US Job Reports for 2025 Revisions Show Steady Downward Shift Across All Months

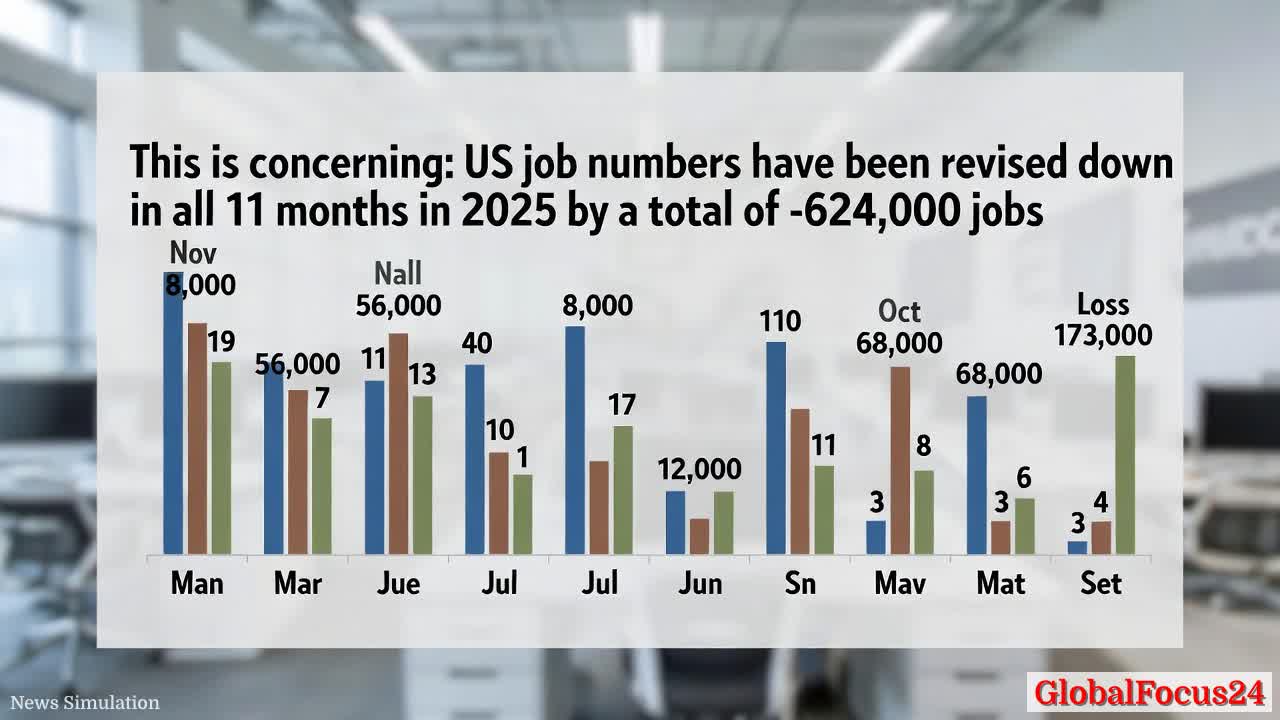

In a year that began with optimism about the labor market, new revisions to United States employment data for 2025 reveal a consistent downward trajectory across every month. The aggregate effect is a substantial reduction in reported job gains, totaling 624,000 fewer jobs than initially estimated. The revisions, which average a monthly decrease of about 56,728 positions, underscore the importance of revisiting economic interpretations in light of updated data.

Historical context and the arc of revisions In the months that followed the 2024-2025 economic cycle, initial job reports often painted a resilient labor market. However, as more complete data became available, statisticians and economists began to adjust those early figures downward. The 2025 revisions continue a broader historical pattern in which preliminary payroll numbers are refined as more comprehensive information becomes accessible from employers, state agencies, and other data sources. While revisions are a normal part of statistical practice, the magnitude observed in 2025 is notable for its breadth across all months.

The pattern begins with early-year reports that showed steady or modest gains and transitions toward increasingly negative revisions as the year unfolded. This shift can influence interpretations of underlying economic health, including sectoral performance, wage dynamics, and the pace of cross-month momentum. For policymakers, investors, and the public, understanding that initial snapshots may overstate near-term strength is essential for calibrated decision-making and expectations.

Economic impact across sectors and regions The cumulative downward revisions to payrolls have a ripple effect across the broader economy. Hiring trends influence consumer confidence, wage growth, and household spending, particularly in industries tied to discretionary consumption and durable goods. When job gains are revised lower, consumer sentiment can waver, potentially slowing spending in areas such as retail, hospitality, and manufacturing. Conversely, the revisions also illuminate resilience in certain pockets of the economy, especially where services demand remains robust or where temporary labor markets show momentum despite downward revisions in other months.

Regional differences also matter. Some regions may experience milder revisions due to labor-market dynamics, while others encounter sharper downward adjustments. The revisions highlight how local industry composition, seasonal hiring patterns, and sectoral mix can alter the trajectory of payroll data. For example, areas with a concentration of high-wage professional services or manufacturing may see different revision patterns than regions reliant on seasonal tourism or hospitality.

Contextualizing with broader economic indicators Payroll revisions should be considered alongside other macroeconomic indicators, including unemployment rates, participation levels, wage growth, and productivity metrics. When payroll gains are revised downward while unemployment remains comparatively steady or improves only marginally, questions may arise about the relationship between job creation and labor-force participation. Analysts often cross-reference payroll data with nonfarm payrolls, average hourly earnings, and the Job Openings and Labor Turnover Survey (JOLTS) to build a more nuanced view of labor-market health.

