Retail Investors Outperform Major Indices in 2025 ETF Trading

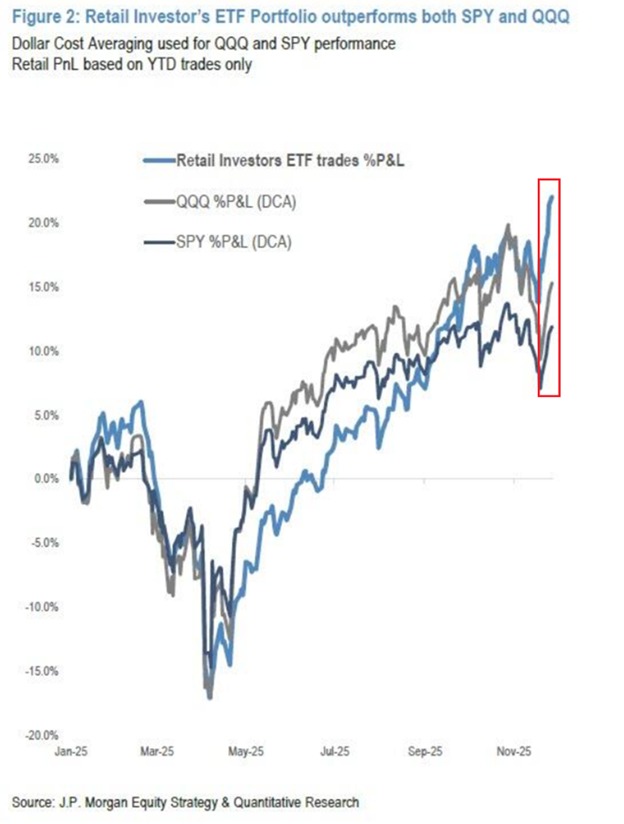

New York — Individual investors trading through exchange-traded funds (ETFs) posted an average year-to-date return of 23 percent in 2025, surpassing the performance of key benchmark indices and signaling a notable shift in how retail participants navigated market volatility. The results come amid a year characterized by sharp swings, geopolitical uncertainties, and evolving macroeconomic signals that left many traditional benchmarks stranded in a narrow trading range. As 2025 draws to a close, the performance gap between retail-driven ETF portfolios and major indices highlights both the adaptability of individual traders and the central role of ETFs in everyday investing.

Historical backdrop: a decade of ETF-driven retail activity

The prominence of ETFs in retail portfolios has grown steadily since their mainstream adoption in the early 2000s, but the 2020s accelerated the trend dramatically. By 2025, households and individual traders increasingly relied on cost-efficient, liquid, and diversified instruments to express market views without the need for deep security-by-security research. The 23 percent year-to-date return recorded by many retail ETF portfolios reflects a combination of broad market exposure, tactical sector bets, and disciplined rebalancing routines that align with common retail investing practices such as regular contributions and automatic investments.

Industry observers note that the retail ETF phenomenon did not occur in a vacuum. In the previous decade, passive index strategies dominated many portfolios, but the 2025 environment rewarded more active tilts within ETFs, especially in technology-oriented and precious metals themes. This period saw a resurgence of interest in semiconductors, cloud computing beneficiaries, and energy transition plays, alongside safe-haven and hedging assets during periods of heightened volatility. The result is a nuanced landscape where the average retail investor could capture larger moves without stepping into individual stock picking.

Economic context: volatility, opportunities, and risk management

The year featured multiple shocks that tested portfolio resilience. Inflation cooled in some regions, while supply chain disruptions and monetary policy shifts created a backdrop of uncertainty. For retail traders, ETFs offered a practical way to adjust exposure quickly as volatility spiked in September and October. The technology sector, long a driver of the market’s upside, remained a focal point as AI, cybersecurity, and cloud infrastructure continued to attract attention. Precious metals, often used as a hedge, also drew significant interest during risk-on rallies and periods of geopolitical tension.

From an economic standpoint, the outperformance by retail ETFs underscores two key realities. First, broad exposure to technology and related growth themes can yield outsized gains when market sentiment favors higher-beta assets that benefit from speculative inflows and faster-than-expected earnings revisions. Second, diversification within ETF baskets, including core holdings and thematic exposures, provides resilience when broad market indices lag or when volatility drives rapid sector rotation. For investors who employed regular investment schedules and systematic rebalancing, the discipline of dollar-cost averaging helped smooth entry points during drawdowns and capture upside during rallies.

