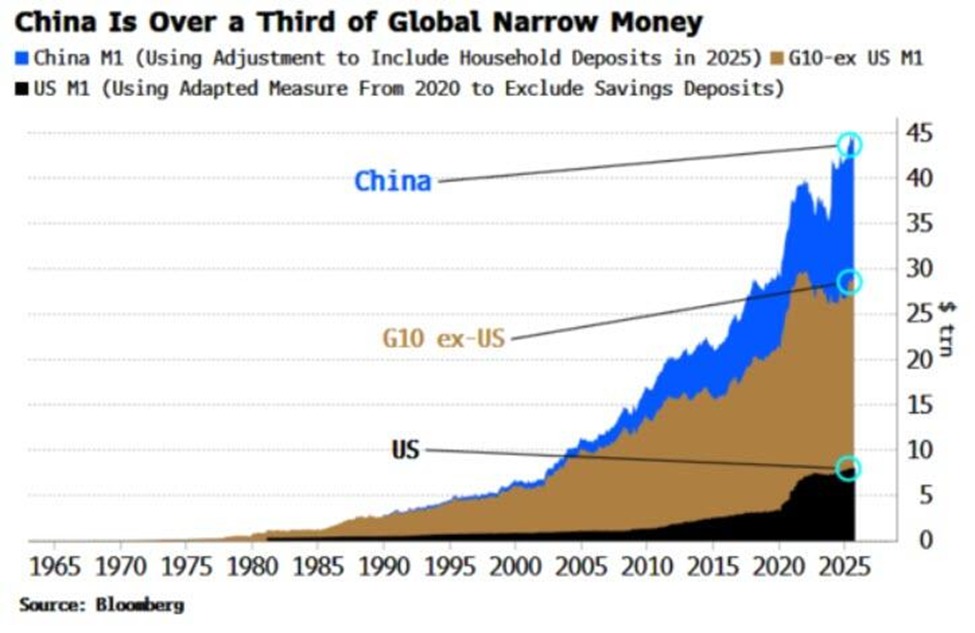

Global Narrow Money Surpasses Historic Threshold: China Accounts for Over a Third of Global M1

A landmark development in global finance emerged in 2025 as China’s narrow money supply, adjusted to include household deposits, surged to an unprecedented share of the world total. Data published for the year reflects a global M1, the narrowest measure of money in circulation and readily available for spending, reaching roughly $45 trillion. Within this framework, China’s contribution stands at about $16.5 trillion, equating to roughly 37% of global M1. The United States, by comparison, reports an M1 around $8 trillion, or about 18% of the global total, representing a marked divergence in the trajectory of monetary aggregates since the 1970s.

Historical context and the evolution of money supply Monetary aggregates like M1 capture the most liquid forms of money—currency in circulation plus demand deposits and other funds that can be quickly deployed for transactions. The modern era has seen several shifts in how these aggregates are constructed and interpreted, driven by regulatory changes, financial innovation, and evolving consumer behavior. In the post-Gold Standard era and through the late 20th century, the United States and other economies relied heavily on broad monetary measures that included savings deposits and time deposits. Over time, policymakers and analysts began to emphasize narrower definitions to gauge immediate liquidity in markets and households, especially as digital payments and non-bank financial intermediaries grew in prominence.

China’s rapid ascent in M1 since the early 2000s aligns with several macroeconomic and policy developments. Beijing’s phased credit expansion, industrial policy, and investments in urbanization created a broad base for household deposits and demand for liquidity within the domestic financial system. Additionally, the maturation of China’s financial markets—coupled with the expansion of consumer credit, online payment platforms, and the integration of digital wallets—contributed to higher levels of readily usable money held by households and businesses. The accompanying rise in money velocity in certain sectors has also influenced the observable broad liquidity of the economy, even as monetary authorities aimed to balance growth with financial stability.

Economic implications: liquidity, investment, and growth dynamics A larger share of global narrow money can reflect several intertwined dynamics. On one hand, abundant liquidity in a large economy can support robust consumer spending, capital formation, and investment in infrastructure and technology. On the other hand, concentrated liquidity in a single economy can influence exchange rates, cross-border capital flows, and global financial resilience. The 2025 data suggests that Chinese households and firms maintain substantial liquid buffers, which can facilitate quick responses to shifts in demand, credit conditions, or policy signals. This liquidity pool also interacts with China’s ongoing efforts to rebalance growth toward domestic demand, reduce overreliance on external demand, and deepen financial inclusion across urban and rural areas.

