Central Banks Ramp Up Unofficial Gold Acquisitions

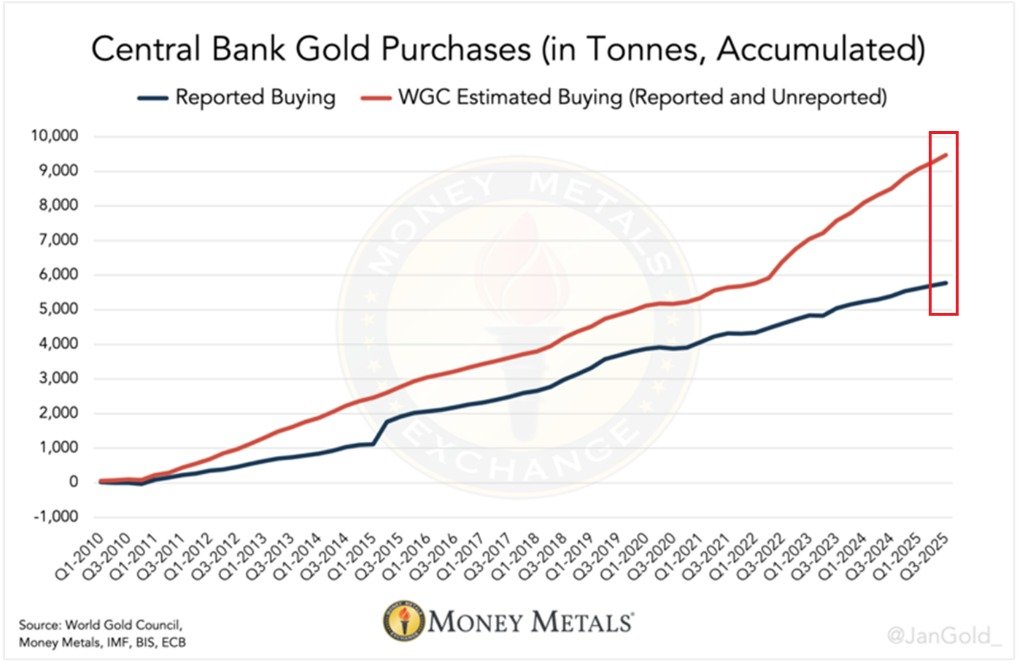

A sweeping shift in central bank strategy is reshaping gold reserves and the global monetary landscape. New estimates suggest that global central banks have accumulated approximately 9,500 tonnes of gold through unofficial purchases since 2010, significantly outpacing officially reported figures by about 3,700 tonnes, or 64%. The divergence between official disclosures and unofficial activity points to a broader, nontransparent effort by many nations to diversify their collateral and bolster financial stability in an era of rising geopolitical and economic uncertainty.

Historical context of gold as a strategic reserve Gold has long served as a trusted store of value and a hedge against currency volatility. For centuries, governments used gold to underpin national confidence and to signal fiscal resilience. In the post-World War II era, the Bretton Woods system anchored currencies to gold, albeit briefly, before the system evolved into fiat regimes. Over the decades, central banks formalized their holdings, publishing quarterly or annual reserve reports that became a barometer of monetary discipline and economic outlook. Yet beneath the surface, the demand for gold has persisted in forms that escape official accounting, driven by the need for pool liquidity, diversification, and crisis-proof collateral.

The rise of unofficial purchases The acceleration in unofficial gold buying began in 2022, a year marked by intensified global uncertainty, including supply chain disruptions, inflationary pressures, and heightened geopolitical tension. Since then, around 3,500 tonnes have been added in unofficial purchases, accounting for approximately 37% of the total gold acquisitions in the period. These unofficial purchases are often motivated by regulatory constraints, reporting lags, and the desire to establish private holdings for national reserve diversification without triggering immediate market signals.

China’s surge and regional dynamics In the third quarter of 2025, China acquired 118 tonnes of gold, a 55% increase from the previous year. This notable uptick underscores Beijing’s broader strategy to strengthen macroeconomic resilience and diversify assets amid domestic realignment and external pressures. Analysts note that the pace of purchases in China has accelerated alongside improved domestic demand for safe-haven assets and a belief in gold as a stabilizing counterweight to a potential depreciation of other assets.

Estimates indicate that China’s gold reserves reached a record 5,411 tonnes in the latest quarter, substantially higher than the officially reported 2,304 tonnes. The gap between unofficial and official figures highlights the complexities of accurately tracking reserve movements in a multi-agency, cross-border financial system. While official tallies provide transparency for market participants, unofficial estimates may capture broader central bank actions, regional stockpiling, and strategic pooling efforts that are not immediately disclosed.

