PRECIOUS METALS SELL-off SPARKS MARKET-WIDE REACTION AND REGIONAL IMPACT ANALYSIS

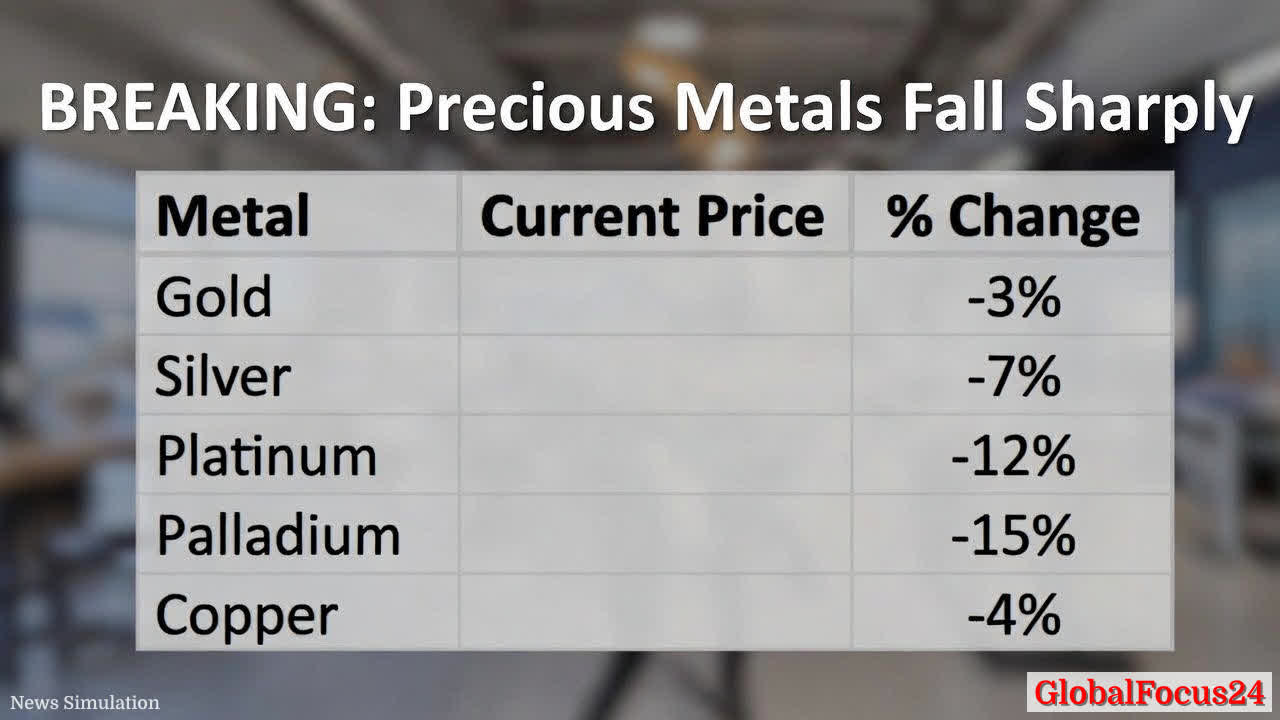

The precious metals market experienced a pronounced decline on Monday, with multiple metals posting sharp daily losses and prices retreating to new lows across the board. Gold fell roughly 3% to around $4,420.70 per ounce, Silver dropped about 7% to roughly $72.25 per ounce, Platinum slid about 12% to approximately $2,206.95 per ounce, and Palladium led the pack with a roughly 15% decline to around $1,736.25 per ounce. Copper, often considered a gauge of broader industrial demand, declined about 4% to about $5.62 per pound. The day’s moves followed a recent run of rallies in the sector, underscoring ongoing volatility as investors digest macroeconomic signals, interest rate expectations, and geopolitical developments.

Context and historical frame

- Historically, precious metals have oscillated in tandem with macroeconomic policy signals, inflation expectations, and real interest rate trajectories. The current pullback follows a period of renewed risk appetite and a re-pricing of safe-haven assets in response to shifting monetary guidance and inflation prints. While gold has long been viewed as a hedge during times of uncertainty, its price action can also reflect shifts in real yields, U.S. dollar strength, and expectations for central bank policy.

- Silver and platinum-group metals (PGMs) often react to both demand-side factors—industrial usage, especially in electronics, automotive catalysts, and jewelry—and supply-side considerations, including mine output, geopolitical risk, and recycling dynamics. Palladium, in particular, has a strong linkage to catalytic converter demand in the automotive sector, making it sensitive to auto production trends and regulatory environments.

Economic impact and market dynamics

- Investor positioning and margin dynamics can amplify daily moves in the metals complex. A swift retreat in price can trigger stop-loss activity and forced liquidations, especially among leveraged funds and short-term traders. Conversely, buyers may see value in later retracements if inflation pressures persist or if real interest rates remain unattractive for yield-seeking investors.

