Cannabis Reclassification Moves, Market Reactions, and Regional Impacts

A shift in federal policy toward cannabis reclassification spurred immediate market reactions and raised questions about the path forward for the sector. The White House directive to reclassify marijuana to a less dangerous category, coupled with an executive order directing the attorney general to pursue the change, represents a notable policy pivot after years of divergent federal and state approaches. As markets absorbed the news, however, the initial optimism many investors anticipated did not materialize in the immediate trading session.

Historical context and policy backdrop To understand the implications, it helps to revisit the historical framework that has shaped cannabis markets for decades. Cannabis was placed in Schedule I under the Controlled Substances Act, a category reserved for substances deemed to have a high potential for abuse and no accepted medical use. This classification has created a labyrinth of regulatory constraints for the industry, including limited access to banking, stringent tax treatment under IRS code, and hurdles to capital formation. Over the past decade, a broad wave of state-level legalization for medical and recreational purposes has contrasted with ongoing federal restrictions. The tension between state-level legalization and federal prohibition has had lasting effects on market structure, investment dynamics, and the speed at which companies can scale.

Economic implications and tax considerations A key economic consequence of reclassification concerns tax treatment for cannabis businesses. Under current federal tax rules, many cannabis operators struggle with effectively high tax rates because they cannot fully deduct ordinary business expenses such as rent, wages, and utilities. If reclassification were accompanied by changes to tax policy, the potential reduction in effective tax rates could substantially affect net income and cash flow for operators. Historically, relief in this area has been cited by industry participants as a catalyst for depreciation, expansion, and hiring.

The broader fiscal picture also includes unresolved tax liabilities that have accumulated over years of operation under a tax regime with limited deductibility. Industry data indicates a substantial portion of unpaid liabilities remains outstanding, with a significant gap between what is collected and what is owed. The degree to which reclassification would alter this balance depends on both the structural changes in tax law and the enforcement framework that follows.

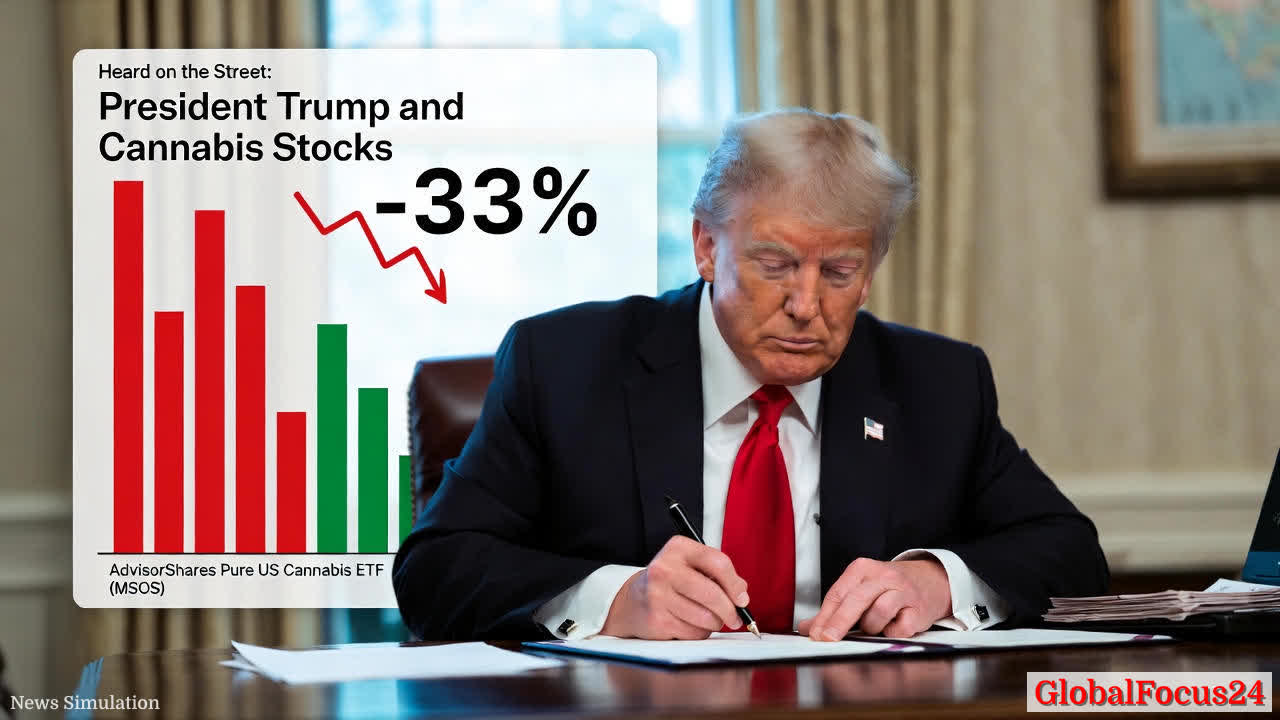

Market response and investor sentiment In the immediate aftermath of the policy announcement, cannabis-focused equities moved in a manner that surprised some observers. An exchange-traded fund tracking U.S. cannabis producers experienced a sharp decline on the news day, followed by continued volatility. The price action reflects a blend of expectations: some investors anticipated a robust uplisting of U.S. operators and broader access to banking and capital markets, while others warned that the path to full implementation would involve a lengthy process with potential regulatory and legal considerations.

