Trump’s Ban on Institutional Purchases of Single-Family Homes Triggers Market Reassessment and Regional Comparisons

In a landmark policy shift aimed at addressing housing affordability, the administration announced a prohibition on large institutional investors purchasing additional single-family homes. The measure, described as a targeted step to curb the influence of Wall Street firms in the residential real estate market, has ignited a swift and wide-ranging response from markets, homeowners, and housing policy analysts. While the policy targets future acquisitions, experts note that existing investor-owned properties remain unaffected, creating a complex landscape for buyers, renters, and lenders as the housing cycle adapts to new constraints.

Historical Context: The Rise of Institutional Real Estate Investment

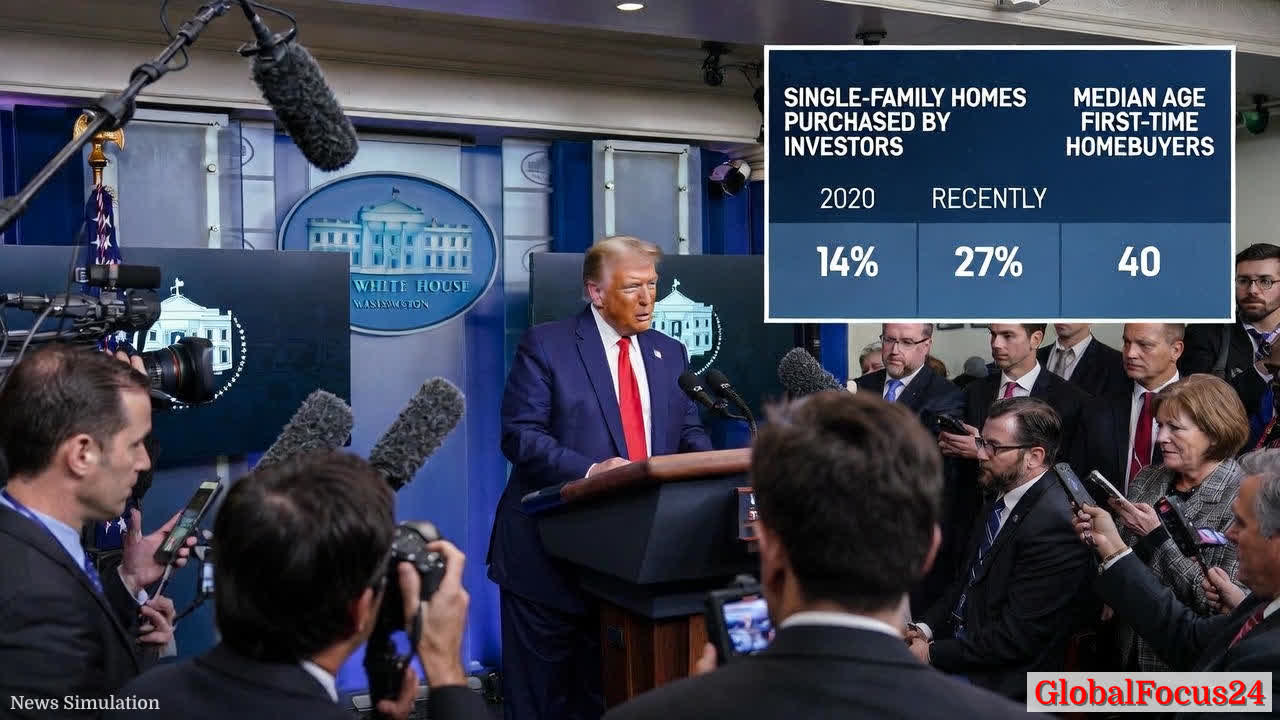

Over the past decade, institutional investment in single-family rental housing has moved from a niche strategy to a core component of the U.S. housing ecosystem. Pandemic-era dynamics, including ultra-low interest rates, housing supply constraints, and shifting demand patterns, accelerated the concentration of ownership among large investors. At the onset of the health crisis in 2020, investor share of single-family transactions stood at roughly 14%. By the mid-2020s, that share had climbed to approximately 27%, reflecting a broader trend of financialized housing that connected capital markets with local neighborhoods.

Investors shifted from purely financial plays to long-term rental portfolios, influencing regional price trends, rental yields, and maintenance standards. The policy announcement signals a notable pivot in this trajectory, with potential implications for future supply, price dynamics, and the balance of power between individual buyers and large firms.

Economic Impact: Short-Term Market Reactions and Long-Term Implications

Immediate market responses reflect a combination of policy uncertainty and recalibration of investment theses. In after-hours and early trading, major real estate investment firms faced heightened scrutiny over their portfolios and financing strategies. The policy’s focus on future acquisitions suggests a cautious environment for new purchases, while permitting the continued operation of existing rental assets.

From an economic standpoint, several forces are at play:

- Demand Fundamentals: If institutional buyers reduce acquisition activity, demand from individual homebuyers could regain some traction, potentially easing competition in certain markets. However, the magnitude of this effect depends on regional dynamics, inventory levels, and financing conditions.

- Inventory and Prices: The housing stock constraint remains a central driver of prices in many regions. Analysts caution that a 3% reduction in investor demand may have limited impact on prices if supply remains tight, underscoring the dominance of supply constraints over demand shifts in determining price trajectories.

- Mortgage Rates and the Lock-In Effect: The persistence of favorable mortgage rates for existing homeowners continues to suppress turnover. On average, homeowners carry rates around 4.2% for traditional 30-year loans, while current new borrowers face rates closer to 6.2%. That gap reinforces a “lock-in” effect, delaying home sales and contributing to a thinner pool of available homes on the market.

