Tech Giants Lock in $569 Billion Worth of Data Center Leases as AI Infrastructure Race Intensifies

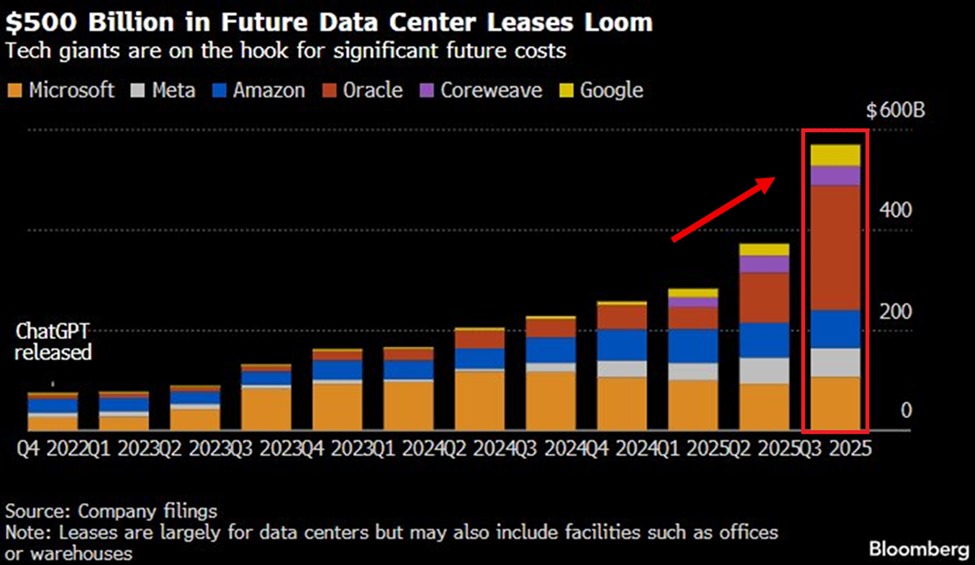

The world's largest technology companies have committed to an unprecedented $569 billion in future data center lease obligations, marking one of the most significant infrastructure buildouts in the history of the tech industry. This massive financial commitment represents a 53% increase from the second quarter of 2025, when total lease obligations stood at $372 billion, adding $197 billion in just three months.

These lease agreements, which span multiple years and in some cases nearly two decades, represent long-term rental commitments for data center facilities, computing infrastructure, and related properties. Unlike traditional real estate purchases, these operating leases allow companies to access vast computing resources without the upfront capital expenditure of ownership, though they create substantial fixed cost obligations that must be met regardless of future business conditions.

Oracle Leads Unprecedented Infrastructure Expansion

Oracle has emerged as the most aggressive player in this infrastructure race, adding $148 billion in new lease commitments during the third quarter of 2025 alone. This single-quarter addition brings the database and cloud computing giant's total data center lease obligations to $248 billion, representing nearly half of the entire industry's commitments across all major technology companies.

The duration of these agreements underscores the long-term nature of Oracle's strategic bet on artificial intelligence and cloud computing infrastructure. Some of Oracle's lease contracts extend up to 19 years into the future, locking the company into fixed payment schedules that will persist well into the 2040s. These commitments create predictable revenue streams for data center operators and real estate investment trusts, while placing substantial financial obligations on Oracle that must be serviced through future operations.

This represents a fundamental shift in how major technology companies are approaching infrastructure investment. Rather than building and owning their own facilities outright, which has historically been the preferred approach for companies with deep capital reserves, the current lease-heavy strategy allows for faster deployment and greater flexibility in geographic distribution.

The ChatGPT Catalyst and AI Infrastructure Boom

The dramatic acceleration in data center lease commitments can be traced directly to the public release of ChatGPT in late November 2022, which sparked a fundamental reassessment of artificial intelligence's commercial viability and infrastructure requirements. Prior to this watershed moment, data center lease obligations grew at a steady but modest pace from the fourth quarter of 2021 through the end of 2022.

The period following ChatGPT's release saw technology executives and investors recognize that generative artificial intelligence would require computing resources on a scale previously unimaginable. Training large language models demands thousands of specialized graphics processing units operating in parallel for weeks or months at a time, while serving inference requests to millions of users requires distributed computing infrastructure across multiple geographic regions.

This realization triggered a fundamental shift in capital allocation priorities across the technology sector. Companies that had previously focused primarily on software development and existing cloud services began committing enormous resources to securing physical infrastructure capable of supporting next-generation AI workloads.

Major Players Driving the Infrastructure Build-Out

While Oracle's commitments dominate the current landscape, the $569 billion in total lease obligations represents collective investment from the technology industry's most influential companies. Microsoft, which has partnered extensively with OpenAI and integrated artificial intelligence capabilities throughout its product suite, maintains substantial lease commitments to support both its Azure cloud platform and AI-specific infrastructure.

Meta Platforms, formerly known as Facebook, has committed significant resources to data center infrastructure supporting both its social media operations and its ambitious artificial intelligence research initiatives. The company's investment in AI infrastructure spans from consumer-facing features in its social networks to fundamental research in areas like computer vision and natural language processing.

