatively, the magnitude of U.S. inflows in January 2026—both in absolute dollar terms and as a share of total assets—outpaces that of prior years, suggesting U.S. investors are leading this renewed liquidity preference. Analysts note that the pattern parallels 2008 and 2020, when similar run-ups in money market balances preceded inflection points in interest rate cycles and asset valuations.

Economic Implications of Record Liquidity

From a macroeconomic perspective, the buildup in money market holdings can serve as both a stabilizing and a cautionary signal. On one hand, it indicates that the financial system is flush with liquidity, helping maintain orderly funding conditions. On the other, it can reflect reticence to commit capital to long-term projects or riskier asset classes, which could dampen investment momentum if sustained.

Some economists interpret the current surge as a transitional phenomenon rather than an enduring retreat from risk. As inflation data moderates and the probability of a global recession recedes, the vast stores of sidelined cash may gradually reenter equity, bond, and real-asset markets later in the year. Yet others argue that the extended period of high yields could normalize larger cash allocations as a permanent feature of modern portfolio management.

Institutional Versus Retail Participation

The composition of recent inflows reveals a diverse set of participants. Institutional investors continue to dominate volume, leveraging money market funds as yield-enhancing liquidity vehicles. Corporate treasurers have used these instruments to park operational cash, especially as higher yields outstrip returns on traditional overnight deposits.

Retail engagement has also expanded markedly. Individual investors, drawn by the simplicity and relative safety of money market funds, have increased their participation through brokerage and mutual fund platforms. Many have shifted portions of their savings from low-yield bank deposits into funds offering higher returns with comparable liquidity.

This broad-based participation underscores how the high-rate environment has reshaped investor behavior, democratizing access to yield once largely confined to institutional portfolios.

Comparisons With Prior Peaks

Historically, sharp inflows into money market funds have corresponded with pivotal moments in the financial cycle. In late 2008, global assets in these funds spiked as the credit crisis deepened. In March 2020, money market balances again ballooned amid pandemic-induced market dislocation.

The January 2026 pattern, by contrast, follows a period of steady economic expansion and easing inflation pressures. That distinction makes the latest inflow noteworthy: it suggests investors are proactively managing risk rather than responding to crisis. This behavioral change may reflect the lessons of recent years—particularly the importance of maintaining adaptable, liquid portfolios in unpredictable macroeconomic conditions.

Outlook for the Year Ahead

As 2026 unfolds, attention will turn to whether the current trend persists or begins to reverse as rate expectations evolve. Should central banks begin cutting rates more aggressively in the second half of the year, yields on money market instruments would decline, potentially prompting investors to redeploy capital into equities, bonds, or alternative assets seeking higher returns.

However, several structural factors could support sustained growth in fund assets. Enhanced product offerings, digital access to liquidity funds, and regulatory frameworks emphasizing transparency continue to make money market vehicles attractive. Additionally, global institutional cash balances remain elevated after multiple years of record earnings and conservative balance-sheet strategies.

Financial strategists forecast that even if inflow momentum slows, total assets under management in money market funds will likely remain near historic highs throughout 2026, marking a durable shift in investor behavior born from years of financial turbulence and rising-rate adjustments.

Caution and Opportunity in the New Monetary Era

The record-breaking start to 2026 highlights a defining theme of the post-tightening era: disciplined liquidity management. As investors navigate a landscape of lingering inflation risks, evolving rate outlooks, and geopolitical crosscurrents, money market funds represent both caution and opportunity—a bridge between safety and return.

While the precise duration of this cash-centric phase remains uncertain, its scale affirms one key message. Even in a climate of relative calm, the appetite for liquidity endures. For now, investors appear content to keep their powder dry, earning meaningful returns while waiting for the next clear signal from global markets.