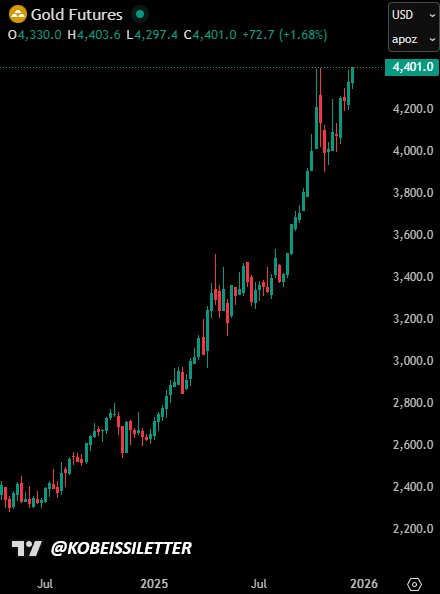

Gold Futures Surge to All-Time High as 2025 Rally Hits Historic Peak

Gold futures surged above $4,400 per ounce on Thursday, marking an unprecedented milestone in the commodity’s price history and signaling a dramatic year for the precious metal. The move, which represents a 67% gain for 2025, positions gold for its strongest annual performance since 1979 and underscores a complex tapestry of macroeconomic forces, investor sentiment, and global risk dynamics shaping markets worldwide.

Historical Context: A Century of Gold as a Safe Haven and Investment Barometer

Gold’s enduring appeal as a store of value dates back millennia, yet its modern market movements are deeply tied to the economic philosophy and policy tools of the last half-century. In the late 1970s, gold’s price spike followed the collapse of the Bretton Woods system and rampant inflation, prompting central banks and investors to reassess the metal’s role in hedging against currency depreciation and financial instability. Since then, gold has oscillated with shifts in monetary policy, geopolitical tensions, and the evolving landscape of financial instruments.

The 1980s and 1990s saw periods of consolidation as equities and bonds offered compelling returns, while gold remained a strategic hedge for central banks and large institutions. The 2000s brought a renewed surge as loose monetary policy following the global financial crisis and subsequent market stress elevated demand for alternative stores of value. The current cycle, however, is driven by a blend of persistently high inflation expectations, ultra-accommodative monetary policy in major economies, and a renewed focus on diversification within investment portfolios.

The latest record-breaking ascent to $4,400 reflects a convergence of economic concerns: inflation remains stubborn in several major economies, real yields have fluctuated, and geopolitical tensions have re-emerged in various theaters. Market participants are weighing the long-run implications of tighter financial conditions versus the need to safeguard purchasing power, with gold positioned as a flexible instrument that can function both as a hedge and a speculative asset in different market regimes.

Market Dynamics: Why Gold Jumped to a New High

Multiple catalysts have converged to push gold to historically high levels. First, concerns about inflation, particularly in economies where price pressures have persisted despite gradual improvements in other macro indicators, have kept investors drawn to hard assets. Second, ongoing geopolitical uncertainty in regions with significant supply chain exposure or strategic importance adds a risk premium that supports demand for gold as a portfolio diversifier.

Another factor in the current rally is the evolution of the global investment landscape, including the growing popularity of exchange-traded products and the role of gold as a cross-asset hedge. As investors reassess the sensitivity of traditional assets to monetary policy shifts, gold’s liquidity and global recognition render it a versatile choice for risk-off and risk-on environments alike.

Additionally, currency market dynamics contribute to gold’s price trajectory. When major currencies experience depreciation or heightened volatility, gold—priced in U.S. dollars—often benefits as an alternative store of value. The interplay between dollar strength, global reserve flows, and developing-market demand has amplified price discovery in the futures market.

Regional Comparisons: How Different Markets Are Interacting with Gold’s Rally

- United States: The U.S. market has shown sustained interest in gold through futures and bullion demand, with financial institutions and retail investors alike seeking hedges against potential rate volatility, inflation surprises, and geopolitical risk. The price surge carries implications for consumer inflation expectations, monetary policy signaling, and asset allocation strategies across diversified portfolios.

- Europe: European demand remains sensitive to policy guidance from the European Central Bank, currency moves within the eurozone, and regional inflation dynamics. Gold’s appeal as a safe haven in times of policy uncertainty has found receptive buyers among institutional investors and sovereign wealth funds looking for diversification within a cautious macroeconomic outlook.

- Asia: In many Asian markets, physical demand for gold has historically tracked festival cycles, wedding seasons, and domestic savings behavior, in addition to macroeconomic uncertainties. The current rally is likely to influence jewelry and investment bullion movements, with central banks in the region also monitoring gold’s performance as part of their foreign reserve strategies.

- Emerging Markets: For economies grappling with inflation, currency depreciation, or external financing pressures, gold’s role as a hedge can be particularly pronounced. Investment channels vary by country, but the overarching theme is a heightened emphasis on capital preservation in the face of global volatility.

