U.S. Pending Home Sales Fall Sharply, Driving Broad Market Slowdown

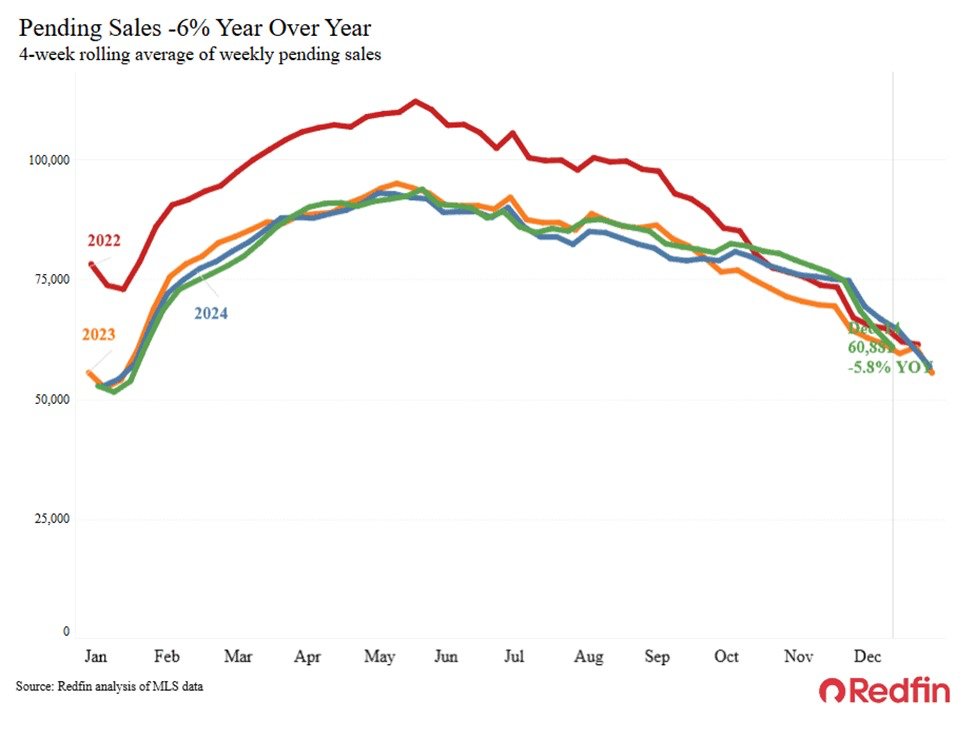

The U.S. housing market continued its cautious pace into December, as a government-backed measure of pending home sales showed a 5.8% year-over-year decline for the four weeks ending December 14. The drop marks the steepest year-over-year slide since early 2025 and underscores a broader slowdown in housing activity that economists say reflects higher mortgage rates, evolving demand, and shifting regional dynamics.

Context and meaning of pending sales data Pending home sales are a forward-looking indicator that track contract signings for existing homes, offering a glimpse into future closed sales. While not a perfect predictor—because many contracts ultimately fall through or are delayed—the series has historically provided a useful read on momentum in the housing market. The December readings suggest buyers faced tighter financial conditions and uncertainty about prices, inventory, and financing as the year drew to a close.

Regional breadth of the downturn The decline was widespread across major metropolitan regions, with only six of the 50 largest metro areas escaping a year-over-year pullback. Among the hardest-hit areas were San Jose, where activity tumbled by 35.1% from a year earlier, followed by Houston at 20.9% and Oakland at 17.6%. These sharp drops reflect a blend of affordability constraints, shifting job markets, and local supply conditions that have amplified price sensitivity.

Other notable patterns include a softer cadence in historically active markets where inventory has remained tight but prices have stabilized. In these regions, buyers have faced higher borrowing costs, which can dampen demand even as mortgage rates show intermittent relief. The national picture thus blends pockets of resilience with zones of renewed caution, painting a more nuanced portrait than a singledecline might suggest.

The supply side: listings and days on market New listings also contracted, falling 3.1% year-over-year—the steepest decline in more than two years. This reduction in new inventory compounds demand-side headwinds by limiting choices for buyers and contributing to longer negotiation periods. In tandem with the pending sales dip, homes are now spending more time on the market: the average time to go under contract extended to about 52 days, roughly a week longer than a year ago.

These timing shifts matter for developers, sellers, and lenders. For prospective buyers, longer timelines heighten exposure to fluctuating interest rates and the risk of price adjustments. For sellers, extended market times can pressure pricing strategies, sidewalks of concessions, and strategic timing of sales campaigns. For lenders, slower turnover can influence underwriting considerations and the sequencing of pipeline activity at regional branches.

Price dynamics and broader affordability implications The recent wave of activity aligns with a period of renewed attention to affordability. While mortgage rates have fluctuated, they have often remained higher than the historic lows seen during the pandemic recovery, constraining first-time buyers and more price-sensitive cohorts. In many markets, inventory constraints have given way to cautious optimism among homeowners who are reluctant to move to higher-rate financing or who have built equity in a low-rate environment and now weigh the cost of upgrading.

