US Dominates Global Landscape of High-Value Private Tech Firms

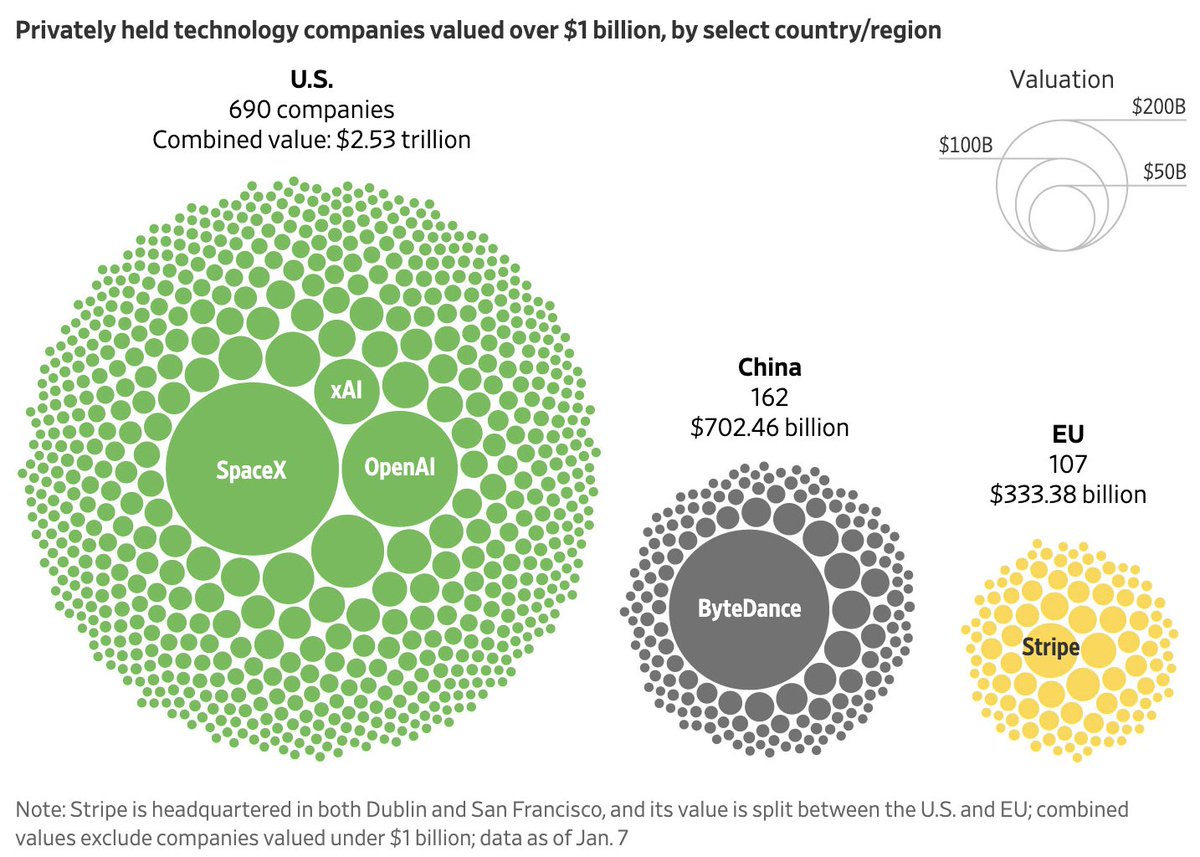

In a landscape shaped by rapid innovation and evolving economic currents, the United States stands at the forefront of privately held technology companies valued at more than $1 billion. As of early January, the United States boasted 690 such firms, collectively valued at approximately $2.53 trillion. That figure underscores a market leadership that combines abundant access to capital, strong talent pipelines, and a robust ecosystem that sustains high-growth ventures from space exploration to artificial intelligence.

Historical Context: The Rise of Private Tech Giants in the United States

The United States’ current dominance in high-value private tech firms is anchored in a multi-decade sequence of institutional advantages. Postwar research institutions, a culture of entrepreneurship, and a permissive but protectionist environment for startups created fertile ground for innovation. The space race of the mid-20th century, followed by the software and telecommunications booms of the 1980s and 1990s, cemented the United States as a global hub for scalable, high-value tech enterprises. The convergence of venture capital, world-class universities, and a permissive regulatory climate for new technologies accelerated a maturation cycle that saw early-stage startups evolve into industry-defining private companies valued at billions.

