Gulf Coast Set for Record Natural Gas Pipeline Expansion in 2026

Gulf Coast Natural Gas Buildout Reaches 18-Year High

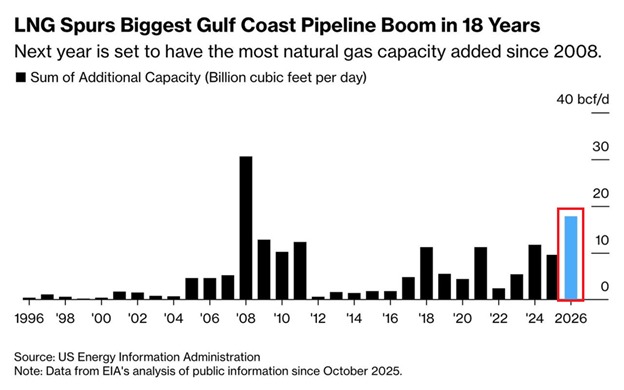

The U.S. Gulf Coast is poised for its largest annual natural gas pipeline expansion in nearly two decades, with about 18 billion cubic feet per day (Bcf/d) of new capacity projected to enter service in 2026. The buildout, driven primarily by liquefied natural gas (LNG) export growth, spans 12 major projects across Texas, Louisiana, and Oklahoma and represents an estimated 13% increase in the region’s total pipeline capacity.

In volume terms, the anticipated incremental capacity is roughly equivalent to the entire annual natural gas consumption of Canada, underscoring the scale of the transformation underway along the Gulf Coast. Midstream companies, LNG developers, and natural gas producers are aligning to reconfigure regional flows, connect inland shale basins to export terminals, and accommodate rising global demand for U.S. gas.

Industry analysts describe the 2026 expansion as a pivotal moment for North American energy infrastructure, reshaping how gas moves from production centers to coastal export hubs and industrial users, while also intensifying debates over long-term demand, pricing, and system resilience.

Historical Context: Largest Wave Since the Shale Boom

The last time the United States saw anything approaching this level of incremental pipeline capacity on a single-year basis was during the height of the shale gas revolution. In 2008, new pipeline additions exceeded 35 Bcf/d, as operators rushed to connect surging production from emerging shale plays like the Barnett, Fayetteville, Haynesville, and early-stage Marcellus to power plants, industrial users, and regional markets.

That earlier wave was largely about harnessing unexpectedly large domestic supply. Producers discovered that advances in horizontal drilling and hydraulic fracturing could unlock vast amounts of gas at relatively low cost, outpacing existing midstream infrastructure and prompting a rapid grid expansion.

In contrast, the 2026 Gulf Coast expansion reflects a different kind of structural shift:

- Instead of focusing primarily on domestic demand, the buildout now centers on export capacity.

- The pipeline network is being designed to feed LNG terminals, petrochemical complexes, and cross-border pipelines.

- Infrastructure planning is increasingly synchronized with global energy markets, including Europe, Asia, and Latin America.

By comparison, previous notable buildout years such as 2000, 2004, and 2006 saw much smaller volumes added, often below 10 Bcf/d. Even the early 2020s, a period marked by steady demand growth and rising LNG exports, typically saw annual U.S. pipeline additions in the 5–10 Bcf/d range.

Set against that historical backdrop, the Gulf Coast’s anticipated 18 Bcf/d of new capacity in 2026 stands out as a major inflection point, not just for the region but for the broader North American natural gas system.

LNG Exports as the Primary Driver

The central factor behind the Gulf Coast pipeline expansion is the rapid increase in LNG export capacity. Multiple liquefaction projects in Texas and Louisiana are under construction or nearing completion, including new terminals and expansions of existing facilities. These projects require reliable high-volume feedgas deliveries, often in the range of several Bcf/d per terminal when fully operational.

To meet that demand, midstream operators are constructing and expanding large-diameter pipelines and adding compressor stations designed to move gas from shale basins such as:

- The Permian Basin in West Texas and southeastern New Mexico.

