Record Leverage Ratio in ETFs Signals Heightened Market Optimism Heading into 2025

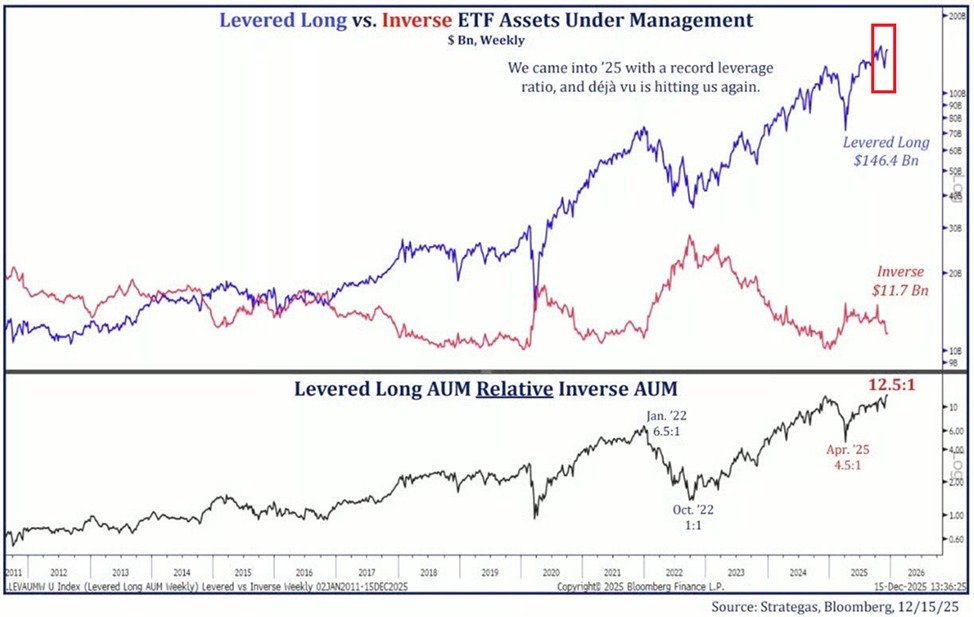

As 2025 unfolds, investors have shown a pronounced tilt toward bullish bets in the exchange-traded fund (ETF) space, with leveraged long ETFs amassing significantly more assets under management (AUM) than their inverse counterparts. By the start of the year, leveraged long ETFs reached an all-time high of $146.4 billion in AUM, while inverse ETFs held about $11.7 billion, yielding a record leverage ratio of 12.5 to 1. This ratio marks the highest level observed in the relevant data series, underscoring a widespread preference for magnified bullish exposure among market participants.

Historical context provides a useful lens for understanding the current dynamic. Leverage in ETFs has long been a tool for traders seeking amplified daily returns, typically through 2x or 3x exposure to a given index or sector. The ratio of leveraged long to inverse ETF assets tends to move with broader risk sentiment and macroeconomic expectations. In October 2022, during a broad market downturn, the ratio collapsed to 1.1 to 1 as investors sought downside protection through inverse positions or abandoned leveraged products altogether. The market rebounded in the ensuing years, pushing the ratio higher in January 2022 to 6.5 to 1 during a period of pronounced market highs and renewed optimism. Those historical inflection points illustrate how leverage can swing in tandem with the cycle of fear and greed that characterizes equity markets.

The 2025 year-to-date trajectory shows a sustained shift toward leveraged long exposure. In April 2025, the ratio stood at 4.5 to 1, reflecting growing risk appetite and a favorable macro backdrop for equities. Subsequent months have seen leveraged long AUM continue to expand even as inverse AUM has remained relatively stable. This divergence suggests a structural change in investor behavior: a preference for amplified upside while hedging or capping downside risk through other means, or simply a belief that long-run equity appreciation remains the central investment thesis.

From an economic perspective, the swelling appetite for leveraged long ETFs carries both opportunities and caveats. On the positive side, amplified exposure can magnify returns for investors who correctly forecast market direction and magnitude, potentially contributing to more efficient capital allocation by channeling funds into sectors and factors with higher growth expectations. For asset managers, higher AUM in leverage products can translate into scale economies, enhanced liquidity, and greater enterprise value through management fees and trading activity.

However, the ascent of leverage also invites scrutiny about risk transmission and market fragility. Leveraged ETFs are designed to deliver multiple times the daily return of an underlying index. Their compounding mechanics mean that over longer horizons, the realized return can diverge significantly from the target multiple, especially in volatile markets. This characteristic has historically drawn attention from regulators, practitioners, and risk managers who emphasize the importance of understanding daily reset features and the potential for amplified drawdowns during sustained downturns. As the leverage ratio climbs, the concentration of assets in leveraged strategies may influence volatility spillovers, particularly if a sizable segment of the market moves in a correlated direction.

