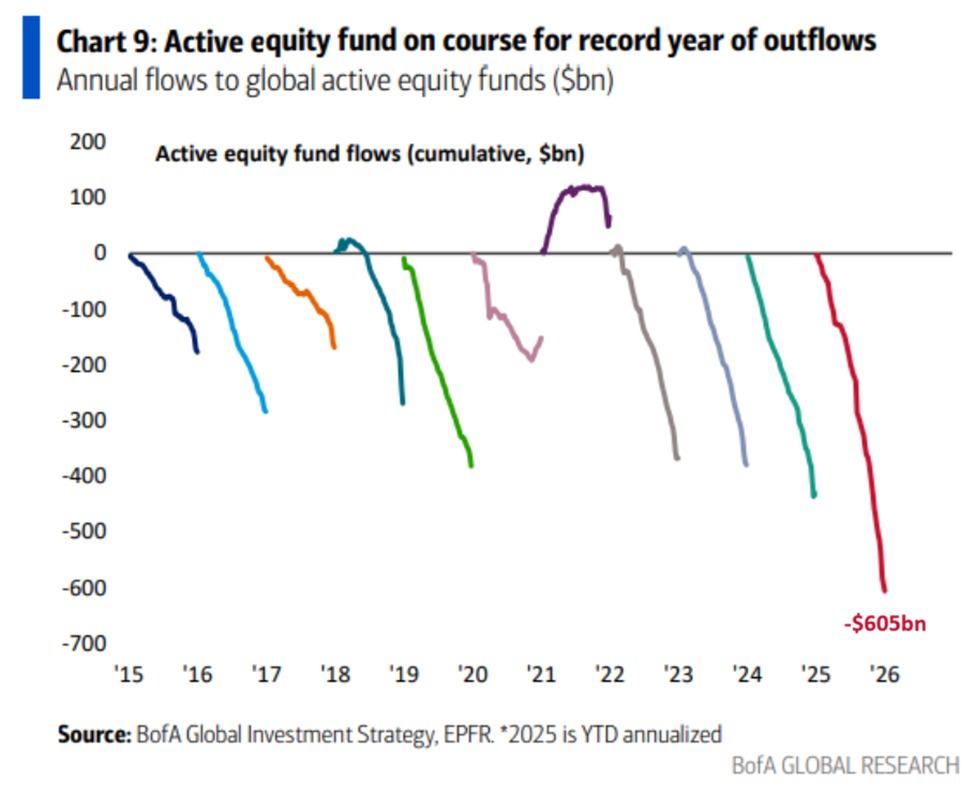

Global Active Equity Funds Face Record $605 Billion Net Outflows in 2025

Global active equity funds are on track to endure an unprecedented year of capital flight, with projected net outflows reaching $605 billion in 2025. This figure, derived from year-to-date annualized data, surpasses the prior record of $450 billion and underscores a decade-long trend of investor reprioritization away from active management amid mixed performance, rising costs, and shifting market dynamics. As fund flows reshape the landscape for asset managers, the trajectory also raises questions about the long-term resilience of active strategies in a cost-conscious, technology-enabled investing environment.

Historical Context: A Ten-Year Pattern of Outflows The 2025 projection sits within a broader context of persistent, though uneven, outflows from active equity products. Over the past 11 years, the industry has witnessed outflows in 10 of those years, totaling approximately $3.1 trillion in cumulative net losses. This pattern has been driven by several converging forces: a long-running comparison against low-cost passive vehicles, evolving investor expectations for alpha, and a shifting regulatory and operational environment that increases the cost of active management.

To understand the significance of the current year, it helps to recall earlier cycles. When passive investing gained traction in the 2010s, many investors shifted assets from active funds into index-tracking products and exchange-traded funds. The appeal was twofold: lower fees and transparent exposure to broad market indices. Even during periods of market stress, passive strategies often carried through with less friction than some actively managed portfolios, contributing to persistent outflows from active sleeves of the market.

In this light, 2025’s projected outflows can be seen as a continuation, rather than a departure, from a gradual reallocation of capital. Yet the magnitude—exceeding $600 billion—signals a potential inflection point in investor sentiment, especially if the underperformance of a broad swath of large-cap funds persists through key market cycles.

Performance Dispersion and the Challenge for Active Managers Recent performance data indicate that only 29% of large-cap mutual funds have outperformed their benchmarks year-to-date—a record-low since 2019 and well below the long-run average of about 37% since 2007. This breadth of underperformance has intensified scrutiny of active strategies, highlighting the difficulty of consistently beating benchmarks after fees in a shifting market environment characterized by rapid information flow and complex macro dynamics.

The implications for fund sponsors and advisers are multifaceted. First, persistent underperformance can erode investor confidence and drive further allocations toward passive vehicles, including smart beta and factor-based ETFs that attempt to blend elements of active and passive approaches. Second, managers face heightened pressure to demonstrate clear value propositions, whether through superior stock selection, risk management, or distinctive thematic exposures. Third, cost considerations—expense ratios, trading costs, and turnover—gain renewed importance as investors seek to optimize net returns.

Economic Impact: How Outflows Reshape Markets and Industry Economics The scale of 2025’s projected outflows has ripple effects across several dimensions of the financial ecosystem:

- Asset-raising potential for active managers: Persistent outflows constrain capital formation for active funds, potentially limiting the ability of managers to scale strategies, recruit top talent, or invest in research and data capabilities. This constraint can, in turn, influence the breadth of investment ideas and the depth of fundamental analysis available to clients.