- The Haynesville Shale in East Texas and northern Louisiana.

- The Anadarko and SCOOP/STACK plays in Oklahoma.

These supply sources, known for high productivity and competitive breakeven costs, have already reshaped U.S. gas markets over the past decade. The new buildout strengthens their role as the primary feedstock sources for Gulf Coast LNG plants, tying regional production even more closely to global energy trade.

Developers say the 2026 pipeline capacity additions are timed to coincide with the next wave of LNG projects reaching commercial operations. This coupling of upstream and midstream investments aims to reduce bottlenecks, ensure sufficient gas deliverability at coastal hubs, and provide flexibility to ramp exports in response to international price signals.

Regional Footprint: Texas, Louisiana, and Oklahoma

The 12 major pipeline projects forming the 2026 expansion span three core states, each with a distinct role in the Gulf Coast energy ecosystem.

Texas hosts a large share of the new capacity, reflecting its dual role as both a production center and a critical corridor to coastal LNG export terminals. New and expanded lines will move gas from the Permian and Eagle Ford regions toward hubs near Corpus Christi, Freeport, and the broader Texas Gulf Coast.

Louisiana, home to several of the country’s largest existing LNG terminals and industrial complexes, will see its network densify further. Pipelines are being designed not only to deliver feedgas to liquefaction plants along the Calcasieu and Mississippi River corridors, but also to serve petrochemical facilities, fertilizer producers, and local utilities.

Oklahoma’s contribution to the 2026 buildout is more focused on connecting inland production to downstream markets. New capacity will help channel gas southward into Texas and then east toward Louisiana, integrating the Anadarko and associated plays more tightly with Gulf Coast demand.

Collectively, these projects are expected to:

- Increase system redundancy and routing options.

- Reduce constraints during peak demand or maintenance events.

- Enhance interconnections between major interstate and intrastate pipelines.

The resulting network will give shippers more flexibility in how they move gas from the wellhead to export and industrial centers, which could have lasting implications for flow patterns and regional pricing.

Economic Impact for the Gulf Coast

The pipeline expansion carries significant economic implications for the Gulf Coast and surrounding states. During construction, the projects are expected to support thousands of direct and indirect jobs in engineering, construction services, equipment manufacturing, and related sectors. Local communities along the rights-of-way may see temporary boosts in lodging, retail, and service activity as construction crews mobilize.

Over the longer term, increased infrastructure capacity can:

- Support higher levels of gas production in the Permian, Haynesville, and other basins.

- Underpin investment decisions for additional LNG trains, petrochemical plants, and power generation facilities.

- Strengthen the region’s position as a global hub for energy-intensive industries.

State and local governments may benefit from higher tax revenues derived from property taxes on pipeline assets, corporate income, and associated economic activity. Ports, railroads, and service companies that support LNG and industrial exports could also gain from higher throughput volumes and expanded operations.

At the same time, the scale of investment raises questions about long-term utilization rates and market risk. If global LNG demand underperforms expectations or if competing supply from other regions gains ground, some infrastructure may face lower-than-anticipated usage. Nonetheless, developers and many market observers currently view demand outlooks as robust, particularly in Asia and parts of Europe seeking to secure diversified supply.

Comparisons with Other U.S. Regions

While the Gulf Coast has emerged as the focal point for LNG-driven pipeline expansions, other U.S. regions have experienced more subdued growth in recent years. The Northeast, which saw a rapid buildout to connect the Marcellus and Utica shales during the 2010s, has more recently faced permitting challenges and slower addition of new interstate capacity.

By contrast, the Gulf Coast’s regulatory environment and longstanding role as an energy corridor have made it a natural center of gravity for new projects. Existing rights-of-way, proximity to deepwater ports, and a dense network of refineries and industrial users create conditions in which incremental projects can often build on existing infrastructure footprints.

