US Power Grid Nears Breaking Point as Demand Surges Past Capacity

The United States stands on the edge of a potential electricity shortage as demand projections increasingly outpace available generation resources. Analysts warn that peak power needs could exceed supply within the next few years, with the gap widening into the early 2030s. The emerging imbalance raises questions about grid resilience, regional disparities, and the pace of investment required to avoid rolling outages during periods of peak consumption.

Historical context: a decades-long transition and the limits of aging infrastructure To understand the current moment, it helps to look back at how the U.S. power grid evolved. The North American Electric Reliability Corporation (NERC) and regional transmission organizations (RTOs) built a system in which reliability margins were maintained through a combination of baseload generation, seasonal peaking plants, and diverse fuel sources. For much of the 20th century, coal and hydroelectric power provided the bulk of generation, with natural gas and a growing share of renewables entering the mix in later decades.

The late 2000s through the 2010s saw a dramatic shift toward cleaner energy and more distributed resources. The rise of natural gas-fired plants, along with wind and solar, reshaped dispatch patterns and introduced new challenges: variability, intermittency, and the need for enhanced transmission capacity to reach population centers and industrial hubs. Investment lagged behind rapid demand growth in several regions, particularly where urban expansion, data-center campuses, and electrification of transportation converged.

Today’s demand drivers: data centers, charging infrastructure, and manufacturing

- Artificial intelligence and data centers: The data center sector has grown at a pace that rivals some traditional industries. Beyond storage, millions of servers require steady, high-capacity power, with cooling loads adding to the overall energy draw. The concentration of hyperscale facilities in certain regions intensifies local demand spikes, stressing nearby transmission corridors during heat waves or cold snaps.

- Electric vehicle (EV) charging networks: As vehicle fleets transition, charging infrastructure expands from urban cores to suburban and rural communities. The timing of charging—whether daytime or overnight—affects load profiles and grid management strategies. Fast-charging corridors, high-power deployments, and fleet refueling stations add new layers of complexity for grid operators.

- Modern manufacturing and electrification of industry: Electrification plans for manufacturing facilities, once dominated by fossil-fuel processes, increasingly rely on electricity for high-temperature processes, robotics, and digital controls. This shift boosts peak demand and necessitates reliable, resilient supply chains for electricity.

Regional disparities and the evolving demand landscape Geography plays a pivotal role in how the demand-supply gap manifests. Regions with significant data-center footprints—states like Virginia, Oregon, and parts of Northern California—face localized stress during extreme weather, when cooling needs surge. The Southwest, with rapid population growth and high cooling requirements, grapples with transmission constraints and summer peaks. The Midwest and Northeast, while historically well-served by a dense network, are contending with retirement of aging coal and nuclear plants and the integration of intermittent renewables, which requires flexible balancing resources.

Meanwhile, interconnections between Canada and the United States add a cross-border dimension. Import dependence during tight conditions can provide a safety valve but also introduces exposure to weather and policy changes on either side of the border. In coastal regions, extreme weather—hurricanes, tropical storms, and nor’easters—continues to test grid hardening and emergency response capabilities.

Economic impact: potential costs of inaction The forecasted shortfall carries tangible implications for the broader economy. Electricity is a foundational input for virtually every sector: manufacturing, services, transportation, and agriculture all rely on stable power. If peak demand routinely exceeds available supply, several consequences could unfold:

- Increased energy prices during peak periods as markets price scarcity, potentially feeding into consumer costs and business operating expenses.

- Greater likelihood of rolling outages or controlled load shedding, which disrupts production schedules, harms inventory management, and reduces competitiveness.

- Slower adoption of high-energy-tech initiatives if certainty around power reliability erodes, potentially delaying AI deployments, data-center expansion, and advanced manufacturing projects.

- Higher capital costs for utilities and ratepayers as infrastructure owners accelerate investments in transmission, storage, and rapid-response generation capable of withstanding volatility.

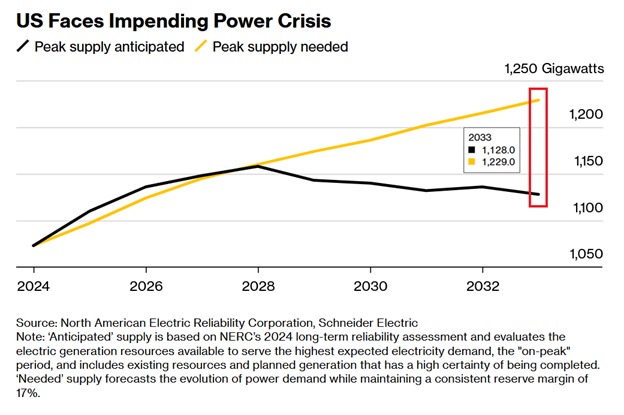

Projected trajectory: what the numbers suggest for 2024–2033 Forecasts indicate a widening chasm between peak demand and available supply. Early readings point to a peak around 1,160 gigawatts (GW) by 2028, with anticipated supply near 1,158 GW, implying a narrow imbalance even at that point. The gap is projected to grow substantially after that, potentially reaching as much as 175 GW by 2033. In that year, demand could approach 1,229 GW while available generation sits around 1,128 GW, leaving little to no emergency reserve margin.

