European Regulators Drive Record Accruals as Tech Giant Reports $10.5 Billion in EC Fines

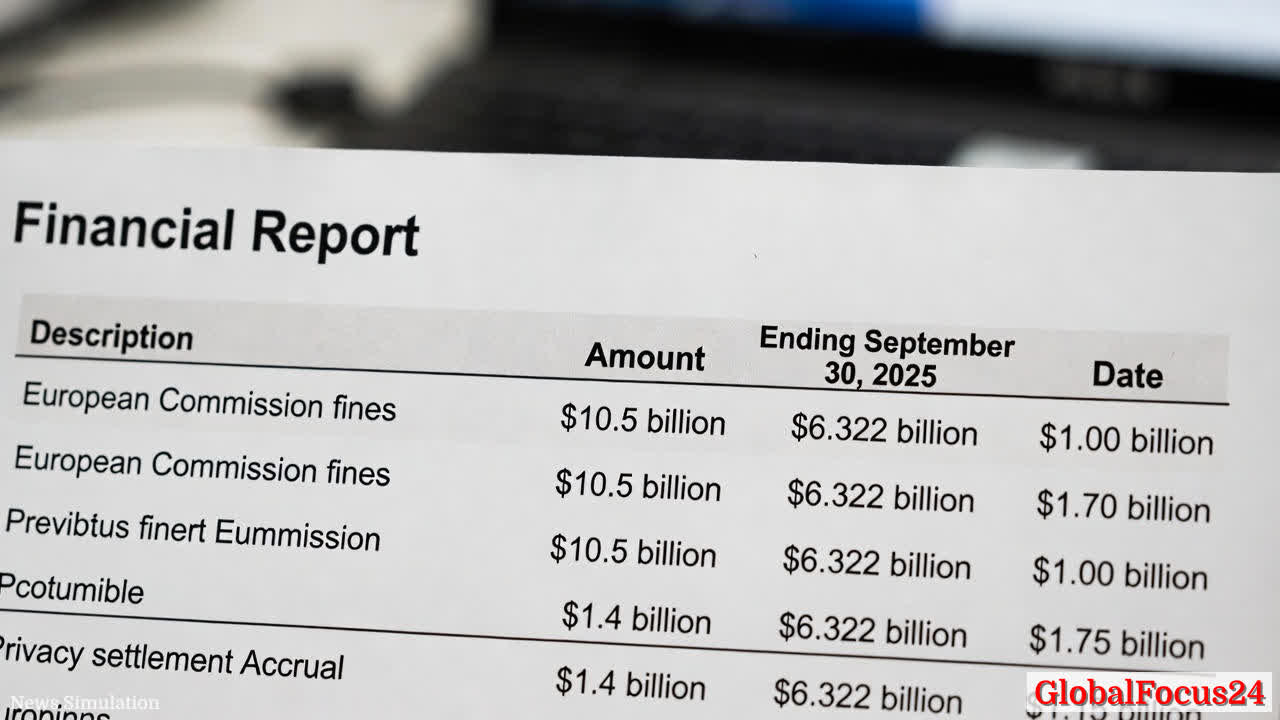

A leading technology company disclosed a striking growth in accrued expenses tied to European Commission penalties in its latest quarterly filing, dated September 30, 2025. The company lists $10.5 billion under the line item labeled “European Commission fines,” up from $6.322 billion at the end of 2024. The disclosure underscores the increasing fiscal impact of regulatory actions across the region and highlights how settlements, appeals, and related foreign exchange movements shape quarterly results for multinational technology incumbents.

Context and Background

The European Commission has long pursued antitrust, competition, and consumer protection actions affecting major tech platforms. In recent years, high-profile investigations have scrutinized market access, data practices, pricing strategies, and the role of platform ecosystems in digital advertising. While regulators balance consumer protection with fostering innovation, the magnitude of penalties and the pace of regulatory activity have surged in several sectors, including digital markets, e-commerce, and cloud services.

Analysts note that the accrued fines reflect both settled matters and ongoing appeals, combined with adjustments for foreign exchange fluctuations and interest. The September 2025 filing shows the company accounting for these regulatory penalties in a way that captures the liquidity risk and potential future settlement cash flows embedded in ongoing negotiations with European authorities. The sizable accrual is not necessarily a cash outflow in the immediate term, but it signals the scale of potential liabilities that could influence shareholder value, capital allocation decisions, and debt management practices.

Historical Context

To understand the significance of a $10.5 billion EC fines accrual, it helps to compare with prior regulatory episodes in Europe. In the past decade, several tech firms faced substantial penalties from European authorities for antitrust and privacy-related issues. These cases often spanned multiple years, with initial fines followed by appeals, remedial measures, and, in some instances, incremental settlements. As regulatory frameworks in the EU evolve—particularly with the digital markets and data privacy regimes—regulators have increasingly tied penalties to market influence, user impact, and cross-border business practices. The escalation in accrued penalties over time may reflect both the growing visibility of large platforms and the EU’s willingness to pursue extended actions where evidence suggests anti-competitive effects or consumer harm.

Economic Impact

The scale of the accrued EC fines bears notable economic implications beyond the balance sheet. For the company, a multi-billion-dollar accrual can affect key performance indicators, including earnings per share, operating margins, and free cash flow (FCF). While not all of the $10.5 billion may mature into cash payments immediately, the prospect of large settlements or ongoing appeals can influence:

- Investor sentiment and capital allocation decisions, including share repurchases and dividend policy.

- Financing strategies, as elevated regulatory liabilities may interact with debt covenants or credit ratings.

- Project prioritization within the business, with potential shifts toward compliance, risk management, and regional market strategies.