Global implications for monetary policy and markets The trend toward increased unofficial gold acquisitions has several implications for central banks, financial markets, and the global economy. First, a larger, more diversified gold stockpile can reinforce confidence in a country’s monetary credibility, especially during periods of currency volatility or external shocks. Gold’s role as a liquidity anchor becomes more pronounced when other assets exhibit greater sensitivity to interest-rate expectations, inflation dynamics, or sovereign risk.

Second, the shift influences international capital flows and currency dynamics. A higher allocation to gold can affect reserve composition, potentially altering demand for foreign exchange reserves and the perceived stability of regional currencies. Regions with rising gold holdings may experience changes in risk sentiment and investment patterns, including shifts in sovereign debt pricing and credit risk assessments.

Third, central banks may use gold strategically to manage balance-of-payments pressures. In scenarios where currency depreciation or external imbalances threaten stability, gold reserves can serve as a buffer that supports confidence and market functioning. This is particularly relevant for economies navigating commodity price cycles, capital flight risks, or sanctions-related constraints.

Economic impact beyond reserve management The ongoing accumulation of gold reserves intersects with broader economic considerations. Countries delaying or reducing returns on traditional investments in favor of gold may affect domestic investment, inflation dynamics, and exchange-rate policies. At the same time, the gold market itself responds to central bank demand with price adjustments, mining activity implications, and shifts in jewelry and technology-related demand cycles.

From a regional perspective, several markets are closely watching reserve movements as indicators of policy posture and economic resilience. Asia, with its growing manufacturing power and financial markets, shows particular interest in how gold accumulation translates into broader financial stability. Europe, grappling with structural debates on monetary union and inflation, observes shifts in reserve composition as part of its long-run strategy for resilience. The Americas, including major mining and processing hubs, monitor global demand and supply balances to gauge the potential impact on price and liquidity in gold markets.

Environmental and ethical considerations As central banks contemplate reserve diversification, environmental and ethical factors surrounding gold mining gain renewed attention. The industry’s footprint, including energy use and labor practices, weighs on policymakers who seek sustainable models for resource extraction. Some central banks and national procurement policies emphasize responsible sourcing, incorporating third-party audits and traceability to ensure that reserve assets align with broader commitments to sustainable development.

Regional comparisons and supply considerations Gold reserve strategies are not uniform. While some economies emphasize rapid accumulation as a shield against currency instability, others adopt a more gradual approach, balancing gold with foreign exchange reserves and other safe-haven assets. Differences in mining capacity, domestic demand, and access to international gold markets influence regional patterns. For instance, economies with robust mining sectors may blend domestic production with imports, while others rely heavily on international markets to meet reserve growth targets.

Market participants and investor perspectives Asset managers, central banks, and sovereign wealth funds monitor reserve movements as signals of policy intent and financial health. Unofficial purchases, in particular, can quietly shift miners’ capacity, refinery output, and logistics planning as demand for refined gold increases. Market observers assess the sustainability of such buy-and-hold strategies and their implications for price volatility, hedging, and long-term inflation expectations. While gold is often described as a safe-haven asset, its role in foreign reserve management underscores its function as a strategic tool in macroeconomic policymaking.

Looking ahead: potential scenarios and uncertainties Several scenarios could shape the trajectory of official and unofficial gold acquisitions in the coming years. If global inflation pressures ease and real interest rates rise, central banks may adjust their reserve allocations toward a more balanced mix of assets, potentially slowing gold purchases. Conversely, continued geopolitical tensions, currency volatility, or fresh sanctions regimes could incentivize further accumulation as a form of strategic insurance. The pace of growth in unofficial holdings will depend on transparency, reporting standards, and the evolving landscape of international monetary cooperation.

Public reaction and communication challenges Public perception of rising reserve gold holdings varies by country and economic context. In some regions, gold is celebrated as a time-tested store of value and a symbol of financial sovereignty. In others, concerns arise about the opportunity costs of tying assets to a single commodity, especially if inflation or currency pressures abate. Policymakers face the challenge of balancing prudent reserve management with transparent communication to maintain public trust and market confidence.

Conclusion The enduring allure of gold as a cornerstone of national resilience maintains its relevance in a complex global economy. Official and unofficial central bank purchases collectively reinforce a strategic preference for tangible assets that can weather a wide range of shocks. As countries navigate inflation, currency fluctuations, and geopolitical risk, gold reserves stand as a silent but potent indicator of a nation’s readiness to weather uncertainty and adapt to evolving financial realities. The convergence of historical perspectives, regional dynamics, and market responses suggests that gold will remain a central feature of monetary strategy for years to come, even as the exact footprints of reserve movements continue to unfold behind the scenes.