Mystery Trader’s $410,000 Bet Sparks Debate Over Prediction Markets and Market Integrity

A high-stakes episode on a crypto-based prediction platform has spotlighted the risks and opportunities embedded in modern forecasting markets. An anonymous user, operating under a minimal profile, placed a series of escalating bets predicting that Nicolás Maduro would lose Venezuela’s presidency within a tight, January deadline. The final round of wagers, executed hours before a U.S. military operation was publicly announced, resulted in a profit of roughly $410,000 on about $34,000 in total stakes. The sequence has prompted discussions about insider information, regulatory gaps, and the evolving regulatory landscape for prediction markets in the United States and abroad.

Historical context and the rise of prediction markets

Prediction markets, which let participants speculate on future events and trade “contracts” tied to outcomes, have long attracted both enthusiasts and researchers. They blend elements of betting with crowd-sourced probability estimation, offering real-time wisdom of crowds and a fluid mechanism for aggregating diverse information. In recent years, digital and blockchain-backed platforms have expanded access, lowered barriers to entry, and broadened the scope of tradable outcomes—from political developments to cultural phenomena and corporate milestones.

Historically, these markets faced skepticism and regulatory scrutiny because they can function as financial instruments that reflect and amplify information asymmetries. Early models emphasized a need for robust oversight to prevent manipulation, insider trading, and illicit activity. The current episode underscores the tension between innovation in forecasting tools and the imperative to ensure fair and lawful participation across jurisdictions.

What happened in the Maduro betting episode

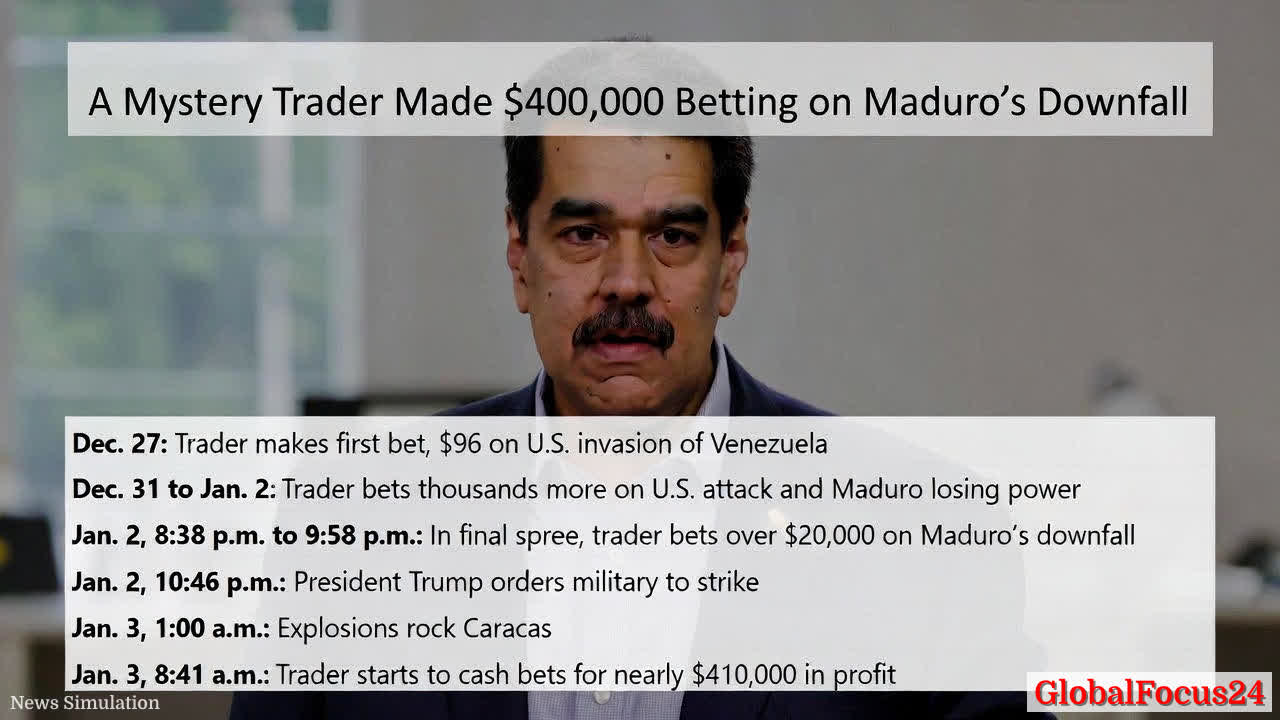

- Initial bet: On December 27, a new account placed a $96 wager on a U.S.-led invasion of Venezuela by January 31.

- Escalating bets: Over the following days, the bettor added substantial sums to contracts tied to Maduro’s ouster by the same date.

- Final spree: The most significant activity occurred on January 2, with more than $20,000 placed on Maduro’s removal in a short window, just hours before a high-profile policy decision.