The interaction between demand constraints and supply shifts has distinctive regional footprints. In the West Coast, where tech-driven employment cycles and high entry costs shape demand, the combination of cooling activity and elevated home prices has tempered bidding competition. In the South and Sun Belt, population growth and relative affordability among adjoining markets have supported steady, if moderated, sales activity, even as higher mortgage rates challenge affordability for some buyers.

Historical context: cycles, resilience, and lessons learned Housing markets operate in cycles influenced by demographics, credit conditions, and policy environments. The current slowdown echoes prior pauses during periods of rising borrowing costs, but the persistence and geographic dispersion of the decline signal a structural recalibration rather than a quick return to “boom” levels. Historically, when interest rates retreat from peaks and buyers regain confidence, housing activity tends to rebound—albeit at a moderated pace if affordability remains a constraint.

Economists note that long-run supply constraints—such as limited new construction in recent years, land-use regulations, and zoning barriers—continue to shape regional dynamics. Even as demand cools, tight inventories in some markets can sustain prices above national averages, while overbuilt or economically stressed regions may experience sharper price corrections. The balance between supply resilience and demand normalization will likely dictate the rate and distribution of recovery in 2024-2025 and beyond.

Economic impact across sectors A sustained slowdown in pending sales reverberates beyond the housing market. Construction activity, home improvement spending, mortgage originations, and related financial services flows all respond to the rhythm of contract signings and closings. Banks and mortgage lenders calibrate risk exposure, pricing, and product offerings in light of evolving demand and refinancing opportunities. Real estate brokers and agents adjust marketing tactics, inventory management, and client education to reflect shifting buyer sentiment.

Additionally, the housing sector’s health influences consumer confidence and discretionary spending. For households carrying mortgages or contemplating moves, monthly housing costs tie into broader budgets, affecting everything from commuting choices to school enrollment decisions. Policymakers monitor such indicators as they assess economic stability, labor markets, and inflation trajectories.

Regional comparisons illuminate divergent paths While the nationalpoints to a slowdown, regional comparisons reveal a mosaic of trajectories. Some metros with diversified job bases and aging housing stock may experience slower turnover as buyers balance affordability against home equity. Others with robust employment growth and relatively affordable housing options may see more resilient activity, even as the macro environment tempers enthusiasm.

The data also underscore the importance of home inventory dynamics. Markets with ongoing new construction and quicker absorption of available homes can experience a milder slowdown, whereas areas with constrained supply may see more pronounced price stability or declines. These patterns highlight the role of local policy decisions, land-use planning, and infrastructure investments in shaping housing outcomes.

Public reaction and market sentiment Public sentiment toward the housing market remains cautious but not devoid of optimism. Homeowners watching equity gains in recent years may exercise patience, choosing to wait for more favorable terms before listing or purchasing. First-time buyers, meanwhile, face a more challenging path as they navigate down payments, closing costs, and the challenge of qualifying for loans amid higher rates. Real estate professionals emphasize education and transparent pricing to manage expectations during a period of slower activity.

Market participants—builders, brokers, and financiers—are increasingly focusing on value-added strategies. These include offering seller concessions, improving energy efficiency in listings, and leveraging data-driven pricing to align with buyer demand. In a market where timing can be as critical as price, those who adapt quickly to shifting conditions stand a better chance of sustaining transaction pipelines through the winter and into the spring selling season.

What to watch next Analysts point to several indicators that could signal a shift in momentum in the coming months:

- Mortgage rate trends: A sustained decline could unlock demand and spur earlier contract signings, while continued volatility may sustain caution.

- Inventory changes: The pace of new listings and the rate at which existing homes leave the market will influence price dynamics and buyer options.

- Economic fundamentals: Labor market strength, consumer confidence, and affordability indices will shape buyer willingness and capacity.

- Regional policy signals: Zoning reforms, housing incentives, and infrastructure investments could alter the supply-demand balance in key metro areas.

Broader implications for housing policy Several policymakers and industry observers view the current slowdown as a prompt to address structural housing supply issues. Expanding affordable housing stock, streamlining permitting processes, and increasing incentives for new construction can help reduce friction in the market over the longer term. While cyclical fluctuations are normal, structural improvements aimed at improving affordability and supply could contribute to more stable price trajectories and healthier market dynamics in subsequent years.

Conclusion: navigating a transitional moment The December metrics illustrate a housing market in a transitional phase. A combination of higher financing costs, cautious demand, and inventory constraints has produced a broad-based slowdown in pending sales across major metros. Yet history suggests that markets adapt, with inventories adjusting, buyers recalibrating expectations, and lenders refining product structures to align with risk.

As 2025 closes, the housing sector stands at a crossroads: the path forward will likely hinge on a delicate interplay of rates, affordability, and supply-side responses. For prospective buyers, sellers, and investors, the message remains clear—timing and local conditions matter more than ever, and the most successful players will be those who stay informed about evolving trends, remain flexible in strategy, and approach opportunities with disciplined, data-informed judgment.