Amazon, through its Amazon Web Services division, continues expanding its global infrastructure footprint to maintain its position as the world's largest cloud computing provider. The company's lease commitments reflect both competitive pressure from rivals and growing demand from enterprise customers deploying their own AI applications on AWS infrastructure.

Google, which pioneered many foundational technologies in machine learning and operates one of the world's largest computing infrastructures, has accelerated its data center commitments to support both its consumer AI products like Bard and its cloud computing services. The company's early investment in custom AI chips and efficient data center design has not eliminated the need for massive physical infrastructure expansion.

CoreWeave, a relative newcomer compared to the established tech giants, represents a specialized player focused specifically on GPU-accelerated computing for AI workloads. The company's inclusion among the major lease commitment holders signals how AI-specific infrastructure providers have emerged as significant players alongside traditional technology conglomerates.

Economic Implications and Regional Impact

The scale of these lease commitments creates ripple effects throughout multiple sectors of the global economy. Data center operators and real estate investment trusts specializing in technology infrastructure are experiencing unprecedented demand for their services, with some facilities commanding premium rates due to limited availability of power and cooling capacity.

Local and regional economies hosting major data center clusters are seeing substantial economic benefits from this investment wave. Construction employment, electrical infrastructure upgrades, and ongoing operational staffing create jobs and tax revenue in communities ranging from rural areas with cheap land and power to established technology hubs offering skilled workforces.

Power consumption represents one of the most significant economic and logistical challenges associated with this infrastructure expansion. Modern data centers, particularly those supporting AI workloads, consume enormous amounts of electricity. Training a single large language model can require as much power as several thousand homes use in a year, while serving inference requests to millions of users demands constant, reliable electrical supply.

This power demand is driving investment in electrical grid infrastructure and raising questions about the environmental impact of AI technology. Some technology companies have responded by committing to renewable energy purchases and investing in next-generation nuclear power, though the immediate infrastructure needs often rely on existing grid capacity.

Historical Context and Industry Evolution

The current data center lease commitment surge represents the latest phase in the technology industry's ongoing evolution regarding infrastructure ownership and management. During the early internet era of the 1990s and early 2000s, major technology companies typically owned their data center facilities outright, viewing physical infrastructure as a core competitive advantage requiring direct control.

The rise of cloud computing in the late 2000s and 2010s began shifting this calculus, as companies like Amazon demonstrated that infrastructure could be monetized as a service rather than simply an internal cost center. This period saw the emergence of purpose-built data center operators and real estate investment trusts specializing in technology infrastructure.

The current AI-driven expansion differs from previous infrastructure cycles in both its velocity and its geographic distribution requirements. Unlike traditional web services, which could be served effectively from a limited number of strategically located facilities, AI workloads create demand for distributed computing resources closer to end users to minimize latency while maintaining enormous central training facilities.

Previous technology infrastructure booms, such as the fiber optic cable expansion of the late 1990s and the smartphone-driven mobile infrastructure buildout of the 2010s, offer cautionary lessons about overinvestment and demand forecasting. The telecommunications sector's overbuilding during the dot-com era led to numerous bankruptcies when projected traffic growth failed to materialize on expected timelines.

Risk Factors and Long-Term Considerations

The extended duration of many lease commitments, with some contracts running 19 years or longer, creates substantial financial risk if artificial intelligence demand fails to meet current projections. These operating lease obligations appear on corporate balance sheets as liabilities and must be serviced regardless of future revenue generation, potentially constraining financial flexibility during economic downturns or technological shifts.

Technology adoption curves historically follow unpredictable paths, with periods of rapid growth often followed by consolidation and rationalization. The current enthusiasm for generative AI and large language models may not translate into sustained commercial demand sufficient to justify the enormous infrastructure investments being committed today.

Competition among cloud providers and AI infrastructure operators could also compress profit margins over time, potentially making it difficult for companies to generate adequate returns on their infrastructure investments. The commoditization of computing resources has historically driven prices downward, and AI infrastructure may follow a similar trajectory as the technology matures.

Additionally, the concentration of AI infrastructure among a small number of large technology companies raises questions about market competition and barrier to entry for potential rivals. The capital requirements for competitive AI infrastructure may prove prohibitive for smaller companies, potentially consolidating market power among established players with existing resources and relationships.

Future Outlook and Industry Trajectory

The $569 billion in committed data center leases represents a collective bet by the technology industry that artificial intelligence will generate sufficient commercial value to justify these enormous infrastructure investments. The third quarter 2025 acceleration, adding $197 billion in new commitments in just three months, suggests that corporate confidence in AI's commercial potential remains strong despite ongoing debates about the technology's limitations and appropriate applications.

The trajectory from the fourth quarter of 2021 through the third quarter of 2025 shows sustained growth in lease commitments, with particular acceleration following ChatGPT's release. This pattern indicates that technology companies view AI infrastructure not as a speculative bubble but as fundamental infrastructure required for future competitiveness across multiple product categories and business models.

As these facilities come online over the coming years, they will fundamentally reshape the technology industry's cost structure and competitive dynamics. Companies with early access to sufficient infrastructure may enjoy significant advantages in developing and deploying AI applications, while those lacking adequate computing resources could find themselves at a persistent disadvantage in an increasingly AI-centric technology landscape.