- Customer and partner perceptions, especially in markets where regulatory actions are top-of-mind for business planning.

From a regional economics perspective, the EU’s regulatory posture can affect cross-border investments, data localization strategies, and cloud services deployment. Firms may respond with enhanced transparency, more robust governance structures, and investments in privacy engineering or competition-compliance programs. The broader European tech ecosystem could experience slower near-term growth if penalties influence compliance costs, though a robust legal regime can also foster long-term consumer trust and a level playing field for smaller competitors.

Regional Comparisons

When evaluating regulatory risk across continents, two contrasts stand out:

- Europe vs. United States: U.S. regulators often emphasize different dimensions of market power and consumer protection, with a longer history of sector-specific proceedings. In contrast, the EU tends to pursue comprehensive remedies with durable standards and broader impact on business operations across EU member states. The sizable European penalties observed in the quarterly report align with the EU’s tendency to deploy substantial penalties in cross-border digital markets.

- Europe vs. Asia-Pacific: The APAC region presents a mosaic of regulatory regimes, with varying degrees of enforcement intensity. Some jurisdictions may impose penalties in certain cases, while others emphasize compliance frameworks, data sovereignty, and local competition laws. Companies operating globally must manage a diverse risk profile, balancing EU scrutiny with evolving standards elsewhere.

Corporate Strategy and Compliance Implications

From a strategic standpoint, the elevated EC fines accrual reinforces the importance of proactive regulatory risk management. Firms at scale in Europe often invest in:

- Comprehensive compliance programs that align with EU competition rules, privacy directives, and sector-specific mandates.

- Independent governance and risk committees to ensure ongoing oversight of regulatory exposure.

- Transparent reporting mechanisms that communicate regulatory liabilities clearly to investors and stakeholders.

- Data ethics and user-consent frameworks designed to minimize future disputes and streamline compliance.

In the current environment, some executives view regulatory liability disclosures as a test of governance quality. A clear, well-documented plan to address findings, remedial actions, and timelines can help reassure markets that the company is effectively managing risk, even when penalties are substantial.

Investor and Public Reaction

Public and investor responses to large regulatory accruals can be mixed, depending on how the company frames the information. Markets typically weigh:

- The trajectory of the accruals: whether the total amount is rising or stabilizing, and how much is tied to ongoing appeals or projected settlements.

- The quality and credibility of management’s guidance regarding future cash flows related to penalties.

- The company’s track record on compliance improvements, including investments in compliance personnel, internal controls, and governance transparency.

- The broader sector context: if several peers report similar regulatory exposures, investors may view the risk as a common industry challenge rather than company-specific missteps.

Public sentiment in Europe often centers on the balance between protecting consumer rights and enabling innovation. News cycles can amplify concerns about the costs of compliance, especially for users who rely on free or low-cost digital services. A measured, fact-based communication approach from the company—highlighting steps taken to protect users, improve data practices, and foster fair competition—tends to resonate with stakeholders seeking stability and accountability.

Financial Statement Nuances

The quarterly filing notes that the $10.5 billion figure includes fines currently under appeal and accounts for foreign exchange and interest adjustments. This complexity matters for several reasons:

- Timing and realism: The accrual captures potential liability, but its conversion to cash depends on the outcome of appeals, settlements, or negotiated terms with regulators.

- FX sensitivity: Given the multinational nature of the business, fluctuations in currency exchange rates can shift the reported value of regulatory liabilities when translated into the company’s reporting currency.

- Interest accruals: Interest components can accumulate on unresolved regulatory fines, adding to the total liability over time if proceedings extend.

Additionally, the report mentions a separate $1.4 billion accrual related to a privacy-matter settlement as of September 30, 2025. This underscores the breadth of regulatory and legal considerations facing tech platforms, where privacy, data handling, and consumer protections intersect with competition concerns.

Historical Performance Context

For investors and analysts, it helps to place the September 2025 numbers in the context of the company’s broader earnings trajectory. The reported escalation in accrued penalties is one facet of a larger narrative encompassing revenue growth, operating efficiency, capital expenditure, and regulatory risk management. While regulatory liabilities are non-cash items in the short term, they are material indicators of potential future cash outflows and the strategic importance of regulatory compliance in sustaining long-term value creation.

Regional Market Outlook

Looking ahead, European markets are likely to continue shaping the regulatory landscape for technology firms. Several factors could influence future outcomes:

- Policy evolution: New or revised EU rules around digital markets, data protection, and enforcement mechanisms could affect both the likelihood of penalties and the speed with which settlements are reached.

- Enforcement intensity: If regulators maintain or increase the pace of investigations, large penalties may persist as a recurring theme for several quarters or years.

- Market competition: As European digital ecosystems evolve, competition authorities may scrutinize platform practices more closely, potentially driving incremental compliance costs but also encouraging fairer competition.

Conclusion

The latest quarterly disclosure of a $10.5 billion European Commission fines accrual signals a watershed moment in the regulatory financing landscape for major technology platforms operating in Europe. While not all of the amount represents immediate cash outlays, it highlights the substantial risk and potential financial exposure that can arise from regulatory actions that span investigations, appeals, and settlements. As regulators and the courts continue to shape the rules of the digital economy, the industry will likely see ongoing emphasis on compliance, transparency, and governance as essential elements of sustainability and resilience in a rapidly evolving market environment.

Public reaction to such disclosures will continue to inform investors, policymakers, and consumers about how tech giants balance innovation with accountability. In a region where data privacy, competition, and consumer rights remain central to policy debates, the ability of a company to navigate complex regulatory processes with clarity and foresight will be a defining feature of its governance and long-term competitiveness.