This historical arc culminated in a contemporary dominance characterized not only by the sheer number of firms but by the breadth of their impact. Private firms such as SpaceX, OpenAI, and xAI have captured attention for ambitious goals spanning autonomous transportation, artificial intelligence, and computational breakthroughs. The US ecosystem’s blend of risk tolerance, aggressive fundraising, and the option for aggressive, long-horizon investment has indelibly shaped the global private-tech landscape.

Economic Impact: Work, Capital, and Market Dynamics

The concentration of high-value private tech firms in the United States translates into meaningful economic effects across multiple channels:

- Job creation and high-skill labor markets: Private tech firms in this tier are major job engines, offering competitive compensation for engineers, researchers, and product developers. The high-value nature of these firms tends to attract a specialized workforce, bolstering regional talent pools and supporting ancillary services in technology clusters such as Silicon Valley, the Northeast Corridor, and burgeoning ecosystems nationwide.

- Capital formation and investor signaling: A large stockpile of unicorns and near-unicorns serves as a barometer for venture-capital appetite and long-horizon investment strategies. Private valuations influence fundraising dynamics, seed to late-stage rounds, and the broader venture ecosystem by signaling where market expectations are concentrated and which technological trajectories are deemed most promising.

- Supply chain and supplier ecosystems: High-value private firms stimulate demand across a network of suppliers, service providers, and research collaborators. This creates multiplier effects in specialized industries—cloud infrastructure, AI tooling, hardware accelerators, and specialized engineering services—that ripple through regional economies.

- Global competitiveness and productivity: The scale and ambition of US-based private tech firms contribute to productivity gains within the broader economy. Through advanced AI models, automation, and data-intensive services, these firms can raise efficiency across sectors such as manufacturing, healthcare, finance, and logistics.

Regional Comparisons: China and the European Union

The geopolitical and economic landscape for high-value private tech firms is not uniform. A comparative snapshot reveals notable differences in scale, concentration, and market dynamics:

- China: With 162 high-value private tech firms valued at about $702.46 billion, China remains a major global player. This cohort reflects a robust state-influenced ecosystem that increasingly emphasizes domestic-scale platforms, AI, and consumer-tech breakthroughs. The Chinese market enjoys strong capital backing and a policy environment that prioritizes strategic sectors, yet it also faces regulatory and international-market challenges that shape private-sector risk appetite and cross-border collaboration.

- European Union: The EU hosts 107 high-value private tech firms valued at approximately $333.38 billion combined. The European landscape features diverse national policies, regulatory rigor, and a strong emphasis on data protection, competition rules, and social considerations. While European firms frequently excel in enterprise software, fintech, and specialized hardware, the regional ecosystem has historically faced funding cycles and scale challenges relative to the United States. A notable example within the EU is Stripe, whose dual headquarters—San Francisco and Dublin—illustrate a transatlantic approach to growth, complicating regional tallies and valuation counting. Excluding Stripe from the EU tally would reduce the region’s total value by around 15 percent, highlighting how corporate governance and corporate structure can influence regional metrics.

- Cross-regional dynamics: China’s large-scale consumer and enterprise platforms often benefit from vast domestic markets and coordinated policy incentives, while the United States emphasizes speed, risk tolerance, and a highly developed venture-capital ecosystem. The European Union, with its emphasis on regulatory safeguards and data privacy, often prioritizes sustainable, long-term value creation and governance that can shape the pace and nature of private tech growth. These regional distinctions influence investment strategies, talent mobility, and international collaboration in the tech sector.

Key Players: Notable Entries Across Regions

- United States: SpaceX, OpenAI, xAI are representative of the US cohort’s broad ambitions—from aerospace and AI research to proprietary AI development and commercialization. The US approach often combines audacious projects with scalable business models, leveraging both government collaboration and private capital.

- China: ByteDance stands as a flagship for China’s high-value private-tech environment, illustrating the country’s strength in social media platforms, content ecosystems, and AI-enabled services that reach hundreds of millions of users.