A visualization commonly cited in industry analyses shows the supply trajectory starting from roughly 1,050 GW in 2024, cresting near 1,180 GW around 2026, then tapering to about 1,128 GW by 2032. The demand trajectory begins at about 1,050 GW in 2024 and climbs steeply to exceed 1,230 GW by 2032. The resulting gap emphasizes a need for both near-term acceleration and longer-term capacity additions.

Reserve margins and reliability concerns Historically, the American grid operated with a reserve margin around 17 percent, designed to absorb unexpected outages and weather-driven demand spikes. If the projected shortfalls materialize, that buffer could erode, forcing utilities to consider emergency measures. Load shedding, voluntary or mandatory demand response programs, and curtailment of noncritical loads become more likely during heatwaves or cold snaps when the system is under the most strain.

Utility planning bodies and regulators are under intense pressure to update reliability standards, accelerate transmission buildouts, and streamline permitting for new generation resources. The interplay between federal policy, state objectives, and private sector investment remains a critical factor in determining how quickly capacity can be added and how effectively the grid can be modernized.

The path forward: accelerating capacity, diversifying resources, and modernizing the grid Industry stakeholders emphasize several parallel priorities to mitigate the looming deficit:

- Expand generation capacity: Buildout of new natural gas plants, renewables with backup capabilities, and dispatchable resources such as nuclear and hydro where feasible. Alongside these, investment in flexible capacity, including natural gas-fired peaker plants or energy storage systems, is seen as essential for balancing intermittent renewables.

- Invest in transmission and storage: Transmission upgrades and expanded interconnections are vital to move electricity from regions with abundant renewable resources to high-demand areas. Large-scale storage, including batteries and pumped hydro, can smooth daily and seasonal fluctuations and reduce peak stress.

- Deploy demand-side solutions: Demand response programs, time-of-use pricing, and smart-grid technologies can modulate consumption to align with generation capacity. Advanced metering, real-time data analytics, and automated control systems enable more efficient use of existing resources.

- Accelerate electrification with resilience in mind: As transportation and industry electrify, the grid must be resilient to weather extremes and cyber threats. This includes hardening critical infrastructure, diversifying supply chains for critical components, and ensuring rapid recovery capabilities after outages.

Global comparisons and lessons Looking beyond the United States, other large economies face similar dilemmas as they electrify transportation fleets and expand data-center footprints. Regions with aggressive renewable integration but slower storage deployment, or with aging networks that lag in modernization, often experience comparable tension between demand growth and capacity expansion. The contrast between regions—where some have made rapid grid modernization a policy priority and others have lagged—highlights the importance of coherent long-term planning, predictable policy incentives, and robust investment climates.

Public reaction and societal implications Public awareness of grid reliability tends to rise during severe weather events or high-profile outages. Communities that experience even brief interruptions often push for faster investment in local infrastructure, including microgrids for resilience, community solar projects, and storage at the city or utility scale. Businesses adapt by revising contingency plans, securing backup power options, and re-evaluating supply chain risk. Policymakers face pressure to balance affordability with reliability, navigating the trade-offs between rapid expansion and prudent fiscal stewardship.

Environmental considerations and energy transition dynamics The push toward decarbonization intersects with grid reliability in meaningful ways. While renewables reduce emissions and can lower fuel costs over time, their intermittency requires careful planning for backup and storage. The drive to electrify transportation and industry must be matched with robust capacity expansion and grid modernization to avoid compromising reliability. This balancing act remains a central challenge for energy policy and corporate strategy alike.

Regional grid performance: case studies and variances

- Coastal states with heavy cooling loads and large urban centers must manage intense summer peaks while integrating offshore wind and solar resources. Transmission upgrades and regional partnerships are essential to prevent localized bottlenecks.

- Inland areas experiencing rapid growth in data centers and manufacturing require robust power delivery to sustain high-intensity electrical usage without triggering outages or voltage instability.

- Regions with abundant renewable potential but limited transmission access face the paradox of high generation capacity stranded due to bottlenecks that prevent delivery to demand centers.

Technology and innovation driving near-term improvements Advances in grid-scale storage, grid-forming inverters, demand-side automation, and advanced forecasting improve the ability to balance supply and demand. Digital twins of the grid—virtual models used to simulate scenarios—aid planners in testing infrastructure changes before construction. High-performance transmission materials, faster permitting processes, and cross-border energy trading agreements could collectively shorten the time to bring new capacity online.

Conclusion: a pivotal decade for the U.S. power system The coming years will determine whether the United States can avert a structural shortfall in its electricity supply. The forecasting signals a need for rapid, coordinated action across federal policymakers, state authorities, utilities, and private investors. Without a substantial acceleration in capacity additions, transmission improvements, and demand-side management, the grid could face persistent stress during periods of extreme weather and high demand, raising the specter of outages that would ripple through households and the broader economy.

As the nation electrifies transportation, data flows continue to surge, and manufacturing shifts toward full electrification, the resilience of the power grid will become not only an energy issue but a cornerstone of economic competitiveness and public safety. The actions taken in the next few years will shape the reliability of electricity for households and businesses alike, defining a critical chapter in the evolution of the American energy landscape.