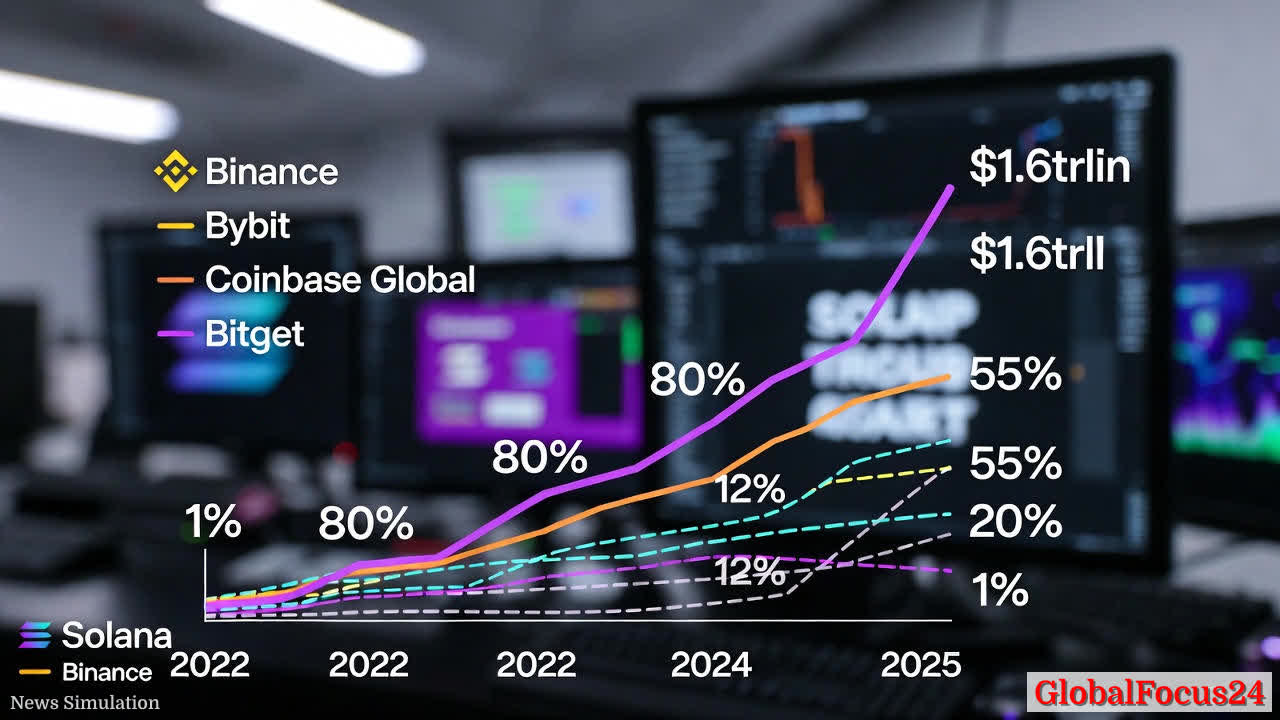

Solana Onchain Spot Volume Surges Past Major Centralized Exchanges in 2025

In a notable shift within the cryptocurrency ecosystem, Solana’s onchain spot trading volume surpassed several long-standing offchain exchanges throughout 2025, marking a turning point in how traders access and execute digital asset trades. By year’s end, Solana’s onchain activity reached approximately $1.6 trillion in spot volume, narrowly trailing only Binance, the dominant exchange in the space. This development underscores a broader migration of trading activity toward onchain venues and has implications for liquidity, price discovery, and market resilience across the digital asset landscape.

Historical context: a decade of evolving trading models

The crypto market has long oscillated between onchain and offchain trading paradigms. Early years were dominated by centralized exchanges (CEXs), which offered high liquidity, user-friendly interfaces, and rapid execution. Over time, onchain or decentralized trading venues—where trades are settled on the blockchain and users maintain custody of their funds—gained traction among enthusiasts seeking greater transparency, security, and control over assets. The 2020s brought continued innovation in layer-1 and layer-2 ecosystems, with Solana emerging as a high-throughput blockchain designed to support fast, low-cost transactions. The convergence of Solana’s technical strengths with growing demand for onchain trading created a fertile environment for sustained onchain volume growth.

Economic impact: liquidity, price formation, and market resilience

Solana’s rising onchain spot volume in 2025 has several observable economic effects:

- Liquidity redistribution: As onchain trading activity increases, liquidity pools and order books on Solana’s onchain venues expand. This intensifies competition for price discovery and can reduce reliance on any single venue, contributing to more robust market depth during periods of volatility.

- Cost dynamics: Onchain trades can carry different cost structures, including network fees and potential slippage, depending on liquidity and routing. Traders and liquidity providers may optimize routes to minimize costs, potentially shifting capital toward high-efficiency onchain venues like Solana's ecosystem.

- Diversification of market access: A broader set of participants—ranging from retail traders to algorithmic funds—now access Solana-based onchain markets. The diversification of market access can enhance resilience, particularly if cross-venue arbitrage and cross-chain liquidity bridging remain well-functioning.

- Price discovery and transparency: Onchain activity often benefits from transparent trade data and auditable settlement. As institutions and large traders engage more with onchain venues, the market can see more real-time price discovery signals and improved transparency for participants tracking market microstructure.