- The broader commodity space often tracks industrial metals closely with copper serving as a barometer for global economic momentum. A 4% dip in copper prices signals potential softening in manufacturing activity or inventory adjustments in key consumer and industrial sectors. Market participants will be watching for any signs of stabilization or renewed weakness in downstream demand as the calendar progresses.

- Central bank policy expectations remain a critical driver. If markets price in higher-for-longer rates or a slower pace of rate cuts, real yields may rise or stay elevated, exerting downward pressure on non-yielding assets like bullion. Conversely, any shift toward more accommodative stances or concessions in inflation trajectories could redraw risk sentiment and provide a renewed bid for precious metals as capital preserves value.

Regional considerations and comparisons

- In North America, gold and silver price reforms can influence consumer and institutional demand, with coinage markets, jewelry purchases, and ETF flows contributing to price dynamics. Local sentiment often reflects a blend of hedging behavior and speculative trading, as market participants balance potential macro risks against policy guidance from major economies.

- Europe has traditionally served as a barometer for gold demand amid geopolitical uncertainty and currency fluctuations. The eurozone’s inflation narrative, energy considerations, and fiscal policies shape investors’ appetite for safe-haven assets and industrial metals alike. A decline in precious metals prices here may reflect synchronized global movements or region-specific funding constraints.

- Asia remains a pivotal hub for demand, particularly in India and China, where jewelry consumption, industrial applications, and hedging strategies influence pricing. The region’s demand elasticity can modulate global price trajectories, especially when currency movements or domestic policy changes alter the relative attractiveness of owning physical metal versus financial instruments.

What to watch next

- Price stability versus continued volatility: Market participants will monitor intraday price action, liquidity conditions, and the behavior of major bullion banks and exchange-traded product (ETP) holders to gauge whether the decline is a short-term episode or part of a broader correction.

- Demand signals from jewelry and industry: Seasonal demand cycles, consumer confidence indices, and industrial activity readings will inform expectations for a rebound or further pressure on prices.

- Supply-side developments: Mining output reports, refining capacity, and recycling trends can influence supply dynamics, particularly for platinum and palladium, where inventory and production cost considerations contribute to price sensitivity.

Historical context in regional markets

- The current price moves echo past cycles where precious metals reacted to shifts in global risk appetite. For instance, periods of rising confidence and strong equity performance have historically coincided with gold’s normalization or pullbacks as investors rotate into higher-yielding assets. By contrast, episodes of economic stress or geopolitical flare-ups have underscored gold’s role as a portfolio ballast, sometimes supporting price floors despite broader risk-on sentiment.

- Platinum and palladium, with substantial auto-catalyst demand, show noticeable sensitivity to automotive cycles and emissions regulations. In regions with significant vehicle manufacturing activity, metal prices can reflect factors beyond pure financial markets, including factory utilization rates and regulatory timelines.

Implications for investors and institutions

- Portfolio alignment: For investors, a rapid decline in precious metals prices may prompt reassessment of hedging strategies and diversification objectives. Institutions might adjust exposure levels in bullion, futures, and related instruments to align with risk tolerance, liquidity needs, and longer-term strategic views.

- Inflation protection versus risk appetite: The balance between inflation expectations and appetite for risk assets shapes how portfolios respond to metal price swings. When inflation remains a concern but real yields rise, investors may re-weight toward or away from precious metals accordingly.

- Commodity-linked equities: Mining companies and metal producers are likely to experience correlated movements with metal prices, but company-specific factors—such as debt levels, hedging programs, and mine grades—will determine the magnitude of stock performance relative to the broader market.

Market sentiment and public reaction

- Public and investor sentiment in the wake of the day’s declines tends toward cautious repositioning. Some participants may view the move as a buying opportunity, arguing that higher volatility can present entry points for long-term holders. Others may adopt a wait-and-see approach, awaiting more decisive signals from central banks, inflation data, and economic indicators before committing capital.

- Media narratives often frame metal price dynamics through the lenses of risk, value preservation, and opportunistic trading. Consumers and investors alike watch for clues about whether current pricing reflects a temporary dip or a structural shift in demand and supply fundamentals.

Conclusion and forward outlook

- The day’s broad-based declines in precious metals prices underscore the market’s sensitivity to macroeconomic signals, policy expectations, and regional demand dynamics. While near-term volatility is likely to persist, the metals complex remains a key component of diversified portfolios, offering a counterbalance to risk assets during periods of uncertainty and a potential hedge against inflation when conditions warrant.

- As markets absorb the latest price action, stakeholders will be attentive to subsequent data releases, including inflation metrics, manufacturing indices, and central bank communications. The interplay between real returns, currency movements, and geopolitical developments will continue to shape the trajectory of gold, silver, platinum, palladium, and copper in the weeks and months ahead.