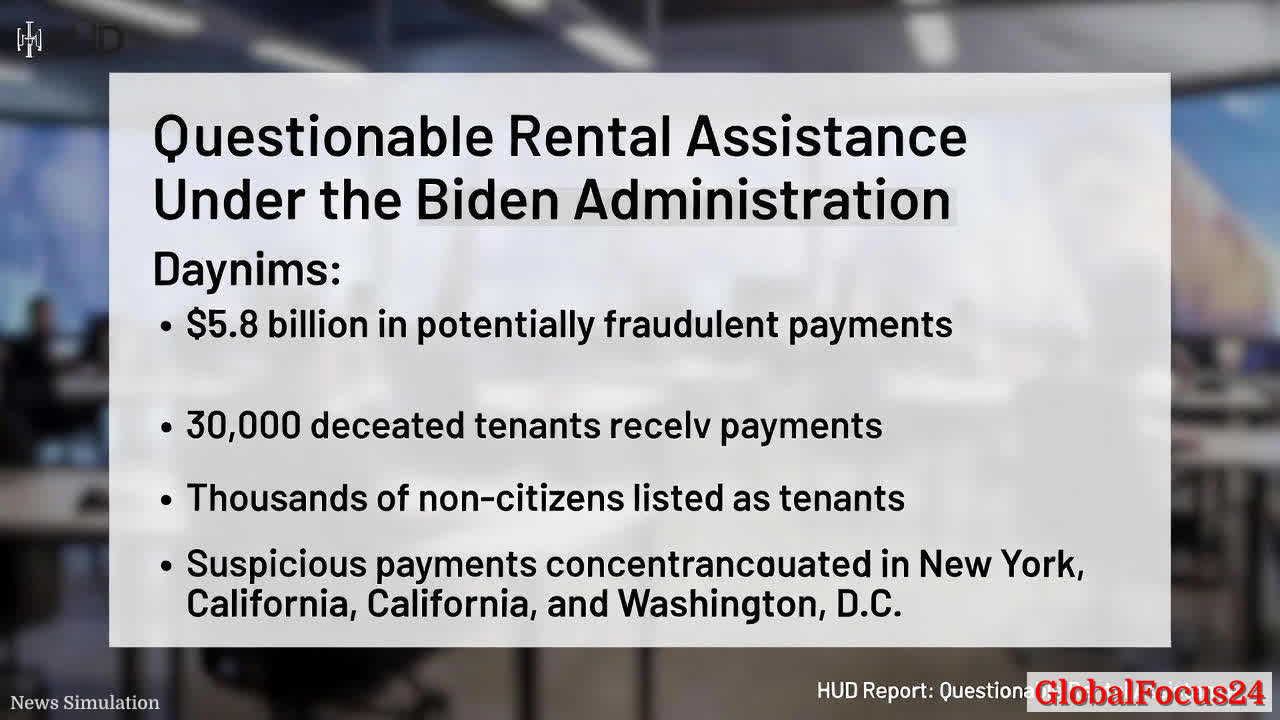

HUD Rental Assistance Program: $5.8 Billion in Questionable Payments Prompts Overhaul

In a landmark federal audit released this year, the U.S. Department of Housing and Urban Development (HUD) disclosed that more than $5.8 billion in rental assistance funds were distributed to potentially ineligible recipients during the final year of the Biden administration. The audit, which scrutinized roughly $50 billion in federal rental assistance programs for fiscal year 2024, identified widespread concerns about eligibility verification, oversight, and program integrity across Tenant-Based Rental Assistance and Project-Based Rental Assistance. The findings illuminate vulnerabilities in the system designed to support low-income households and renters facing housing instability, and they come at a moment when housing affordability challenges remain a central issue in many regions.

Historical context and program structure

Rental assistance programs administered by HUD are intended to help households with limited means secure or maintain affordable housing. Two major pillars—Tenant-Based Rental Assistance (TBRA) and Project-Based Rental Assistance (PBRA)—operate through a network that includes public housing authorities (PHAs), private landlords, and a range of contractors. TBRA funds are allocated to eligible tenants, who choose housing in the private market, while PBRA funds are tied directly to specific housing developments.

Historically, these programs expanded significantly in response to economic stress, natural disasters, and shifts in the housing market. The intended safeguards rely on a layered approach: income verification, asset checks, citizenship or immigration status determinations, and ongoing monitoring of eligibility. When properly implemented, these controls aim to prevent waste, fraud, and abuse while ensuring that aid reaches households most in need.

Key findings: scale of questionable payments and where they occurred

The HUD audit examined nearly $50 billion in rental assistance and found that roughly 11%—amounting to more than $5.8 billion—was allocated to ineligible recipients. Among the ineligible payments, the audit identified:

- Payments to deceased individuals: Approximately 14% of the ineligible total involved recipients who were no longer alive, a troubling signal of gaps in beneficiary data and timely record updates.

- Payments to non-citizens: About 4% of ineligible funds went to non-citizens when eligibility rules called for citizen or eligible non-citizen status under specific programs.

- Income overages: A striking 82% of the ineligible disbursements were to individuals whose reported income exceeded program thresholds, a discrepancy that suggests weaknesses in income verification or delayed reporting.