Regional comparisons: momentum beyond traditional hubs

The transition toward onchain trading on Solana occurs within a broader global context. While Binance maintained a commanding share of global spot volume in 2022, its dominance has softened over time as competition intensified and regulatory scrutiny increased. By 2025, Binance’s market share had declined from about 80% in 2022 to roughly 55%, reflecting a more plural and competitive landscape. This shift mirrors similar trends in other regions where users increasingly value onchain custody, lower counterparty risk, and the ability to trade without intermediaries.

- North America: Traders in the region have shown growing appetite for onchain venues that deliver fast settlement and transparent trading data. While regulatory developments shape the structure of the market, Solana-based onchain trading has attracted both retail and institutional participants seeking lower fees and rapid execution.

- Europe: European users have emphasized interoperability and compliance-friendly models. Onchain platforms operating on Solana often highlight low transaction costs and strong throughput as differentiators, appealing to high-frequency traders and market makers.

- Asia-Pacific: The APAC ecosystem remains a dynamic driver of innovation in both onchain and offchain trading. Solana’s scalability features align with the region’s demand for high-speed, low-latency markets, supporting rapid order routing and efficient liquidity utilization.

Technical and infrastructural considerations

Several factors contribute to Solana’s sustained onchain volume growth:

- Throughput and latency: Solana’s architecture emphasizes high throughput and low latency, enabling rapid settlement of trades and enabling more granular price discovery. Traders seeking tight spreads can benefit from faster order matching and reduced latency arbitrage opportunities.

- Fee economics: Competitive onchain transaction fees, driven by Solana’s low-cost execution, attract traders who previously faced higher equivalents on alternative chains or centralized venues. Cost-conscious traders often optimize fee structures by layering orders across liquidity pools and on-chain routes.

- Security and custody: Onchain trading requires users to manage private keys or rely on trusted custody solutions. The ecosystem’s emphasis on security—through audits, secure wallets, and robust bridge infrastructure—helps sustain confidence among participants, particularly institutions that may be integrating onchain strategies.

- Interoperability and tooling: The availability of developer tools, liquidity aggregators, and cross-chain bridges enhances the practicality of onchain trading on Solana. These tools enable traders to access liquidity across multiple pools and routes, improving overall market efficiency.

Operational insights: what the data suggests for market participants

- Adoption trajectory: The growth from a modest share to 12% of total volume since 2022 indicates a steady, sustained migration toward onchain venues. The 2025 milestone, where Solana surpassed several prominent offchain exchanges, demonstrates the potential for onchain platforms to compete meaningfully in a market historically dominated by centralized operators.

- Risk and risk management: Onchain markets can expose participants to network congestion, slippage, and on-chain settlement risk. Traders are increasingly implementing risk management practices, including dynamic order sizing, time-in-force strategies, and automated routing to optimize fills while controlling fees and risk exposure.

- Market makers and liquidity providers: As onchain volumes rise, the role of market makers who supply liquidity on Solana-based venues becomes more crucial. Their participation can improve liquidity depth, reduce volatility during news events, and support more efficient price discovery.

Comparisons to legacy venues: lessons from history

The trajectory of Solana’s onchain volume invites parallels with earlier shifts from exclusively centralized trading to diversified market structures. In past cycles, notable spikes in onchain trading activity often accompanied periods of heightened volatility or rapid de-risking by traders who sought to reduce exposure to custody risk or regulatory uncertainty. The 2025 data suggests a durable structural shift rather than a temporary anomaly: traders appear increasingly comfortable with onchain settlement, citing transparency and control as primary drivers. This evolution is not about replacing centralized exchanges but augmenting the ecosystem with complementary venues that offer different trade-offs.

Public reaction and market sentiment

Industry observers have reacted with caution and curiosity. Proponents highlight the benefits of enhanced transparency, auditable trade history, and the potential for more inclusive access to liquidity. Critics point to the ongoing need for robust risk controls, user education around onchain custody, and the importance of safeguarding against potential network-level disruptions. In practical terms, traders often express enthusiasm about the ability to execute large trades with reduced counterparty risk, while still acknowledging the importance of monitoring network health and liquidity conditions.

What this means for the broader crypto market in 2026

If the current trajectory persists, 2026 could see continued growth in onchain trading activity across multiple ecosystems, with Solana serving as a leading example of how high-throughput networks can support scalable, transparent markets. Market participants may increasingly diversify execution venues, employing a mix of onchain and offchain routes to optimize liquidity, cost, and settlement certainty. Regulators and industry groups will likely focus on standardizing best practices for onchain trading, including disclosure standards, custody safeguards, and interoperability norms across chains.

Final observations

The emergence of Solana’s onchain spot volume as a major force within the cryptocurrency trading ecosystem signals a maturation of onchain venues as credible alternatives to traditional centralized exchanges. With a sustained rise in share and a demonstrated capacity to attract significant liquidity, Solana’s onchain trading activity reinforces the broader narrative of an increasingly multi-venue market. As traders adapt to evolving dynamics, the market will continue to balance the advantages of onchain transparency and control with the operational realities of fee structures, network reliability, and risk management.