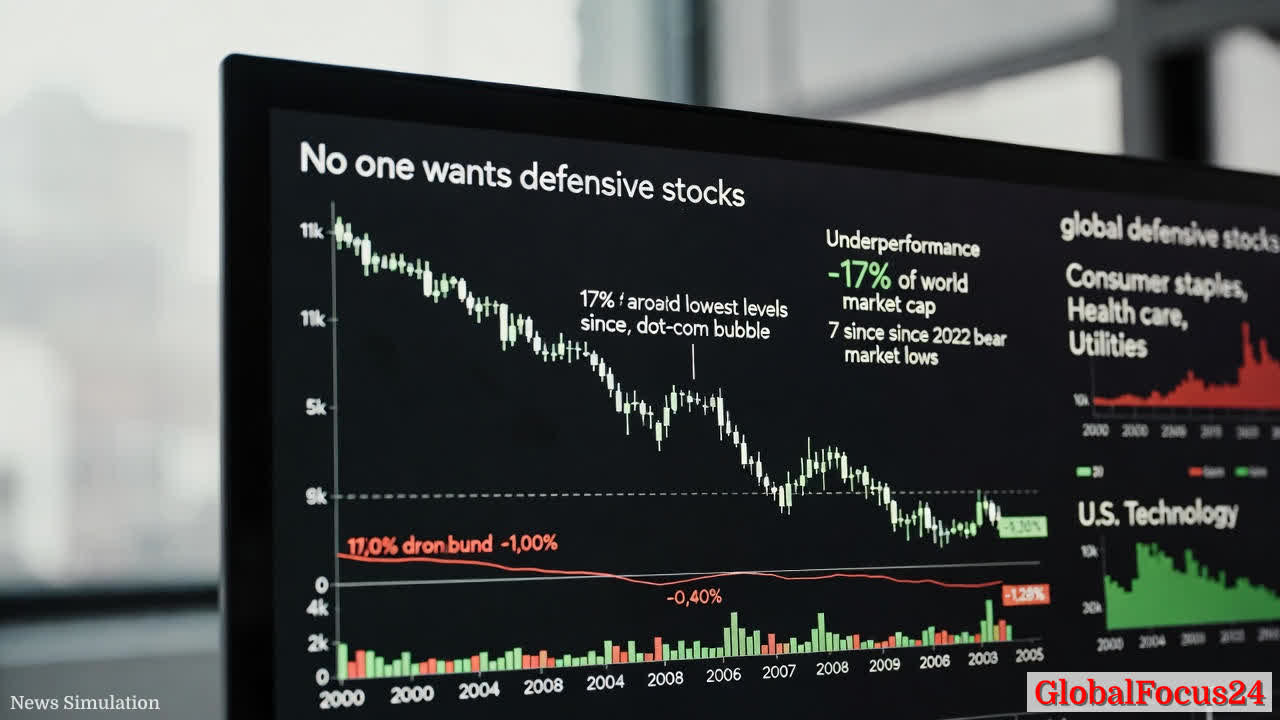

Global Defensive Stocks Slip Near Historic Lows in Market Capitalization

In a striking shift for global markets, defensive stocks—traditionally seen as ballast during periods of volatility—have fallen to represent just 17% of the world’s total market capitalization. The figure, approaching the dot-com era lows of 2000, signals a pronounced tilt toward cyclical and growth-oriented equities, driven in large part by a sustained surge in U.S. technology leadership and a reevaluation of risk across asset classes. The moves rippled through sectors like consumer staples, health care, and utilities, which have lagged the broader market in recent years and now face renewed questions about their relative resilience in a high-growth, high-expectations environment.

Historical context helps illuminate the current dynamics. Defensive sectors earned their name by offering steady cash flows and predictable earnings, traits that tend to appeal when investors anticipate economic headwinds or elevated market volatility. The late 1990s and early 2000s, marked by the technology bubble and its subsequent burst, featured a similar phenomenon: cyclical growth stocks surged, while traditional defensive pillars struggled to keep pace. In contrast, the 2008 financial crisis underscored a different pattern, as investors sought the cushion of defensives amid a deep systemic pullback, driving their outperformance when fear spiked. The present moment thus recalls a hybrid of those historical regimes, underscoring how macro forces—technology optimism, inflation dynamics, and central-bank policy—reshape sector leadership over multi-year cycles.

The economic implications of this shift extend beyond daily price moves. A 17% share of global market capitalization held by defensive stocks translates into a sizable reallocation of capital, with potential consequences for portfolio diversification, risk management, and long-run capital formation. As investors favor technology-centric equities, the price signals across defensive industries become more sensitive to earnings revisions, regulatory changes, and demographic trends. For companies in consumer staples, health care, and utilities, the challenge is to demonstrate not only resilience but also growth of free cash flow in an environment where competition for capital remains intense, and where investors increasingly demand higher-quality growth narratives.