- Market move and profit: After news emerged that a U.S. operation had been authorized, contract values surged. The trader realized a net profit approaching $410,000 from roughly $34,000 in exposure, with much of the conviction reflected on the eve of the event.

Analysts identified a few red flags that fueled speculation about insider information. The bets were concentrated in a single account, described by a default blockchain address rather than a personal identity. The timing of the wagers, in close proximity to a major, unannounced military action, added to the suspicions that the trader might have had advance access to nonpublic information.

Legal and regulatory considerations

- Insider trading concerns: If a government official or someone with nonpublic information used the platform to profit from sensitive knowledge, traditional insider-trading statutes could apply in certain jurisdictions, especially if the instrument functions as a security-like swap or derivative.

- Jurisdictional questions: Prediction markets operate across borders, with some platforms restricting or attempting to limit U.S. participation. When participants access services from abroad or without traditional ties to a single regulatory regime, enforcement complexities arise.

- Platform governance: Polymarket, like several prediction markets, relies on user-reported data and on-chain activity. While it has introduced analytics tools to flag suspicious activity, critics argue that the absence of comprehensive safeguards can leave room for exploitation.

Industry response and ongoing debate

- Self-regulation and transparency: The platform’s leadership has emphasized real-time data monitoring and community-led flagging of potential insider activity. Observers note that visible alerts and rapid responses can mitigate some issues, but they do not wholly substitute for formal regulatory oversight.

- Legislative considerations: As prediction markets gain mainstream attention, lawmakers are weighing proposals to limit participation by insiders, define clearer compliance standards, and potentially regulate these markets more stringently. A recent discussion among policymakers centers on whether federal officials and appointees should be barred from trading in prediction markets where they could access nonpublic information.

- Market design challenges: Experts argue that the balance between open access and protections against manipulation is delicate. Some advocate for stricter identity verification, improved transaction monitoring, or even outright prohibition for certain actors in scenarios with national-security implications.

Economic and regional impact

- Liquidity and price discovery: Prediction markets attract capital from diverse participants who assess probabilities through contract prices. High-profile events can generate rapid price movements, which, in turn, influence perceptions of risk across related markets. The Maduro betting episode highlights how a single event can yield outsized gains or losses, testing the resilience of market pricing in volatile political environments.

- Information signals for policymakers and industry: When extreme bets accumulate around a geopolitical or policy outcome, observers may interpret the activity as a signal of market expectations about stability, risk, or intervention. While not a substitute for official data or intel, these markets can contribute to a broader picture of sentiment and risk appetite.

- Regional comparisons: Similar prediction-market ecosystems in other regions have faced comparable scrutiny. In Europe and parts of Asia, regulators have pursued a cautious approach, emphasizing consumer protection and prevention of illicit activity, while still allowing innovation in forecasting tools. The balance between enabling innovation and maintaining safeguards remains a central topic for cross-border platforms.

Public reaction and broader implications

- Public sentiment: Reactions to the episode have been mixed. Some view prediction markets as a novel, democratized way to quantify probabilities about future events. Others warn that these markets can incentivize trading strategies built on sensitive information, potentially undermining trust in public process and national security.

- Media and academic interest: The case has spurred discussions among researchers about how to detect insider activity in non-traditional markets and how to design better safeguards without stifling innovation. Scholars are examining the role of transparent analytics, user verification, and incentive structures that align with broader market integrity goals.

- Practical considerations for users: For participants in prediction markets, prudent practices include understanding platform rules, recognizing the limits of nonpublic information, and avoiding trades that could raise ethical or legal concerns. Responsible participation also involves using available tools to monitor for unusual or concentrated activity.

Historical parallels and lessons learned

- Market integrity in digital environments: The Maduro episode echoes earlier concerns about insider advantage in other digital markets, including algorithmic trading and cross-border derivatives. It reinforces the principle that as market mechanics evolve, so too must enforcement approaches and governance frameworks.

- The role of transparency: Visible, auditable data aids in curbing manipulation. Platforms that publish trading activity, risk metrics, and flag potential insider actions can help maintain confidence among users and observers alike.

- The limits of self-regulation: While industry-led safeguards are valuable, they are not a panacea. Complementary regulatory oversight remains critical to ensuring that prediction markets serve as productive tools for information aggregation rather than avenues for illicit gain.

Outlook

As prediction markets continue to gain traction globally, the intersection of innovation, regulation, and integrity will shape their development. Market operators are likely to invest further in analytics, compliance tooling, and user verification to deter misuse while preserving the core value of crowd-sourced probability estimation. Policymakers may introduce targeted restrictions or rules addressing insider information, especially for platforms accessible to participants with potential access to nonpublic information. For participants, the takeaway is clear: as the stakes rise, so must vigilance, ethical considerations, and adherence to applicable laws.

The Maduro-related betting episode serves as a case study in the growing maturity and complexity of prediction markets. It underscores the promise of these platforms to harvest collective intelligence in real time while highlighting the persistent challenges of ensuring fairness, transparency, and legality in a rapidly evolving digital landscape.