Regional comparisons reveal divergent usage patterns of leveraged instruments across major markets. In the United States, where liquidity and product availability are robust, leveraged long ETFs have grown into a mainstream tool for tactical exposure and hedging alongside traditional long-only funds. Investors in Europe and Asia Pacific have shown more mixed adoption, with regulatory environments, currency considerations, and product iterations shaping the appeal and utility of these products. For example, in regions with tighter regulatory scrutiny on structured products or more conservative demand for high-leverage instruments, the same growth trajectory may unfold at a slower pace, even as investor interest in directional bets persists.

The widening gap between leveraged long and inverse ETF assets also raises questions about market dynamics in the context of macroeconomic developments. A favorable growth outlook for equities—driven by robust corporate earnings, easing inflation, or supportive monetary policy—tends to bolster demand for leveraged long products. Conversely, periods of heightened uncertainty or rising rates can test risk frameworks that guide retail and institutional investors toward hedging strategies, including inverse ETFs or diversification across asset classes. The current data suggest that, at least for now, investors are allocating more capital to bets on further equity appreciation, even when those bets are amplified through leverage.

Liquidity and market structure considerations are integral to understanding the practical implications of the current leverage environment. Leveraged ETFs rely on a complex interplay of futures pricing, daily rebalancing, and authorized participant activity to maintain near-target exposure. When markets move smoothly, these products can provide efficient, cost-effective exposure with reasonable tracking error. During periods of abrupt volatility, however, the compounding effect can lead to tracking deviations and heightened premium or discount to net asset value (NAV). As assets in leveraged long ETFs swell, the importance of robust liquidity provision and transparent disclosure grows for both participants and regulators.

Investor behavior remains a critical driver of the ongoing trend. The fear of missing out, tactical momentum playing, and the efficacy of risk budgeting can all influence demand for leveraged long exposure. Market veterans often remind new entrants that leverage magnifies both gains and losses, making disciplined risk management essential. For institutional investors, leverage-enabled positioning may be part of broader portfolio construction that includes hedges, tactical tilts, and risk parity considerations. For retail investors, education about the daily reset mechanics and the potential for volatility drag is crucial to aligning expectations with outcomes.

Beyond immediate market implications, the record leverage ratio carries potential long-run effects on market participation. If the trend toward higher leveraged long AUM persists, it could influence flows into related financial instruments, including sector-specific funds, commodity-linked products, and fixed-income alternatives that offer hedging or diversification attributes. The interconnectedness of leveraged strategies with broader asset classes means shifts in ETF allocations can reverberate through market liquidity, price discovery, and volatility regimes.

In terms of regional outlook, analysts expect continued interest in leveraged long ETFs as part of tactical trading strategies in major markets. However, market participants are likely to vigilantly monitor policy signals, macro data releases, and earnings trajectories that could recalibrate risk appetite. The balance between potential upside amplification and the risk of overextension will shape how investors navigate the leverage landscape in 2025 and beyond.

For policymakers and industry stakeholders, the current environment underscores the importance of transparent product design and clear risk disclosure. As leverage becomes a more pronounced feature of the ETF ecosystem, ensuring that investors understand the mechanics, potential compounding effects, and the scenarios under which leverage can deteriorate returns is essential for maintaining market integrity and investor protection. Ongoing educational initiatives and standardized reporting can help market participants make informed decisions in a landscape where leverage is both an accelerant of opportunity and a magnifier of risk.

Looking ahead, the trajectory of leveraged long versus inverse ETF assets will depend on a confluence of factors: macroeconomic momentum, inflation trajectories, central bank policy paths, and evolving investor sentiment. If the market continues to exhibit resilience and broad-based gains, the appetite for leveraged long exposure could endure, reinforcing the current record leverage ratio. Conversely, any shift toward recessionary signals, tightening financial conditions, or structural changes in risk appetite could temper demand for leveraged strategies and bring the ratio back toward historical norms.

In sum, the record leverage ratio observed as 2025 begins reflects a marketplace that favors amplified exposure to rising equity markets. This development, underpinned by robust absolute and relative AUM growth for leveraged long ETFs and a comparatively stable base for inverse products, signals a period of heightened market optimism tempered by the enduring need for careful risk management and informed investor decision-making. As investors, managers, and policymakers watch the unfolding dynamics, the leveraging stance of ETF participants will remain a key barometer of risk sentiment and potential volatility in the months ahead.