Regional comparisons: how movements played out across markets

While thefigures reference U.S. ETF activity, global parallels emerged as investors sought similar exposures in overseas markets. In regions with robust tech ecosystems and favorable regulatory environments, retail traders pursued ETFs linked to semiconductor supply chains, green energy infrastructure, and digital economy themes. In contrast, markets that experienced higher macro uncertainty or currency volatility tended to see more conservative retail allocations, favoring diversified income-focused ETFs and precious metals proxies.

Within the United States, the performance differential between retail-driven ETFs and major indices—such as the S&P 500 and the Nasdaq 100—points to a broader reallocation trend. The SPDR S&P 500 ETF Trust (SPY) delivered a more modest 12 percent year-to-date return, while the Nasdaq 100 ETF (QQQ) rose about 15 percent. By comparison, many retail ETF portfolios targeted by individual investors achieved an aggregate 23 percent return, signaling a tilt toward high-growth areas and cyclical sectors that benefited from rapid valuation re-rating during market recoveries.

Market psychology and public sentiment: reactions from everyday investors

Public reaction to the year’s performance has been mixed, reflecting the varied experiences of retail participants. Some investors celebrated the outsized gains tied to technology names and commodity-linked ETFs, praising the power of disciplined investing and timely rebalancing. Others, however, caution that the outperformance is not guaranteed to persist and may reflect a favorable alignment of market conditions for equity bulls during specific windows. Financial education initiatives and guidance from independent investment advisors remained crucial for retail participants aiming to avoid overconcentration in volatile themes and to manage risk as markets evolve.

Industry commentary emphasizes that the retail ETF ecosystem benefits from greater transparency and accessibility. Real-time pricing, streaming data, and low-cost structures empower individual investors to implement sophisticated strategies at a fraction of traditional costs. The continued growth of fractional shares, automated investing tools, and educational resources further lowers barriers to participation, enabling a broader cross-section of the population to engage with financial markets.

Technical analysis and strategy notes

For traders who rely on technical signals, October’s rally offered a vivid example of momentum-driven behavior. The surge in certain technology names and metal futures contributed to a cumulative effect across many retail ETF holdings, reinforcing the value of trend-following strategies and disciplined risk management. Dollar-cost averaging, a staple practice among retail investors, helped mitigate the impact of short-term volatility by smoothing purchases over time, while periodic rebalancing ensured that portfolio allocations aligned with evolving risk tolerances and market conditions.

In practice, investors often combined broad market exposure with thematic bets. Core holdings aimed at diversified exposure to large-cap growth and value stocks, while satellite positions targeted semiconductor supply chains, cloud computing beneficiaries, renewable energy, and precious metals. The resulting composite exposure allowed portfolios to participate in broad market upside while capturing outsized gains from high-conviction bets when market narratives aligned with fundamental drivers.

Implications for policy and the financial ecosystem

The notable performance of retail ETFs raises questions about market structure, investor education, and financial inclusion. Regulators and market participants may watch with interest to understand how retail trading behavior affects liquidity, volatility, and price discovery, especially in periods of rapid sentiment shifts. The data underscores the importance of transparent fee structures, clear disclosure of risks, and accessible tools that empower investors to manage risk effectively. As ETFs continue to evolve with new thematic offerings and leverage options, ongoing oversight will help ensure robust market functioning and protect retail participants from undue leverage and misaligned incentives.

Market breadth and the path ahead

While 2025 delivered a strong year for retail ETF investors, analysts caution against extrapolating a guaranteed future trajectory. Market cycles can shift quickly, and what worked in one year may not translate to the next. A prudent approach for retail investors involves maintaining diversified exposures, adhering to risk management practices, and staying informed about macroeconomic developments, interest rate trajectories, and sector-specific dynamics. For regional markets with similar growth drivers, lessons from the U.S. retail ETF experience emphasize the value of accessible investment vehicles and the importance of financial literacy in helping individuals participate in the wealth-building potential of equities.

In sum, the year’s performance illustrates a broader transformation in who participates in the equity market and how they participate. Retail investors have demonstrated resilience and tactical adaptability, leveraging ETFs to express nuanced market views while maintaining a disciplined investment framework. As 2025 closes, observers will be watching whether this trend sustains into 2026, and how institutions and regulators respond to a retail-led paradigm that continues to reshape the landscape of modern investing.