Top 10% of U.S. Earners Now Drive Nearly Half of All Consumer Spending, Reaching Historic High

Wealth Concentration Fuels Uneven Consumer Economy

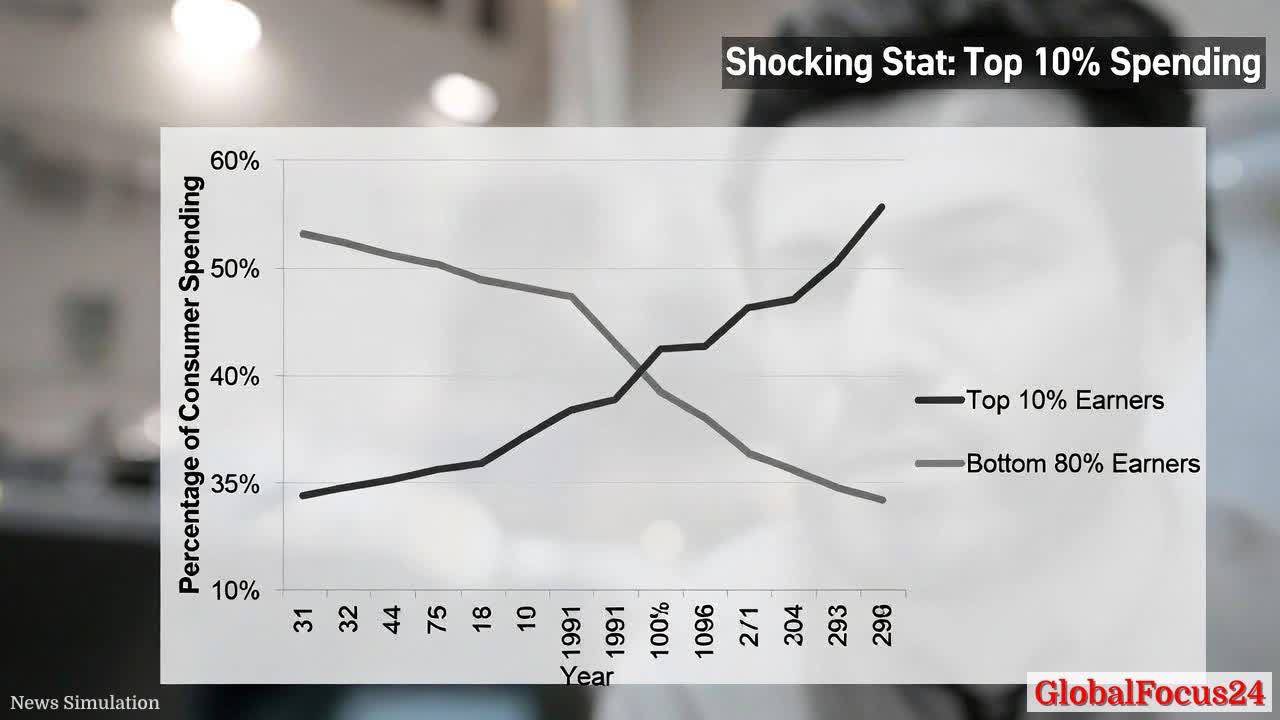

The top 10% of American earners now account for nearly half of all U.S. consumer spending, according to a recent analysis of Federal Reserve data by Moody’s Analytics. In the second quarter, this group was responsible for 49.2% of total consumer expenditures—up from 48.5% in the previous quarter and the highest share recorded since tracking began in 1989.

The finding underscores a structural shift in the country’s consumer economy, where prosperity and purchasing power have grown increasingly concentrated among upper-income households. In the early 1990s, the top 10% accounted for about 35% of total spending. Over the ensuing three decades, that figure has climbed steadily, mirroring trends in income and wealth inequality.

This growing reliance on affluent consumers represents both a foundation and a vulnerability for the broader economy. While strong spending from higher earners has helped the U.S. avoid recession during recent periods of inflation and higher interest rates, it also raises questions about how sustainable growth can be when much of the population faces financial strain.

The Diverging Paths of the American Consumer

Consumer spending, which makes up roughly two-thirds of U.S. gross domestic product (GDP), has long been the primary engine of economic growth. But the composition of that spending has shifted profoundly.

In inflation-adjusted terms, households in the lower 80% of the income distribution are spending a smaller share of the national total today than they did in previous decades. Meanwhile, the top 10% have expanded their influence as their wealth portfolios—buoyed by soaring equities, real estate, and business ownership—have outpaced the broader economy.

Moody’s Analytics’ data illustrate this widening gap. Since the 2008 financial crisis, the spending share of middle- and lower-income consumers has trended downward, aligning with sluggish wage growth and rising costs for essentials such as housing, healthcare, and education. Conversely, the spending power of the wealthy has surged in line with record highs in stock market valuations and corporate profits.

How Asset Values and Inflation Shape Behavior

The resilience of affluent spending is closely tied to the appreciation of financial and property assets. Since 2020, U.S. home prices have climbed over 40% nationally, while major stock indices such as the S&P 500 have doubled since their pandemic lows. These asset gains disproportionately benefit higher-income households, who hold the majority of financial wealth.

During periods of high inflation, those gains can offset increased costs. Wealthier consumers continue to travel, dine out, and purchase luxury goods at robust rates, even as middle-income families cut back. High earners also face greater flexibility in timing major purchases or accessing credit on favorable terms.

