Chinese Government Bonds Outperform Since Tech War Began

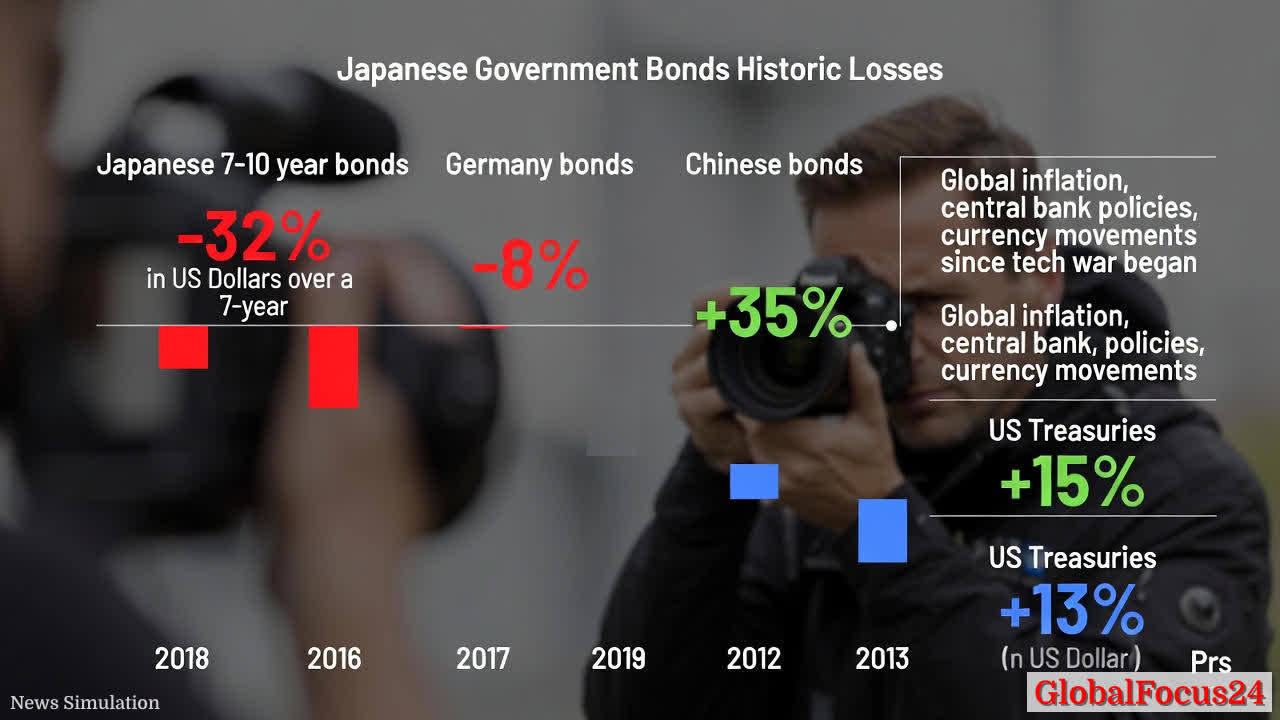

Chinese government bonds have significantly outperformed other major bond markets since the technology-driven trade tensions intensified, delivering notable gains for investors who navigated rapidly shifting global financial conditions. Over the past seven years, 7- to 10-year Chinese government bonds posted a total return of approximately 35% in U.S. dollars, a performance that stands in stark contrast to several of their global peers. This disparity underscores not only how China’s debt market has evolved in a volatile global environment but also how divergent macro forces—ranging from inflation trajectories to currency movements and monetary policy—have shaped fixed income returns around the world.

Historical backdrop and early drivers

The tech war era, characterized by tit-for-tat tariff announcements, export controls, and escalating restrictions on cross-border technology collaboration, accelerated a broader reconfiguration of global supply chains and capital flows. While equities experienced varied volatility, government bond markets reflected shifting expectations for growth, inflation, and currency values. In China, a combination of supply-side resilience, targeted monetary policy, and structural reforms created an environment where domestic yields could normalize more gradually relative to other advanced economies.

From a longer-term historical lens, China’s government bond market has benefited from a steady accumulation of domestic savings, a gradual liberalization of the financial sector, and increased participation by institutional investors. Over the past decade, China has also advanced reforms to improve transparency, enhance market liquidity, and broaden the investor base for government securities. These factors contributed to a more mature yield curve and greater resilience when global risk sentiment fluctuated.

Regional performance and comparisons

The divergence in bond performance became particularly pronounced starting in 2021, a period marked by accelerated global inflation and aggressive monetary tightening by major central banks. As inflation surged in many economies, central banks lifted policy rates to curb price pressures, contributing to rising yields and, in many cases, capital losses for bondholders in certain markets.

- Chinese government bonds: The 7- to 10-year segment delivered robust total returns in U.S. dollar terms, aided by relatively contained domestic inflation and a willingness by Chinese policy authorities to maintain accommodative or targeted policy measures when needed. The result was a gradual decline in yields during periods of global rate volatility, helping price appreciation for longer maturities.

- Japanese government bonds: Japan faced a different set of headwinds, including a weakening currency and persistent bouts of higher yields from a domestic inflation process that lagged global peers. This environment, coupled with a historically low baseline interest rate, created headwinds for bond holders and contributed to negative performance relative to other major markets.

- German government bonds: Euro-area yields also moved higher in the face of inflation surprises and shifting monetary policy expectations. While German Bunds remained a core anchor for many portfolios, their performance was more sensitive to eurozone inflation dynamics and the European Central Bank’s policy stance, which affected relative returns.