- European Union: Stripe serves as a prominent example of a fintech and payments platform with a dual footprint in North America and Europe. The company’s valuation dynamics reflect how cross-border headquarters can influence regional accounting and investment narratives.

The Value Gap: Why the US Leads in Both Count and Value

Several factors contribute to the United States’ outsized position in high-value private tech firms:

- Access to capital: A mature and diverse finance ecosystem supports early-stage funding through late-stage rounds, enabling rapid growth and scaling. This access sustains higher valuations and a greater number of late-stage private entities.

- Talent and education: The United States hosts a dense constellation of research universities, technical institutes, and a culture of entrepreneurship that feeds a continuous pipeline of technical and managerial talent essential for scaling complex technologies.

- Regulatory and policy landscape: While regulatory environments shape risk, the United States has historically balanced innovation-friendly policies with robust antitrust and consumer protections, creating a climate where high-risk, high-reward ventures can flourish.

- Market maturity and demand: A large, sophisticated consumer and enterprise market provides ample real-world testing grounds for new technologies, accelerating product-market fit and value realization.

- Ecosystem density: The concentration of incubators, accelerators, research labs, venture funds, and major tech firms creates synergies that reduce development time, lower transaction costs, and foster knowledge spillovers.

Implications for Stakeholders

- Entrepreneurs and founders: The US remains a viable and attractive environment for ambitious, scalable tech ventures. Founders pursuing breakthroughs in AI, space, or other frontier technologies may look to regions with strong funding networks and supportive ecosystems.

- Investors: The concentration of high-value private firms in the United States can influence portfolio strategies. While diversification remains prudent, the US market’s scale and maturity often yield compelling risk-adjusted returns for investors seeking exposure to cutting-edge tech.

- Policy makers and regulators: Global leaders monitor the balance between fostering innovation and ensuring fair competition and data privacy. International collaboration and coherent policy frameworks can help maintain open channels for cross-border investment and technology transfer.

- Regional economies: States and cities that cultivate tech clusters, talent pipelines, and favorable business environments can attract high-value private firms, contributing to regional growth, infrastructure development, and long-term economic resilience.

Public Sentiment and Market Reactions

Public perception often mirrors the excitement and anxiety surrounding frontier technologies. Breakthroughs from privately held firms can fuel optimism about new industries and job creation, while concerns about market concentration, competitive fairness, and the societal impact of AI-driven automation persist. Communities with exposure to high-growth tech can experience both opportunities, such as new employment pathways, and challenges, including income disparity and housing demand in tech hubs. Policymakers increasingly weigh these factors as they design frameworks that balance innovation incentives with public accountability.

Future Outlook: Trends Steering Private Tech Valuations

Looking ahead, several trajectories are likely to shape the landscape of high-value private tech firms:

- Continued leadership by the United States: The US is positioned to maintain strong momentum in private tech valuations, provided the ecosystem remains supportive of risk-taking, innovation, and robust financial markets. Policymaking that sustains talent mobility and investment activity will be critical.

- Evolution of China’s private-tech ecosystem: China's private tech scene is likely to continue expanding, with a focus on AI, consumer platforms, and infrastructure-scale technology. Regulatory developments and cross-border collaboration will influence valuation trajectories and growth opportunities.

- European Union adaptations: The EU may prioritize governance, data privacy, and sustainable growth while fostering fintech and enterprise software innovations. Strengthening cross-border funding and scale-up support could help EU firms compete more effectively on a global stage.

A Cautious Take: Avoiding Overgeneralizations

While the United States leads in both the number and aggregate value of high-value private tech firms, regional dynamics are nuanced. Not all high-value private tech firms are equally poised for long-term success, and valuations can be sensitive to macroeconomic shifts, regulatory changes, and technological breakthroughs. Stakeholders should view metrics as part of a broader narrative about innovation ecosystems, capital markets, and regional leadership in technology.

Conclusion: A Global Tech Map in Flux

The current snapshot of privately held tech firms valued over $1 billion reflects a United States-led ecosystem that has sustained ambition, capital, and talent at scale. The comparative profiles of China and the European Union illustrate distinct national and regional strategies shaping private-tech growth. As the global tech economy evolves, investors, policymakers, and industry participants will watch closely how these dynamics unfold, with the potential for shifts in leadership, new entrants, and transformative breakthroughs altering the balance of power in the months and years ahead.