- Fee dynamics and product strategy: In a climate of heightened outflows, managers may adjust fee structures or introduce alternative vehicles to preserve client assets. A continued focus on delivering value—through differentiated research, access to exclusive opportunities, or risk-managed approaches—becomes a critical differentiator.

- Market liquidity and price discovery: Broad disinvestment from active funds can influence liquidity and price discovery in certain market segments. If a sizable portion of capital shifts toward passive or hybrid strategies, trading patterns, sector exposures, and volatility dynamics may evolve, prompting policy makers and market participants to reassess risk transmission channels.

- Investor behavior and financial literacy: Sustained outflows reflect evolving investor preferences, including a preference for transparent, cost-efficient products and greater emphasis on total return after fees. This trend underscores the importance of investor education around risk, diversification, and the trade-offs between active and passive strategies.

Regional Comparisons: How Different Markets Are Affected While the data point refers to global active equity funds, regional patterns can illuminate the varied impact across markets:

- United States: As the largest pool of assets and the deepest active-management industry, U.S. funds have been at the center of the outflow narrative. Fee structures, performance dispersion, and the availability of ETF alternatives shape the domestic dynamic. The U.S. market also illuminates the relationship between active underperformance and investor averse to higher fees in an environment of rising interest rates and macro uncertainty.

- Europe: European managers contend with an added layer of regulatory complexity and a historically more conservative investment culture. The shift toward cost-conscious investing is pronounced, with institutional and retail investors alike scrutinizing expense ratios and seeking greater transparency in active management claims. The regulatory backdrop, including MiFID-related disclosures, influences product development and marketing.

- Asia-Pacific: The APAC region presents a mixed picture, with varying degrees of acceptance for active management across markets such as Japan, Australia, and emerging economies. Some markets exhibit robust research ecosystems and high active competition, while others see stronger appetite for cost-efficient or passive solutions. Currency movements and local tax considerations further shape fund flows and product design.

- Emerging markets: In many emerging economies, local asset managers grapple with capital inflows and outflows that are driven by macro stability, political events, and currency volatility. Active funds in these regions can be more volatile, yet they may offer greater alpha potential during periods of geopolitical or macro shifts, attracting investors seeking diversification and growth opportunities.

Implications for Investors and Advisors The 2025 outflow trajectory underscores several practical considerations for investors and financial professionals:

- Reassessing core allocations: Investors may revisit core portfolios to determine whether active allocation remains appropriate given fees, historical tracking error, and the current market regime. A nuanced approach—combining passive cores with selectively chosen active sleeves—can help balance cost efficiency with potential alpha.

- Emphasizing transparency and risk management: For advisers, explaining the risk-reward profile of active mandates improves client understanding. Highlighting factors such as turnover, sector concentration, and style drift can foster more informed investment decisions.

- Monitoring manager science and data: As data analytics evolve, active managers can differentiate themselves through proprietary research, alternative data sets, and advanced modeling techniques. Investors should evaluate a manager’s research framework, decision-making processes, and operational rigor when considering fund selection.

- Considering alternative vehicle options: In response to outflows, managers may launch or expand hybrid products, factor-based strategies, or sector-focused funds that align with client needs. These vehicles can offer a balance of cost, transparency, and potential for excess returns.

Public Reaction and Market Sentiment Markets and investors have watched outflows with a mix of concern and pragmatism. For some, the trend signals a normalization of expectations—investors allocating more aggressively to low-cost options and demanding demonstrable performance. For others, there is anxiety about potential disruption to the traditional active-management model, and questions about whether there will be durable money moving back into skilled stock pickers as market conditions evolve.

Analysts emphasize that while past performance is not indicative of future results, the current flow dynamics reflect a broader shift toward efficiency and clarity in the investment landscape. The public discourse around active management often centers on the balance between potential outperformance and the costs required to achieve it, a balance that investors are recalibrating against a backdrop of macro uncertainty and rapid information dissemination.

Strategic Outlook: What Comes Next Several factors will influence the trajectory of active equity flows in the near to medium term:

- Market regime and volatility: If volatility remains elevated and dispersion among stocks widens, the appeal of active management could rise, offering opportunities for stock-specific insights. Conversely, a sustained bull market with broad-based gains could favor passive strategies.

- Talent and research investments: The ability of asset managers to invest in research capabilities, technology, and talent will be a determinant of whether active funds can deliver consistent value over time. Firms that can demonstrate material process improvements may reverse part of the outflow trend.

- Fee compression and product innovation: Expect ongoing pressure on fees and ongoing experimentation with product design. Managers may pursue tiered fee structures, performance-based fees, or evergreen capital to align interests with investors.

- Regulatory and macro considerations: Global regulatory developments, tax reforms, and central bank policy moves will continue to shape fund flows. Responsiveness to these changes, along with robust compliance and governance, will influence investor confidence and asset allocation decisions.

Conclusion: A Pivotal Year with Lasting Implications The projected $605 billion in net outflows from global active equity funds in 2025 marks a defining chapter in the evolution of asset management. While the numbers reflect current investor preferences and performance realities, they also illuminate the broader transition toward cost-efficient, transparent investment vehicles and the enduring debate about how best to generate returns in an increasingly data-driven market environment. As asset managers adapt—whether by refining active strategies, embracing hybrid approaches, or innovating new product structures—the industry will continue to shape how households, institutions, and intermediaries navigate risk, opportunity, and the quest for sustainable long-term growth.