- U.S. Treasuries: The U.S. market provided a mix of capital appreciation and coupon income, benefiting from a stronger dollar at certain moments and from the relative stability of American macro data at times. Yet, the Treasuries did not escape periods of decline, notably during mid-2021 to 2022 when inflation shocks and policy normalization created a challenging environment for fixed income in the United States.

Mechanisms behind China’s relative strength

Several interconnected factors helped Chinese government bonds outperform during a period of global volatility:

- Yield trajectory and policy stance: While many major economies embarked on aggressive rate hikes to combat inflation, China’s approach to monetary policy remained more calibrated, with targeted easing or liquidity support when needed. This allowed the longer end of the Chinese yield curve to compress or stabilize in ways that boosted bond prices.

- Inflation dynamics: China’s inflation trajectory has, at times, shown a more subdued profile compared with some advanced economies. This relative deflationary or low-inflation environment for a sustained period supported a more favorable backdrop for government bond valuations.

- Currency considerations: The behavior of the yuan, along with foreign exchange dynamics, influenced total returns in U.S. dollar terms. A perceived inflation advantage and currency stability in certain phases added an extra layer of resilience for Chinese bonds when priced in dollars.

- Domestic demand and liquidity: The Chinese debt market has benefited from robust domestic demand for government securities, supported by a growing pool of institutional buyers and a diversified investor base. This demand helped maintain liquidity and price stability across maturities.

- Structural reforms: Ongoing market reforms, including greater transparency, improved settlement infrastructure, and measures to deepen the bond market, enhanced investor confidence and reduced risk premia on Chinese sovereign debt.

Economic impact and spillovers

The outperformance of Chinese government bonds has several meaningful implications for both domestic policy and global capital markets. For policymakers, the relative strength of the sovereign debt instrument provides more control over domestic financing conditions and can influence the stance of fiscal and macroprudential policy. A more stable bond market also lowers borrowing costs for the government, enabling greater room for investment in infrastructure, social programs, and other long-term priorities.

For investors, the relative performance of Chinese bonds highlights the importance of diversification amid global fragmentation in fixed income markets. The different inflation paths and central bank cycles across major economies create a mosaic of risk and opportunity. Allocators may view Chinese government securities as a complement to traditional core sovereign benchmarks, particularly when seeking to balance duration risk against currency and inflation considerations.

Regional comparisons also illuminate how shifts in global demand for safe assets can influence capital flows. In environments where U.S. Treasuries or German Bunds face competing pressures, Chinese government bonds can offer an alternative allocation that aligns with both yield and risk tolerance. As investors recalibrate portfolios in response to macro developments, the interplay between yuan movements, domestic liquidity, and external demand will continue to shape relative performance.

Global investor sentiment and public reaction

Public and investor sentiment toward Chinese government bonds has evolved as markets reassess risk premia and potential policy directions. The resilience of China’s sovereign debt during a prolonged period of global uncertainty has reinforced confidence among many global fixed income managers, while also inviting scrutiny from those who weigh currency exposure and regulatory risk. As with any major market shift, the evolution of market structure, liquidity, and transparency will be closely watched by policymakers, institutional investors, and rating agencies alike.

Historical context and the longer arc of the market

To understand the current performance, it’s helpful to situate China’s sovereign debt within a longer historical arc. The Chinese government bond market has expanded significantly over the past decade, driven by increased issuance, maturity extensions, and the gradual inclusion of more global participants through reforms and market access programs. This expansion has contributed to a more complete yield curve and a broader set of benchmark securities that institutions use for risk management and strategic allocation.

Comparison with other asset classes

While the focus here is on government bonds, the broader context includes equities, commodities, and corporate debt. In times of global risk-off sentiment, government bonds often serve as a safe haven, while riskier assets may experience more pronounced volatility. The Chinese government bond market’s relative performance in this period illustrates how different asset classes respond to inflation expectations, currency dynamics, and policy signaling. Diversified portfolios that incorporate a mix of sovereign debt and other fixed income instruments can help manage duration risk and currency exposure.

Future prospects and considerations

Looking ahead, several factors could influence the continued trajectory of Chinese government bonds:

- Monetary policy evolution: The pace and direction of Chinese monetary policy will remain a key driver. If inflation stays subdued and growth stabilizes, longer-duration bonds may continue to perform well.

- Global rate environment: The behavior of major central banks outside China will affect global risk appetite and currency movements, which in turn can impact U.S. dollar-denominated returns on Chinese bonds.

- Currency volatility: Shifts in the yuan’s value can alter international investors’ realized returns, even when local yields are favorable. Hedging strategies and currency risk management will be important components of portfolio construction.

- Structural reforms: Ongoing reforms to improve market accessibility, liquidity, and transparency can attract a broader pool of international investors, potentially supporting price stability and deeper liquidity.

Key takeaways for investors and policymakers

- The past seven years have underscored the importance of understanding regional dynamics within fixed income. Chinese government bonds demonstrated resilience and consistent gains in a period when others wrestled with inflations and rate normalization.

- Diversification remains essential. A balanced approach across major bond markets can help smooth volatility and provide more predictable income streams.

- Vigilance on currency and policy signals is crucial. The total return on foreign-denominated debt depends not only on local yields but also on exchange rate movements and the stance of the issuing country’s authorities.

Conclusion

The outperformance of Chinese government bonds since the onset of heightened tech-focused tensions highlights the intricate interplay between inflation, policy, and currency markets in a fragmented global financial landscape. As economies navigate post-pandemic normalization and ongoing geopolitical shifts, sovereign debt markets will continue to reflect regional resilience and policy choices. Investors, researchers, and policymakers will watch closely to see how these dynamics evolve in the next chapter of global fixed income, and how China’s debt market adapts to an ever-changing global economic order.