Regional comparisons offer further nuance. In the United States, the technology sector has propelled broader indices higher, reinforcing a narrative of productivity-led expansion that has attracted capital away from traditional hedges. Europe has experienced a more mixed trajectory, with defensive sectors receiving some support from steady household consumption and utility demand, yet facing structural headwinds from energy price volatility and regulatory scrutiny. In Asia, the story varies by market: certain economies with robust domestic consumer demand and healthcare innovation show pockets of defensive strength, while others remain tethered to export-driven growth cycles that amplify cyclical exposure. The net effect is a mosaic: while the global defensive cohort underperforms, pockets of regional stability persist in consumer staples and healthcare where demographic and social trends sustain demand.

From an investor’s lens, the current reading raises questions about sector rotation, valuation discipline, and risk parity. Defensive stocks typically offer lower volatility and steady dividends, which historically provide ballast during bear markets or abrupt downturns. Yet, when the economic backdrop shifts toward rapid technology adoption and high-growth expectations, even traditionally defensive names can underperform, particularly if their earnings outlook fails to prove their defensiveness in the face of accelerating competition and commoditization pressures. This environment underscores the importance of a diversified approach that balances growth potential with risk mitigation. It also highlights the role of macro considerations—interest rate expectations, inflation trajectory, and fiscal policy—in shaping sector narratives and investor behavior.

Historical context reinforces the current phase as part of a longer-running cycle where technology leadership can redefine relative value across sectors. The dot-com era produced a vivid reminder that innovation catalysts can overwhelm traditional defensive assets for a period, even as fundamentals for staples, healthcare, and utilities continue to improve through efficiency gains, innovation, and demographic resilience. The present period suggests a continued re-pricing of risk as investors chase technological breakthroughs, digital transformation, and scalable platforms, potentially at the expense of conventional defensive earnings stability. Yet, the long arc of economic growth remains anchored in the ability of all sectors to adapt: defensive industries may yet rebound if macro conditions shift, but their path will be shaped by productivity gains, cost structures, and policy environments.

The broader market remains attentive to a range of catalysts. Inflation moderation, expectations of central-bank rate cuts, and continued innovation in software, semiconductor manufacturing, and biotechnology can alter the relative appeal of defensives. Corporate earnings reports in consumer staples, health care, and utilities will be scrutinized for signs of pricing power, margin expansion, and capital expenditure discipline. At the same time, geopolitical developments, energy price cycles, and supply-chain resilience continue to influence sector performance and investor sentiment. The interplay between these forces will determine whether defensive stocks regain traction or remain out of favor in a market that prizes growth and technological disruption.

Within this framework, regional benchmarks reveal subtle shifts. In North America, the market’s concentration in technology has helped propel index performance while putting pressure on traditional defensive cohorts. In contrast, some Asia-Pacific markets show a more balanced exposure, with healthcare innovation and consumer demand offering defensive ballast in select segments. Latin America and parts of Europe face unique dynamics tied to currency movements, commodity cycles, and domestic policy decisions, which can influence the relative attractiveness of defensive equities. These regional differences underscore the importance of a tailored investment approach that considers both global trends and local conditions when evaluating sectoral risk and reward.

For policymakers and market observers, the observed trend provides a data point in the ongoing assessment of financial stability. The balance between defensive and growth assets can influence risk premia across the financial system, affecting everything from banking behavior to corporate financing. If defensive stocks continue to underperform, investors may seek alternative hedges or reallocate toward segments with stronger growth visibility, potentially changing debt and equity issuance patterns. Conversely, a sustained reversion toward defensives could dampen volatility and support more predictable earnings streams, with positive spillovers for retirement portfolios, insurance reserves, and long-horizon investment strategies.

Public sentiment around the shift remains mixed but informed by price action and earnings narratives. Investors often weigh the trade-offs between immediate return potential and long-term stability. In markets where technology equities have surged, some households and institutions have expressed concern about concentration risk and the potential for a correction. At the same time, many market participants acknowledge the defensive sectors’ enduring value in providing steady dividends, essential goods, and regulated utilities—components that historically contribute to a resilient portfolio during uncertain times. The public discourse reflects a nuanced view: while bets on innovation dominates, the appeal of reliable cash flow and predictable outcomes continues to hold sway for savers and risk-averse investors.

Looking ahead, strategists forecast a cautionary but not decisively pessimistic path. A return of defensive leadership would likely hinge on a shift in macro conditions—slower earnings growth in tech, cooling inflation, or fresh signs of economic softening that reframe risk-reward calculations. Until that inflection point arises, the market may continue to reward cyclical, technology-driven leadership, while defensive sectors play a more complementary role rather than the primary driver of global equity performance. For portfolio managers, this translates into a disciplined approach: maintain diversification, monitor sector rotation signals, and design conditional hedges that can be deployed if confidence in growth stocks falters.

In summary, the current moment marks a pivotal juncture for defensive stocks within the global market framework. The near-record-low share of global market capitalization signals a shift toward growth-oriented leadership, a trend with wide-ranging implications for investment strategy, corporate financing, and economic policy. As the landscape evolves, the convergence of technology advancement, macroeconomic policy, and regional dynamics will shape whether defensive sectors regain prominence or continue to operate as secondary ballast within a broader, tech-driven market narrative. The coming quarters will reveal how durable this rotation is and whether it represents a temporary re-pricing or a lasting recalibration of sector leadership in the global economy.