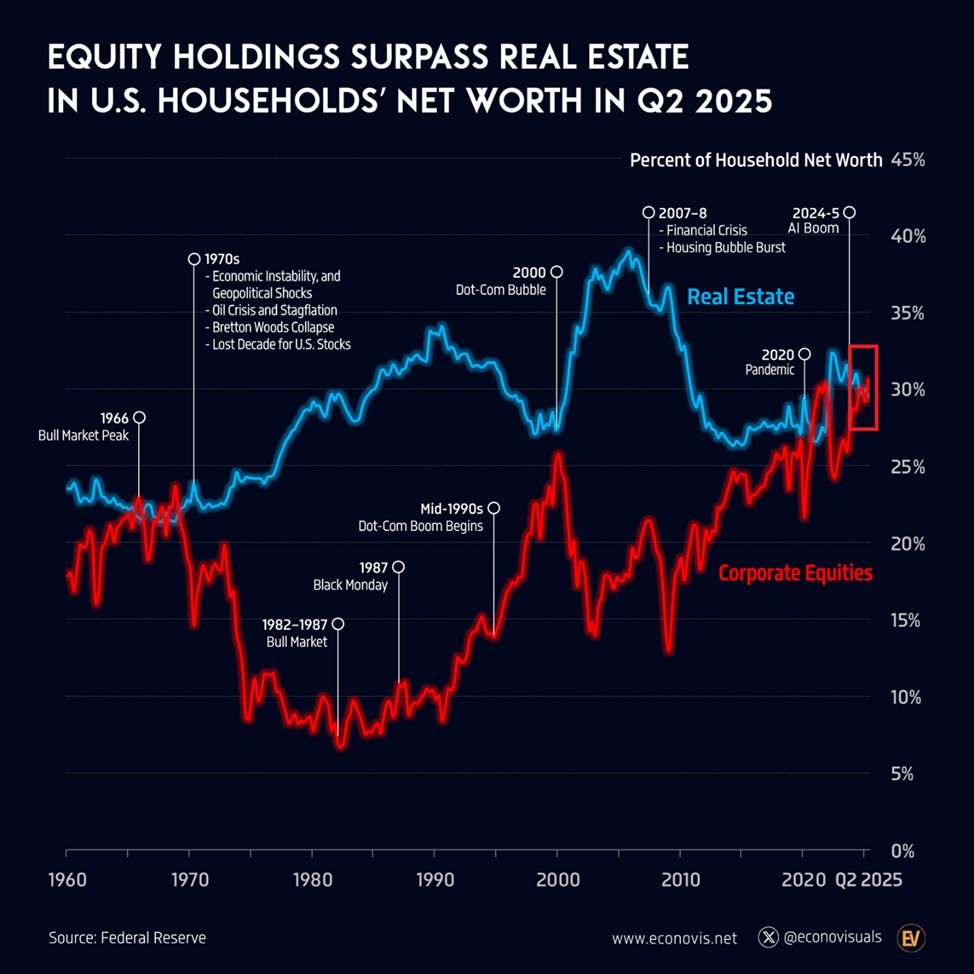

Equity Holdings Surpass Real Estate in U.S. Households’ Net Worth in Q2 2025

A major reordering of American household wealth occurred in the second quarter of 2025, as equity holdings eclipsed real estate to become the dominant asset class in U.S. households’ net worth. Corporate equities and mutual funds now account for roughly 31% of total net worth, an all-time high that reflects a sustained rally in the stock market and a shifting appetite for financial assets. While real estate remains a substantial component of wealth, its share dipped below 30% for the first time since 2021, signaling a notable structural change in the composition of household balance sheets.

Historical context helps explain the gravity of this shift. The long arc of U.S. wealth has zigzagged through periods of exuberance and shock, with major inflection points shaping asset allocations. In the 1970s, high inflation and policy volatility kept real assets in the spotlight as households sought tangible stores of value. The 1987 Black Monday crash and the 1990s technology booms underscored the volatility and opportunity of equities, while the 2000 Dot-Com Bubble and the 2007-08 financial crisis underscored the risks and rewards of financial markets. The hinge moment of the 2020 pandemic era further accelerated wealth accumulation in equities for many households, aided by fiscal and monetary support and a rapid recovery in risk assets. The 2025 data now place equities in a rare, durable leadership position in the national wealth narrative.