The United States’ smaller share, relative to the global total, does not necessarily imply weakness. U.S. money supply composition, financial architecture, and household behavior differ in meaningful ways. The U.S. experiences a long-standing emphasis on diversified financial assets, savings, and investment vehicles that may not be reflected entirely in a narrow money measure. Moreover, regulatory and supervisory frameworks influence how liquidity is created and channeled within the economy. In recent years, monetization of fiscal support and the role of digital payments have reshaped the landscape, even as traditional deposits and currency flows continue to drive a substantial portion of domestic liquidity.

Regional comparisons: Asia, the Americas, and global spillovers Within Asia, China’s dominant share of global M1 stands alongside rapid urbanization, expanding middle-class consumption, and a shifting financial-services ecosystem. Countries in the region have observed both spillover effects and policy implications from China’s liquidity profile. For example, heightened liquidity can influence cross-border capital movement, currency valuation expectations, and regional lending cycles, especially as monetary authorities respond to domestic growth targets and inflation pressures. In contrast, North American markets have pursued a balance between liquidity provision and prudential oversight, with a focus on maintaining financial stability amid evolving payment technologies and consumer finance patterns.

Emerging markets outside of China and the United States are watching these developments with keen interest. A shift in global liquidity can alter capital allocation, impact local interest rates, and shape exchange-rate dynamics. Policymakers in other economies may adjust their own monetary frameworks to accommodate changes in global liquidity, ensuring that domestic financial conditions remain supportive of growth while guarding against overheating or asset bubbles. The 2025 figure underscores the interconnectedness of the global financial system and the potential for regional spillovers as liquidity concentrates in one of the world’s largest economies.

Public reaction and market sentiment The public and market participants have responded with a mix of cautious optimism and prudent concern. Investors weigh the implications of a larger Chinese liquidity footprint against potential shifts in policy, currency strength, and domestic financial stability. Businesses that rely on cross-border financing or import-export cycles monitor liquidity dynamics as they evaluate funding strategies, hedging needs, and pricing assumptions. Consumers, too, may experience nuanced effects—ranging from availability of credit and payment convenience to considerations about inflation, wage growth, and purchasing power. Analysts emphasize the importance of monitoring both nominal dollar totals and the real effects on households and firms as liquidity interacts with broader macroeconomic conditions, such as productivity, employment trends, and fiscal policy.

Policy considerations and financial stability From a policy perspective, the evolution of global narrow money invites careful consideration of monetary transmission channels, financial regulation, and macroprudential tools. Central banks and supervisory authorities may prioritize measures that sustain financial stability while supporting sustainable growth. In a landscape where one economy holds a substantial portion of global liquidity, policymakers must balance the benefits of abundant liquidity with the risk of misallocation, credit booms, or asset price inflation. International coordination on monetary policy spillovers and exchange-rate management remains a relevant topic as economies navigate divergent growth trajectories and inflation profiles.

Looking ahead: trajectories and uncertainties Forecasting the precise path of global narrow money involves navigating a spectrum of variables, including monetary policy stances, financial technology adoption, and shifts in consumer behavior. China’s ongoing urbanization, industrial upgrades, and domestic consumption strength suggest that the country could maintain a substantial share of global liquidity for the near to medium term, barring material policy shifts or unexpected external shocks. The United States, with its deep financial markets and diversified asset bases, may continue to rely on a broader set of monetary measures to capture liquidity trends, potentially moderating the growth of narrow money relative to broad-based liquidity indicators. Global investors and policymakers will likely keep a close watch on how these dynamics influence exchange rates, interest rates, and cross-border capital flows.

Conclusion: a new liquidity landscape in the global economy The 2025 milestone marks a significant moment in the long arc of monetary history. It highlights how the balance of liquidity among the world’s leading economies has shifted, revealing implications for domestic policy, international finance, and everyday economic activity. As China’s share of global M1 rises toward a third or more of the world total, observers should consider the broader context—the evolution of payment systems, consumer finance, and the resilience of financial institutions. While this development underscores China’s growing influence in global liquidity, it also reinforces the importance of vigilant supervision, transparent reporting, and partnership among nations to sustain stable and inclusive growth in a connected world.