Compared with the Midwest and West Coast, the Gulf Coast also offers closer access to international shipping lanes and a well-developed ecosystem of service providers, storage facilities, and trading hubs. These advantages have helped the region attract successive waves of investment, from refineries and petrochemical plants to LNG terminals and now the pipelines that feed them.

Implications for Domestic Gas Prices and Flows

The addition of 18 Bcf/d of pipeline capacity in a single year has the potential to reshape domestic gas flows and pricing dynamics. By easing transportation constraints from supply-rich basins to demand centers, the new pipelines could reduce localized price differentials that sometimes arise when production outpaces takeaway capacity.

In regions like the Permian Basin, producers have periodically faced negative or deeply discounted gas prices due to limited pipeline availability and associated flaring pressures. Expanded takeaway to the Gulf Coast may alleviate those bottlenecks, enabling more consistent pricing and potentially supporting higher production volumes.

For Gulf Coast consumers, including LNG terminals and industrial plants, increased inbound capacity may enhance supply reliability and reduce the risk of price spikes linked to pipeline congestion. However, as more U.S. gas becomes tied to global markets through LNG exports, domestic prices could become more sensitive to international demand swings and geopolitical factors that influence LNG trade.

Market participants will closely watch how quickly the new capacity is filled and whether it leads to changes in basis differentials between inland hubs and coastal trading points such as Henry Hub and regional Gulf Coast indexes.

International Context and Global Gas Markets

From a global perspective, the Gulf Coast expansion reinforces the United States’ role as a leading supplier of natural gas to international markets. U.S. LNG has become an important component of energy security strategies for many importing nations, offering flexible, market-linked volumes that can respond to shifts in regional supply and demand.

The additional pipeline capacity will support the next wave of U.S. LNG projects targeting growing demand in:

- Asia, where countries seek to balance energy needs with emissions reduction goals.

- Europe, which has intensified efforts to diversify away from traditional pipeline suppliers.

- Emerging markets in Latin America and South Asia, where infrastructure buildout is enabling greater gas usage in power generation and industry.

By ensuring sufficient feedgas deliverability to liquefaction facilities, the Gulf Coast network expansion bolsters the reliability of U.S. LNG exports. This reliability is increasingly important as long-term contracts are signed and importers plan their energy systems around expected deliveries over periods that can stretch two decades or more.

Local Communities and Environmental Considerations

Along the Gulf Coast and across inland areas in Texas, Louisiana, and Oklahoma, local communities are closely tracking the pipeline buildout. Public meetings, regulatory hearings, and consultations have highlighted a range of issues, including land use, safety, environmental protection, and economic benefits.

Pipeline developers typically commit to detailed routing studies, environmental impact assessments, and mitigation plans that address concerns such as:

- Protection of wetlands, waterways, and sensitive habitats.

- Minimization of disruptions to agricultural land use and property access.

- Implementation of safety measures, monitoring systems, and emergency response plans.

For residents and local officials, the projects bring a mix of opportunity and scrutiny. While construction and operations can support local jobs and tax revenues, they also add to infrastructure density in regions already heavily shaped by the energy industry. The long-term integration of these pipelines into the landscape, and their interaction with existing facilities, remains a central aspect of community discussions.

A Defining Year Ahead for Gulf Coast Energy

With 18 Bcf/d of new natural gas pipeline capacity expected to come online in 2026, the Gulf Coast is approaching a defining year in its evolution as a global energy hub. The expansion marks the largest single-year increase in nearly two decades and reflects a shift from domestically focused pipeline buildouts to infrastructure explicitly designed for export-driven demand.

As construction advances across Texas, Louisiana, and Oklahoma, the region’s pipeline network will become more interconnected, more resilient, and more deeply embedded in international gas flows. The economic stakes for producers, midstream operators, industrial users, and local communities are substantial, while the broader implications for U.S. energy trade and global gas markets will continue to unfold well beyond 2026.