Economic Impact: What the Rally Means for Markets and Policy

The jump to record highs reverberates through several layers of the economy and financial markets:

- Inflation and Real Yields: Gold’s rally often reflects shifts in inflation expectations and real yields. When real yields are less attractive, non-yielding assets like gold can become relatively more attractive to investors seeking preservation of capital.

- Investment Portfolios: A sustained move higher in gold prices can influence institutional asset allocations, prompting larger allocations to precious metals within diversified mandates, and potentially affecting weights of equities, fixed income, and alternative investments.

- Mining and Industry: Gold mining equities and related supply chains can experience upside from higher gold prices, though the sector’s performance historically depends on broader commodity cycles, costs, and geopolitical considerations influencing supply and mine development.

- Central Bank Policy: While gold itself is not a policy instrument, central banks monitor bullion prices as part of broader currency and reserve management strategies. Rapid price shifts can influence considerations about diversification, reserve composition, and the balance between inflation hedging and liquidity needs.

- Consumer Spending: For households, higher gold prices can affect jewelry demand and investment purchases, especially in regions with strong cultural ties to gold as a savings vehicle. The distributional effects depend on local price pass-through, consumer sentiment, and discretionary income trends.

Sustained Momentum or Short-Term Peak? Analyzing the Trajectory

Analysts emphasize that while the sentiment around gold remains buoyant, the path forward will hinge on a handful of critical inputs:

- Monetary Policy Signals: The trajectory of interest rate expectations, central bank communications, and real rate prospects will shape gold’s relative attractiveness. A shift toward tighter policy or a sharper expectation of rate normalization could pressure prices, while continued softness or accommodation could sustain gains.

- Inflation Pathways: The persistence or moderation of inflation in key economies will influence risk sentiment and hedging demand. If price pressures reaccelerate or prove more persistent than anticipated, safe-haven demand for gold could remain elevated.

- Global Risks: Ongoing geopolitical tensions, supply chain disruptions, or financial instability in any large market can act as catalysts that reinforce gold’s role as a hedge. Conversely, a notably stable global environment could temper demand over time.

- Alternative Assets: The performance of other assets—such as equities, cryptocurrency markets, and real assets—will also impact gold’s appeal. In periods where alternative assets exhibit strong momentum, investors might reallocate, potentially capping further price gains.

Public Reaction: How People Are Responding to the Historic Milestone

Market participants, from long-only investors to speculative traders, have expressed a mix of caution and enthusiasm. Financial sentiment indicators show a broad acknowledgment that the gold rally reflects a confluence of risk factors rather than a single driving force. In retail markets, buyers are weighing the value proposition of physical bullion versus paper futures, with jewelry demand often influenced by cultural and seasonal factors. Media coverage, analyst notes, and social media chatter have amplified the visibility of the milestone, contributing to a feedback loop where price movement attracts attention and shifts in positioning.

Technicals and Market Structure: Understanding the Mechanics Behind the Record

The move beyond the prior intraday or end-of-day references to all-time highs underscores structural dynamics in both the futures market and physical markets:

- Futures Market: Futures pricing incorporates expectations about macroeconomic conditions, currency moves, and demand/supply dynamics across the forward curve. Investors may be layering positions, using spreads to express views on volatility and inflation, or hedging exposures tied to broader portfolios.

- Physical Market: The physical gold market, including bars, coins, and jewelry, interacts with futures through price signals, inventory adjustments, and regional demand fluctuations. Supply constraints, seasonal purchasing patterns, and processing costs can all influence the pace and degree of price discovery.

- Market Liquidity: Liquidity in gold futures and related instruments is a key factor enabling the rapid ascent to new highs. Deep liquidity in major exchanges allows for efficient price discovery, while episodic volatility can arise around macro news or policy announcements.

What Comes Next: Navigating the Uncertain Horizon

For investors and policymakers, the critical question remains: can gold sustain its momentum through the next phase of the macro cycle? While a definitive forecast is elusive, several scenarios emerge:

- Bullish Scenario: If inflation pressures persist and real yields stay constrained, gold could maintain momentum, potentially testing higher psychological thresholds as investors seek diversification amid global economic uncertainty.

- Mildly Bearish Scenario: A gradual normalization of monetary policy with improving inflation data and stronger real yields could temper enthusiasm for gold, leading to a plateau or modest retreat from current highs.

- Mixed Scenario: If geopolitical tensions fluctuate or financial conditions tighten unevenly across regions, gold could experience episodic rallies followed by periods of consolidation, reflecting a balancing act between safety demand and opportunities in other asset classes.

Conclusion: A Historic Benchmark in a Dynamic Market

The record-setting leap above $4,400 per ounce marks a historic chapter in the ongoing evolution of gold as a cornerstone of diversified portfolios and a barometer of global risk. While the long-term implications will unfold over months and years, the moment captures a market that is deeply attuned to inflation expectations, policy trajectories, and the broader sense of urgency surrounding financial stability in a complex, interconnected world. As investors and policymakers watch the price action, the metallic glow of gold remains a symbol of resilience—an asset whose value proposition endures across cycles, geopolitical shifts, and the ever-changing tempo of global markets.