The reaction also highlights the “buy the rumor, sell the news” phenomenon that often accompanies policy shifts. Before the announcement, prices had already adjusted in response to speculative chatter and prior media coverage. Once the policy moved from rhetoric to a formal directive, traders revisited risk assessments, recalibrating positions based on the likelihood of procedural steps, timelines, and the potential for litigation or congressional review.

Banking and capital access considerations A major hurdle for cannabis companies has been access to traditional banking services due to federal illegality. Reclassification could set the stage for broader banking compatibility, enabling more straightforward cash management, lending, and vendor risk controls. Improved banking access would, in theory, support more efficient operations, better inventory management, and easier payroll processing. However, actual improvements depend on the specifics of any accompanying regulatory changes, including guidance for financial institutions, compliance costs, and capital adequacy standards.

Regional perspectives and comparisons Across regions, the cannabis sector has displayed divergent dynamics influenced by state-level legalization, local regulatory environments, and the pace of commercial adoption. States that legalized cannabis for medical or recreational use have generally developed more mature markets with greater competition, standardized product categories, and developed retail ecosystems. In contrast, states with restricted or narrowly defined programs continue to experience slower growth and more volatility, with market participants closely watching federal policy signals for clearer long-term direction.

International comparisons offer additional context. In countries with older, more established frameworks for regulated cannabis markets, integration with financial systems and export-oriented opportunities have tended to evolve more gradually, reflecting a balance between public health considerations, tax revenue goals, and corporate governance norms. While the United States remains the focal point for global investment interest, the broader North American region has seen cross-border implications, including supply chain alignment, shared research initiatives, and harmonization discussions around licensing standards.

Corporate fundamentals versus policys Even as policy developments unfold, investors remain attentive to macroeconomic and sector-specific fundamentals. Companies that maintain strong balance sheets, diversified product lines, and scalable operations may be better positioned to weather short-term volatility. Operational excellence—ranging from compliance and regulatory adherence to efficient cultivation, processing, and distribution—continues to be a critical differentiator. Market participants often assess variables such as cash burn rate, gross margins, and access to strategic partnerships as indicators of resilience.

Public reaction and societal considerations Public sentiment around cannabis policy is nuanced, reflecting a balance of potential benefits and concerns. Supporters highlight the potential for tax revenue, job creation, and advances in medical research, while opponents emphasize public health, youth access, and regulatory risk. As policy discussions progress, communities, workers, and ancillary industries—such as packaging, equipment manufacturing, and logistics—will be watching closely for shifts that could alter employment prospects and local economic activity.

Long-term trajectory and outlook Looking ahead, the trajectory of cannabis policy and the related market response will hinge on several interrelated factors. The pace of executive-branch actions, the legislative environment, and the judiciary’s handling of related challenges will shape the timeline and scope of any reclassification-driven reforms. In parallel, macroeconomic conditions, interest rate trends, and broader capital market dynamics will influence how investors price risk and allocate capital to this evolving sector.

Regional market performance will likely diverge as policy clarity deepens. States with established regulatory ecosystems and robust consumer demand may experience faster normalization of stock prices as banking and financing constraints ease. Conversely, markets awaiting definitive federal guidance or facing ongoing regulatory hurdles could exhibit more measured progress, with stock performance tethered to policy milestones rather than corporate earnings alone.

Implications for infrastructure and supply chains A potential reclassification and subsequent shifts in policy could have meaningful implications for infrastructure and supply chains. Facilities involved in cultivation, processing, packaging, and distribution may benefit from clearer regulatory guidelines and improved access to capital expenditures. Investors will watch for indicators such as capex intensity, automation adoption, and capacity expansion plans that signal confidence in long-term demand.

Environmental, social, and governance considerations Sustainability and governance practices continue to factor into investor assessments. As cannabis companies scale, stakeholders increasingly demand transparent reporting on environmental impacts, labor standards, and community engagement. Strong ESG performance can influence access to capital, particularly from institutions with mandate-driven investment criteria, and may become a differentiator amid ongoing volatility.

Conclusion without bias The reclassification initiative represents a watershed moment with potential to alter the structural dynamics of the cannabis industry. While the immediate market reaction reflected both optimism and caution, the broader implications will unfold as regulatory steps translate into practical changes for taxation, banking, and capital formation. Regional differences, historical precedence, and the evolving public discourse will together shape whether this policy shift translates into durable growth or a period of consolidation and reassessment for investors, operators, and policymakers alike. The path forward will require careful navigation of regulatory processes, market fundamentals, and stakeholder expectations to determine the sector’s resilience in a changing policy landscape.