Foreign Holdings of US Treasuries Dip Slightly in October, Yet Remain Near Historic Peaks

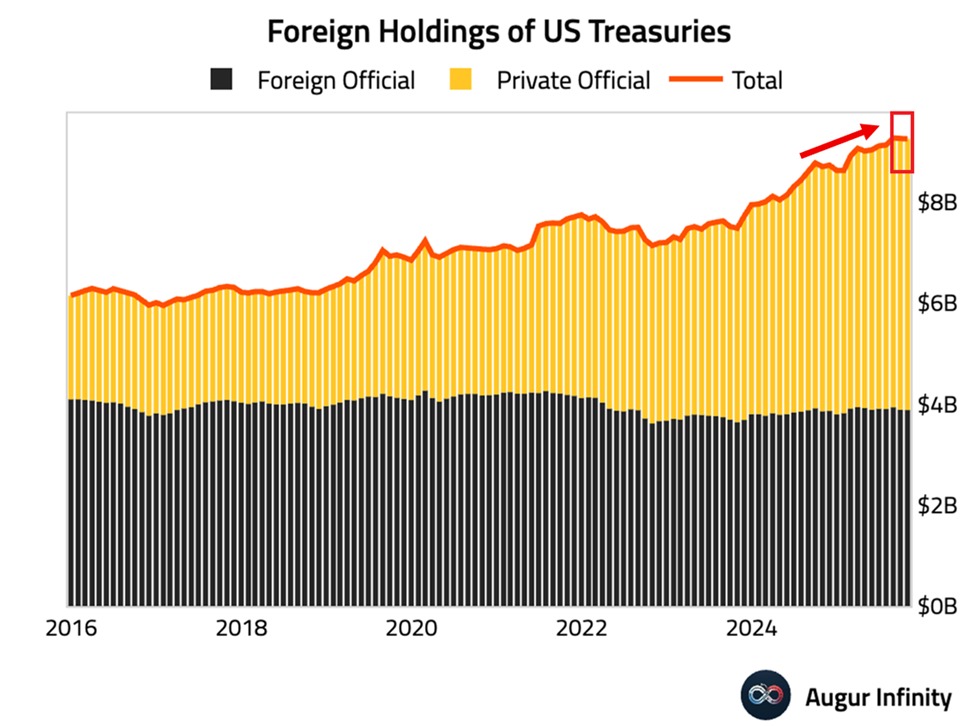

Across the globe, investors and governments continued to favor US government debt in October, even as total foreign holdings slipped modestly. New data show that foreign ownership of US Treasuries declined by $5.8 billion to $9.2 trillion, a level that still stands among the highest in history and reflects a complex mix of risk management, currency dynamics, and macroeconomic policy expectations.

Historical context and trajectory The United States has long benefited from the status of its Treasuries as the world’s benchmark safe-haven asset. After the 2008 financial crisis, demand for US government securities surged as central banks and reserve managers sought liquid, high-quality assets to anchor their portfolios. The ensuing decade saw foreign holdings climb to record highs at various intervals, underscoring the dollar’s central role in global finance and the interconnectedness of international trade and capital markets.

October’s modest dip occurs within this longer arc of resilience. While a $5.8 billion retreat may seem small in absolute terms, it is meaningful when viewed against the backdrop of multi-trillion-dollar holdings and the ongoing reassessment of portfolio risk in an environment of variable inflation expectations, shifting fiscal stimulus plans, and evolving monetary policy stances around the world.

Key holders and shifts

- Japan, as the largest foreign holder, increased its position by $10.7 billion to roughly $1.2 trillion in October. This expansion continues a recent pattern of sustained demand from a major creditor economy seeking to balance its own domestic growth with the preservation of a diversified reserve portfolio. Japan’s appetite for Treasuries often reflects a strategic choice to manage currency stability and finance its sizable current account surplus, even amid a global rate environment that has seen some volatility.

- The United Kingdom, the second-largest owner, added $13.2 billion to bring holdings to about $878 billion, marking a third-highest figure on record. The renewed interest from London highlights the UK’s role as a major financial hub and a bridge between European and North American capital markets, particularly important as macro conditions in Europe navigate inflation persistence and energy price dynamics.

- Belgium, including custodial accounts for third-party assets such as those tied to China, saw an increase of $1.6 billion to a record $468.4 billion. Belgium’s role as a central custodian for large, diverse sovereign portfolios reflects the intricate flow of cross-border collateral and liquidity arrangements that undergird the global treasury market.

- China, the third-largest holder, reduced its US Treasury stash by $11.8 billion to around $688.7 billion—the smallest level since 2008 for that specific figure. The decrease underscores Beijing’s ongoing balancing act between maintaining foreign exchange reserves, managinggeopolitical tensions, and calibrating its own economic trajectory amid domestic growth concerns and policy shifts.

- Canada recorded a notable decline of $56.7 billion, taking its holdings to about $419.1 billion—the lowest since mid-2023. Canada’s movements can be sensitive to changes in trade policy expectations, commodity cycles, and the broader risk sentiment driving cross-border debt investments.

Market implications and economic impact

- Financing dynamics: Foreign demand for Treasuries helps finance the US federal deficit at relatively low borrowing costs. A smaller but still robust appetite across major holders suggests continued confidence in US credit quality, even as global yields move and inflation expectations fluctuate.