In the current landscape, a downward trend in payroll revisions can intersect with broader concerns about inflation, supply-chain normalization, and fiscal policy. If the economy maintains a modest growth path with fewer added jobs than initially reported, central banks and policymakers may adjust expectations regarding monetary tightening or stimulus measures. The interplay between revised job gains and inflation dynamics can shape the trajectory of interest rates and borrowing costs for households and businesses.

A closer look at the November and October revisions Recent updates show specific-month revisions that illuminate the broader pattern. November’s preliminary gain of 64,000 jobs was revised downward by 8,000 to a net gain of 56,000. October’s figure faced a sharper downgrade, moving from a previously reported gain to a net loss of 173,000 jobs. This shift marked the weakest monthly performance since December 2020, a reference point that underscores how even a single month’s revision can redefine the narrative around labor-market vitality.

If the revision cadence continues, December’s initial reading of a 50,000-job gain could undergo a substantial shift, potentially ending up around a loss of roughly 6,700 jobs. While this is speculative pending the final update, the scenario illustrates how ongoing data refinements can alter the perceived momentum of the economy as the year closes.

Interpretation for investors and policymakers Investors watching fixed-income and equity markets often place significant weight on payroll data, interpreting changes as signals about demand strength, wage pressures, and the likely path of monetary policy. Revisions that consistently pull back on job gains can reset expectations for how quickly inflation will cool and how aggressively central banks will respond. For policymakers, the revisions emphasize the need for cautious fiscal planning, recognizing that the labor market may not be as robust as initial reports suggested.

Businesses should also take note of revised trends when modeling labor costs and staffing plans. Hiring plans anchored on optimistic initial numbers may need recalibration in light of more conservative employment baselines. This is especially relevant for sectors with thin margins or high sensitivity to wage dynamics, such as construction, manufacturing, and professional services.

Regional comparisons and implications

- Northeast and Midwest markets: Regions with diverse industrial bases—combining manufacturing, healthcare, and tech services—may experience mixed revisions. The intricate balance between durable goods demand and service-sector growth can result in revisions that vary by state and metropolitan area.

- South and West markets: Areas with strong energy, technology, and trade activity could observe different revision patterns, reflecting shifts in demand, supply chain normalization, and sector-specific payroll changes. Local policy responses, including workforce development initiatives, may influence resilience in these regions.

- Urban vs. rural dynamics: Urban centers often exhibit quicker payroll revisions due to the density of employers and the speed of data collection. Rural regions, while potentially experiencing smaller absolute revision numbers, can show outsized percentage shifts if initial readings were more volatile.

Methodological notes on revisions Payroll revisions arise from multiple data streams and estimation techniques. Early estimates frequently rely on sample surveys and payroll data that may miss late-reported hires, job-series reclassifications, or seasonal adjustment nuances. As additional reports circulate and seasonal factors are refined, statisticians adjust the figures to reflect a more comprehensive picture. The goal is to produce a stable, accurate series that informs business planning, policy formulation, and public understanding.

In practice, revisions can occur in small increments or, as seen in 2025, in substantial downward shifts that reframe the month-to-month trajectory. While revisions are an inherent feature of economic statistics, they also highlight the importance of looking beyond single-month readings to understand the longer-term labor-market arc.

Public reaction and communication challenges Public interpretation of payroll revisions can be uneven. For some, revised data challenges the comfort of a steady jobs narrative, prompting questions about the strength of the economy. For others, revisions may reinforce caution, encouraging prudent budgeting and saving. Media coverage and expert commentary often influence how these revisions are perceived, which can affect consumer confidence and short-term spending behavior.

Clear communication about revisions—emphasizing the distinction between preliminary reports and final data—can help mitigate confusion. When policymakers, businesses, and the public understand that revisions are a routine part of statistical practice, they can adjust expectations without overreacting to single-month changes.

Looking ahead: what the revisions mean for 2026 As the calendar turns to 2026, the pattern of revisions observed in 2025 offers several takeaways. First, the labor market may exhibit more resilience in other indicators even if payroll gains are smaller than initially believed. Second, monetary policy considerations could hinge less onpayroll growth and more on a composite view of inflation, productivity, and wage dynamics. Finally, regional variation will likely persist, underscoring the value of local data in understanding the national picture.

Opinion-free, data-driven assessment This analysis focuses on the factual trajectory of payroll revisions and their potential implications for the broader economy. It avoids prescriptive political commentary and instead centers on how revised job figures influence interpretation of economic strength, consumer behavior, and policy dynamics. By situating the revisions within a historical framework, the article provides a coherent narrative about how the labor market evolves in response to shifting demand, supply constraints, and structural changes in the economy.

Public policy considerations without bias While the revisions themselves do not prescribe policy, they inform conversations about workforce development, education, and infrastructure investments that can enhance productivity and job stability. Regions investing in training, apprenticeship programs, and upskilling initiatives may bolster resilience against a rocky payroll revision cycle. Businesses that anticipate slower-than-expected payroll growth can adjust hiring plans and wage strategies to maintain competitiveness while supporting employee retention.

Conclusion In 2025, the US labor market underwent a notable recalibration as employment data underwent widespread downward revisions across every month. The cumulative effect—624,000 fewer jobs than initially reported—paints a more cautious picture than early readings suggested. Yet, by examining the revisions alongside sustained indicators such as unemployment rates, wage trends, and regional performance, a nuanced narrative emerges: the economy remains capable of growth and adaptation, even as the pace of job creation proves more restrained than first thought. For policymakers, investors, and the public, the message is clear—approach payroll reports with a disciplined eye, weigh them against a suite of indicators, and recognize that revisions are an intrinsic part of how we understand a complex, evolving economy.