- Price Inertia and New Construction: In a notable development, existing homes have begun selling at higher prices than new constructions for the first time since 2005, illustrating the scarcity-driven premium on resale inventory. This dynamic signals that even if investor demand softens, supply constraints will continue to shape pricing, particularly in high-demand regions.

Regional Comparisons: How Markets Are Responding to the Policy

The policy’s impact is not uniform across the country. Regions with long-standing investor activity, tight inventories, and robust demand will experience distinct effects compared with markets where ownership patterns are more dispersed and supply channels more flexible.

- Sun Belt Metros: In rapidly growing markets such as parts of Texas, Florida, and Arizona, investor activity has been relatively high but is also buoyed by strong resident demand and rising wages. A shift away from institutional acquisitions could initially ease competitive pressures for first-time buyers, yet supply constraints and construction timelines will likely dominate price movements in the near term.

- Pacific Northwest and Mountain West: These regions faced affordability stress tied to inventory gaps and zoning restrictions. The policy may modestly rebalance demand away from competing buyers, but delivery timelines for new homes and the pace of price adjustments will hinge on regional permitting, land availability, and labor markets.

- Midwest and Northeast: Markets with more stabilized inventories and historically slower price appreciation could experience smaller bid-ask spreads and improved access for first-time buyers if investor purchase activity cools. However, the overarching constraint remains supply, with housing stock turnover occurring at slower rates in many urban cores.

Policy Mechanism and Future Projections

The ban’s design focuses on prohibiting new acquisitions by large institutional entities, a measure intended to reduce competition for single-family homes among non-traditional buyers. Importantly, the rule does not affect privately held homes or existing portfolios, which means current landlords will continue to manage and rent out their holdings. The practical effect hinges on how quickly portfolio rebalancing occurs and whether alternative investment strategies emerge, such as diversification into multi-family properties or other asset classes.

Analysts emphasize that the macro housing affordability challenge is multifaceted. While reducing institutional demand for single-family homes could contribute to modest price relief over time, supply-side improvements are widely viewed as the most durable remedy. Prospective reforms discussed by policymakers—including zoning reform, streamlined permitting, and incentives to accelerate home construction—could bolster supply and address the root causes of the affordability crisis.

Public Reaction and Market Sentiment

Public sentiment around the policy is mixed. Homebuyers and renters in high-demand markets welcomed any policy component that could tilt the balance toward affordability. Housing counselors and community groups highlighted the potential for greater ownership accessibility if investor competition diminishes. Conversely, landlords and real estate professionals raised concerns about liquidity and the long-term effects on rental supply, property maintenance, and financing. Public discourse underscores the complexity of balancing investor activity with the broader objective of expanding home ownership opportunities for everyday families.

Long-Term Outlook: What Comes Next

Looking ahead, the housing market is likely to continue its evolution under the influence of this policy. If regulatory constraints on institutional purchases persist and are complemented by supply-enhancing initiatives, a gradual shift in market composition could unfold. The key variables to monitor include:

- Inventory Turnover: The rate at which existing homes become available for sale will shape price dynamics and buyers’ options, especially in markets with historically lean inventories.

- Financing Environment: Lenders’ willingness to finance new construction and home purchases at favorable terms will influence the pace of supply growth and buyer access.

- Regional Labor Market Trends: Economic conditions, wage growth, and migration patterns will impact demand consistency across regions, affecting comparative affordability.

- Investor Strategy Shifts: Institutions may pivot toward different asset classes or geographic focuses, which could alter correlations between housing markets and broader financial markets.

Historical Context: From Postwar Growth to Modern Financing

The current moment sits within a broader arc of housing finance evolution. Postwar expansions in suburban development were followed by decades of mortgage market innovations, including the emergence of securities-based financing and the commercialization of rental portfolios. The late-2010s and early-2020s witnessed a convergence of low interest rates, investor interest, and supply bottlenecks, culminating in a housing affordability dynamic where price-to-income ratios surpassed long-run norms in several metros. The new policy adds a contemporary layer to this ongoing historical narrative, signaling a potential recalibration of how capital markets interact with homeownership goals.

What This Means for Homebuyers, Renters, and Lenders

- For first-time buyers: If institutional competition eases, there may be incremental relief in bid competition in select markets. Prospective buyers should monitor local inventory trends, lender qualification criteria, and potential shifts in down payment requirements as banks adjust risk assessments in response to changing demand patterns.

- For renters: A reduced pace of investor acquisitions could influence rental market dynamics, potentially affecting vacancy rates and rent growth in markets where single-family rentals constitute a meaningful share of stock. Ongoing monitoring of rental occupancy and neighborhood development will be essential to gauge real-world effects.

- For lenders and developers: Financing strategies could adapt as institutional activity rebalances. Lenders may reassess portfolio diversification, capital reserves, and risk-weighted assets. Developers might adjust timelines for new construction projects, factoring in the potential for evolving demand profiles and regulatory environments.

Conclusion: A Pivotal Moment in Housing Policy

The administration’s stance on institutional single-family home purchases represents a significant intervention in the housing market, one that blends regulatory action with macroeconomic realities. While the ban targets future acquisitions, its ripple effects will unfold across buyer behavior, rental markets, and the broader economy. The policy’s success will depend on complementary measures to expand supply, reduce regulatory friction, and sustain affordable homeownership pathways for a diverse set of households. As markets digest this shift, regional disparities will become more pronounced, underscoring the importance of nimble policy design that aligns regulatory intent with on-the-ground housing dynamics.

Keywords: housing policy, single-family homes, institutional investors, housing affordability, real estate market, mortgage rates, inventory, regional housing markets, housing supply, urban economics