In economic terms, the shift from real estate to equities signals a broad reallocation of risk tolerance and investment strategy across households. When stock markets advance, the value of publicly traded equities and mutual funds tends to rise, lifting household net worth even if housing markets cool. Conversely, housing can lag during periods of favorable financing conditions or strong equity returns. The 2025 assessment suggests that several factors—persistent low interest rates, a robust corporate earnings environment, and a continued low-cost access to investment vehicles—are contributing to a larger share of wealth being held in financial assets rather than in physical property.

The composition of household wealth is not only a snapshot of financial markets but also a lens on economic behavior and policy impact. Rising equity ownership often correlates with greater participation in retirement accounts, index funds, and employer-sponsored plans. It can also reflect demographic shifts, including increased participation by younger households in equity markets and a broader push toward diversified asset portfolios. At the same time, real estate, traditionally a stabilizing anchor for many households, faces cyclical pressures from mortgage rates, housing supply dynamics, and local market conditions. When housing markets plateau or soften, homeowners may experience slower growth in real estate wealth compared with gains seen in stock prices.

Regional dynamics across the United States illustrate a mosaic of outcomes within the national trend. Coastal and tech-centered metros have typically demonstrated stronger equity market participation due to higher incomes, concentrated asset bases, and exposure to innovation-driven industries. In contrast, many inland and rural regions have historically leaned more heavily on real estate and tangible assets as a store of value. The 2025 movement toward equities is therefore not uniform nationwide; it interacts with local housing cycles, wage growth, and access to financial instruments. Regions with vibrant equity markets and stable housing affordability may see the most pronounced net-worth shifts toward financial assets, while areas with elevated real estate wealth and tighter housing supply may reflect a slower transition.

From an economic policy perspective, the shift toward equities carries implications for consumer confidence, retirement preparedness, and wealth inequality. On one hand, rising paper wealth in equities can bolster household balance sheets, support consumer spending, and aid retirement planning for those with diversified portfolios. On the other hand, equity-driven wealth is inherently more volatile than real estate, which can introduce cyclical risk to consumer behavior and long-term financial security, especially for households with heavier stock exposure or limited diversification. Policymakers may monitor these dynamics to assess the effectiveness of financial stability measures, capital markets architecture, and consumer protection frameworks as asset composition evolves.

The broader market environment in 2025 also plays a central role in understanding this development. Equity markets benefited from steady corporate earnings, continued innovation across sectors such as technology and energy, and the gradual normalizing of monetary policy in the wake of earlier stimulus programs. Mutual funds and exchange-traded funds have provided convenient access points for households to participate in this equity-led growth, enabling a broader swath of savers to build diversified portfolios without needing extensive market expertise. The real estate sector, while not out of the race, faces its own set of headwinds and tailwinds, including mortgage affordability, housing supply, and neighborhood-level trends that can diverge from national equity performance.

As households recalibrate their balance sheets, the interplay between liquidity, diversification, and risk tolerance becomes increasingly salient. Equity-led wealth growth can enhance financial resilience during economic expansions, but it also underscores the importance of prudent asset allocation, emergency savings, and long-term planning. The current snapshot does not imply a universal preference for equities over real estate, but it does reflect a nuanced moment in which financial assets have become the leading engine of net worth for a broad segment of American families.

Historical benchmarks remain relevant as context for what comes next. The 38% peak of real estate wealth during the 2006 housing bubble now stands as a distant memory in the wake of a stock market-driven ascent. Yet real estate’s role as a durable, tangible asset continues to be a foundation for many households, providing utility, shelter, and potential appreciation driven by local market dynamics. The evolving mix of assets underscores the importance of financial literacy, access to diversified investment options, and the need for retirement systems that account for shifting wealth distributions.

Looking ahead, analysts will be watching several key indicators to gauge whether the equity lead is durable or temporary. Stock market performance, corporate earnings trajectories, and interest rate expectations will shape ongoing household appetite for financial assets. Housing affordability, construction activity, and regional price trends will continue to influence the real estate component of net worth. A balanced approach that emphasizes diversification, risk management, and long-term planning will likely remain the prudent path for households seeking to maintain financial stability amid evolving asset allocations.

In sum, the second quarter of 2025 marks a historic moment in which equities overtook real estate as the principal driver of U.S. household net worth. The trend reflects broader market forces, demographic shifts, and policy environments that collectively shape how American families build and preserve wealth. As the economy continues to evolve, households and policymakers alike will navigate the implications of a wealth landscape increasingly defined by financial assets, while real estate retains its enduring significance as a foundational pillar of economic security.