- Yield and pricing effects: Shifts in foreign demand can influence Treasury yields, particularly on longer maturities. Sustained demand tends to anchor longer-term yields, while periods of retreat can push yields higher as the market prices in perceived risk and opportunity costs. October’s data indicate a nuanced balance between buyers and sellers, with big players recalibrating portfolios rather than abandoning US Treasuries altogether.

- Currency considerations: For many holders, Treasuries serve as steadier, liquid assets within diversified reserve portfolios. Movements in holdings often reflect broader currency strategy, including hedging programs and expectations about exchange-rate movements, which in turn can feed back into trade competitiveness and inflation dynamics in their home economies.

- Interest rate expectations: The behavior of foreign holders is intertwined with global expectations for monetary policy. If major central banks continue to tighten or signal patience on inflation, foreign buyers may adjust allocations toward shorter maturities or diversify into other asset classes, influencing the yield curve and borrowing conditions in the United States.

Regional comparisons and broader context

- In Asia, Japan’s uptick contrasts with China’s modest retreat, illustrating divergent policy priorities and economic conditions across the region. Japan’s persistent demand can be traced to its aging population, savings-oriented households, and a desire to keep long-duration assets as a core reserve component.

- Europe’s mixed signals—rising holdings in the United Kingdom and Belgium, alongside more cautious moves from other Western economies—reflect ongoing adjustments as financial markets absorb shifts from energy price volatility, growth forecasts, and post-pandemic normalization.

- North American dynamics, with Canada reducing exposure, may reflect a focus on domestic investment strategies and risk management in a climate of global uncertainty, currency fluctuations, and evolving trade relationships.

Commercial and public reaction Professional traders and policymakers view the October figures as evidence of continued global reliance on US Treasuries, even as strategic reallocations occur. Market participants highlight that the data underscore the importance of Treasuries in portfolios seeking liquidity, diversification, and a hedge against volatility. Public and institutional sentiment often frames Treasuries as a stabilizing force in times of geopolitical tension or unforeseen economic shocks, reinforcing their central role in modern financial systems.

Historical comparisons further illuminate the October snapshot. While the absolute value remains near peak levels, the composition illustrates a rotation among major holders rather than a broad retreat from US government debt. This pattern suggests confidence in the United States’ debt management framework and the relative safety of US securities amid a globally interconnected economy.

What this means for the American economy

- Financing flexibility: A robust external demand for Treasuries supports the U.S. Treasury’s ability to fund deficits at favorable borrowing costs, potentially easing fiscal pressure over time. This, in turn, can influence long-term investment in infrastructure, research and development, and public services.

- Monetary policy transmission: The external demand for Treasuries feeds into the broader monetary policy transmission mechanism. As foreign buyers shape demand, domestic policy makers monitor how external capital movements interact with domestic inflation targets and employment objectives.

- Economic resilience: The resilience of Treasury demand—despite occasional shifts in holdings by major partners—serves as a barometer for global confidence in the U.S. macroeconomic framework. It signals that, even amid geopolitical flux and changing policy landscapes, Treasuries remain a foundational element of international capital markets.

Technical notes and data interpretation

- Data source and scope: The October figures reflect official data on foreign holdings of US Treasuries, including direct allocations and custodial accounts managed by foreign institutions. Movements in custodial holdings, such as those associated with Belgium, can complicate simple ownership tallies but are integral to understanding the liquidity and settlement infrastructure of the market.

- Limitations: While thenumbers capture overall trends, monthly changes can be influenced by factors such as rebalancing activity, currency hedges, and cross-border collateral transactions. Analysts typically examine the longer-run trajectory to gauge underlying demand and risk tolerance.

Regional outlook and potential scenarios

- Baseline optimism: If demand from major holders stabilizes at historically high levels, US Treasury yields may remain anchored, supporting steady financing conditions for government programs and private-sector borrowing alike. This scenario assumes continued confidence in US fiscal and monetary stewardship.

- Diversification pressures: Should foreign investors increase diversification away from long-duration Treasuries due to rising global yields or geopolitical risks, there could be a gradual shift toward shorter maturities or alternative sovereign assets. This would influence the shape of the yield curve and potentially raise financing costs for certain maturities.

- Policy-driven movements: Geopolitical developments, trade policy shifts, or large-scale policy announcements could trigger swift reallocation in foreign-held Treasuries. Markets would watch for signs of sustained changes in reserve composition or capital flows following major international agreements or tensions.

Conclusion October’s modest dip in foreign holdings of US Treasuries does not diminish the overarching narrative: these securities remain a central, highly liquid cornerstone of global finance. The mix of increases and decreases among top holders reflects a dynamic, interconnected world where central banks and sovereign funds continuously recalibrate portfolios to manage risk, align with domestic economic goals, and respond to evolving demand for safe, dependable assets.

As markets absorb ongoing developments in inflation, interest rates, and geopolitical considerations, Treasuries will likely continue to function as a reliable anchor for global capital. Investors, policymakers, and the broader public can expect continued scrutiny of foreign ownership data, with October’s figures contributing to a larger conversation about the United States’ fiscal health, the resilience of its debt markets, and the evolving posture of international investors in a changing economic landscape.