This divergence in consumption patterns has created a “two-track” recovery. On one side, luxury retailers, high-end travel agencies, and premium auto brands have reported strong demand. On the other, budget grocery chains and discount retailers have seen growth among cash-strapped consumers seeking to stretch limited income.

The Strain on the Middle and Lower Tiers

While top earners continue to spend freely, middle- and lower-income households remain squeezed by persistent inflation and elevated borrowing costs. The Federal Reserve’s campaign to curb inflation has kept interest rates at multidecade highs, raising the cost of everything from car loans to credit card balances.

Many households have depleted savings accumulated during the pandemic, when stimulus measures and reduced spending opportunities briefly boosted bank balances. Now, with real wages struggling to keep pace with prices, discretionary spending is faltering in these groups. Restaurants, apparel stores, and service businesses catering to middle-income consumers are feeling the pressure.

Data from the Fed show that lower-income families now hold less wealth than they did before the pandemic after adjusting for inflation. Meanwhile, household debt for this group has risen sharply, especially in credit card balances and auto loans—both of which carry historically high interest rates.

Historical Context and Long-Term Trends

Economic inequality in the United States has been widening for decades, but the pandemic and its aftermath appear to have accelerated that trend. In the 1990s, the U.S. saw relatively broad-based growth, with real incomes rising across most income brackets. However, starting in the early 2000s, gains in productivity increasingly failed to translate into wage growth for the majority of workers.

The Great Recession of 2008 further deepened disparities as job losses, home foreclosures, and a slow recovery hit lower- and middle-income families hardest. The wealthy, meanwhile, rebounded quickly as central bank policies—including near-zero interest rates and asset purchase programs—boosted stock and real estate values.

By the 2010s, the pattern was clear: wealth accumulation flowed primarily to the top percentiles, even as unemployment fell andGDP strengthened. That imbalance continues today. The Federal Reserve’s own research shows that the top 10% of households hold more than 70% of total U.S. wealth—a record high share.

Regional Differences Reveal Broader Fault Lines

The effects of this concentration are not evenly distributed across the country. In coastal metropolitan areas such as New York, San Francisco, and Los Angeles, spending by high-income households underpins much of the service and luxury retail sectors. These regions benefit from strong professional job markets, robust property values, and a concentration of corporate headquarters.

In contrast, many midwestern and southern regions rely more heavily on middle-income consumers, and their economies have felt the pinch of tightening budgets more acutely. Local businesses in these areas report slower sales growth and greater sensitivity to interest rate changes.

Even within states, disparities are widening. For example, Texas has seen both booming high-income enclaves fueled by the energy and tech sectors and regions where inflation and housing costs outpace wage growth. This uneven landscape complicates national policy responses, as economic conditions differ starkly from one metropolitan area to another.

Economic and Policy Implications

The growing dependence on wealthy consumers poses both opportunities and risks for the U.S. economy. On the one hand, high-income households have the resources to sustain spending during downturns, providing a buffer against recessions. On the other, such concentration increases vulnerability: should market volatility or asset price declines erode their wealth, national consumption could fall sharply.

Economists point out that a consumer base skewed toward the top amplifies inequality and limits the multiplier effect of spending. Money spent by higher-income individuals tends to circulate less within local economies, as a greater share goes to imported goods, savings, or investments. In contrast, spending by lower- and middle-income groups tends to support a broader range of local businesses.

Policy discussions increasingly revolve around how to encourage more inclusive economic participation—through measures such as increased access to affordable housing, education, and credit. However, with the Federal Reserve focused on inflation control, and fiscal deficits constraining government spending, large-scale redistribution or stimulus programs appear unlikely in the near term.

Business Adaptations and Market Signals

Companies are already reacting to this shift. Luxury and premium brands are expanding their product lines and investing heavily in customer retention among affluent buyers. Financial institutions are bolstering wealth management offerings, while high-end travel and hospitality sectors continue to roll out exclusive experiences.

Conversely, mass-market retailers and consumer goods companies are adjusting packaging sizes, offering more promotions, and introducing budget-focused product tiers. The bifurcation of the consumer marketplace is visible in corporate earnings reports: firms catering to high-income clients often outperform those dependent on moderate-income households.

This divergence also shapes investment patterns. Investors increasingly assess company exposure to different consumer segments, with a preference for businesses that can either capture premium demand or deliver strong value options at scale.

Broader Social and Economic Consequences

Beyond economics, the disparity in spending power has social and cultural ramifications. When the top 10% drive nearly half of all consumption, their preferences exert disproportionate influence on markets, urban development, and even cultural trends—from restaurant openings to entertainment production.

Meanwhile, a growing portion of the population faces diminished financial security, limiting social mobility and fueling broader concerns about economic fairness. Analysts warn that if the pattern continues, it could undermine long-term growth by reducing aggregate demand, stifling entrepreneurship, and eroding public trust in economic institutions.

Looking Ahead: A Balancing Act

As the U.S. economy enters 2026, the tension between robust high-end spending and constrained middle-income budgets defines its outlook. Growth remains dependent on households whose fortunes are tied to asset markets—leaving the economy sensitive to financial cycles.

Policymakers and business leaders face a challenging balance: sustaining momentum while addressing deepening inequality. If broad-based income gains fail to materialize, consumer demand could become increasingly fragile despitestrength.

The record share of spending by the top 10% underscores both the resilience and the fragility of the American economy. It highlights a system that thrives on prosperity at the top even as the financial foundations for many households grow less secure—a dynamic that may shape U.S. economic performance, policy debates, and social cohesion for years to come.