- Geographical concentrations: The audit highlighted notable concentrations of suspicious payments in major metropolitan areas, with New York, California, and Washington, D.C., standing out as hotspots. Yet cases of deceased recipients receiving payments were identified in all 50 states, underscoring a nationwide challenge to maintain up-to-date beneficiary data.

Administrative response and enforcement plans

HUD’s response centers on strengthening program integrity and pursuing remediation where fraud or improper payments are confirmed. The department plans several steps:

- Direct outreach to housing authorities, contractors, and landlords involved in the programs to verify eligibility and identify fraud or improper payments.

- Pausing or revoking funding for entities found to have enabled ineligible disbursements, with a focus on stopping ongoing losses.

- Referring confirmed cases for criminal investigations where appropriate, potentially leading to prosecutions for individuals or organizations implicated in fraudulent activities.

- Implementing tighter financial controls, improved data matching, and enhanced monitoring to close gaps that allowed improper payments to slip through.

Public accountability and prior audits

The 2024 audit adds to a string of investigations that have periodically raised alarms about program integrity within HUD’s rental assistance framework. Earlier audits have flagged vulnerabilities in fraud risk management and internal controls, noting that rapid fund disbursement and decentralized verification processes sometimes outpaced thorough eligibility checks. In one notable development from the same period, federal prosecutors charged multiple employees at a major housing authority in a bribery case, resulting in convictions and triggering broader reforms aimed at strengthening governance and operational practices.

Economic impact and regional implications

The misallocation of billions of rental assistance dollars has tangible macroeconomic consequences. When funds fail to reach eligible households, the intended stabilizing effect on tenant affordability and neighborhood stability can be undermined. Regions with high housing costs or acute rent burdens may experience persistent affordability gaps if assistance is siphoned off by improper payments or administrative inefficiencies.

From a regional perspective, the concentration of questionable payments in large coastal and urban markets reflects several underlying dynamics. Metropolitan areas with steep housing costs, dense rental markets, and longer processing times for verifying income and immigration status can experience higher risks of misallocation if oversight remains fragmented. Conversely, some inland or less densely populated areas may exhibit lower reported inefficiencies due to different administrative burdens or data-sharing capabilities. The audit’s nationwide scope, including instances of ineligible payments across all states, illustrates that the vulnerability is system-wide rather than confined to a specific region.

Policy response and future safeguards

In response to these findings, stakeholders across federal, state, and local levels are likely to advocate for comprehensive reforms. Key policy considerations include:

- Strengthening data integrity: Investing in real-time data matching with social security, tax, and citizenship databases to ensure current beneficiary status and income levels are accurately reflected.

- Centralized fraud risk management: Establishing uniform risk assessment protocols across PHAs, landlords, and contractors to identify high-risk transactions before payments are released.

- Enhanced beneficiary screening: Improving eligibility checks at the point of application, with ongoing verification during the tenancy period to capture changes in income, household composition, or eligibility status.

- Transparent oversight: Increasing public reporting on program performance, including annual audits, remediation progress, and the outcomes of criminal referrals, to promote accountability and build public trust.

- Targeted reforms for high-risk areas: Creating regional guardrails and auditing schedules tailored to markets with elevated risk factors, while avoiding unintended reductions in access to assistance for those who genuinely qualify.

Comparison to other federal programs

HUD’s rental assistance programs share common risk profiles with other federal welfare and housing initiatives, where rapid disbursement pressures can create gaps in verification. The tension between speed and accuracy has been a recurring theme across multiple rule-making cycles. In several instances, improvements in data-sharing and verification processes have yielded reductions in improper payments, while also safeguarding the program’s primary objective: to support the most vulnerable renters during periods of economic stress.

Public reaction and societal context

Public sentiment surrounding rental assistance programs is often mixed. On one hand, the programs are widely recognized as essential lifelines for low-income households navigating housing costs. On the other hand, revelations of ineligible payments can fuel concerns about taxpayer money being wasted and governance weaknesses. The current audit underscores the importance of maintaining rigorous controls without compromising access for those in genuine need. In communities hardest hit by housing affordability pressures, residents may view these reforms as critical to preserving program legitimacy and ensuring that aid is directed where it belongs.

Operational lessons for housing authorities and stakeholders

The audit’s findings offer practical implications for PHAs, property owners, and program administrators. Key takeaways include:

- Invest in robust data management: Prioritize up-to-date record-keeping for deceased tenants, citizenship status, and income documentation to prevent a backlog of outdated information from triggering improper payments.

- Strengthen verification workflows: Implement multi-layered checks that combine income verification, residency status, and tenancy history to reduce false positives and ensure accurate determinations.

- Foster collaboration: Encourage data-sharing agreements among federal agencies, state housing agencies, and local authorities to create a more cohesive verification ecosystem.

- Emphasize accountability: Build in clear accountability mechanisms for organizations responsible for disbursing funds, with transparent consequences for fraud or negligence.

Looking ahead

As HUD moves to tighten controls and improve program integrity, the broader housing policy environment will watch closely. The balance between protecting taxpayers and ensuring timely assistance remains delicate, especially in districts facing rental market pressures and rising living costs. If the department can implement stronger verification without creating new barriers to access, rental assistance programs can regain momentum and deliver predictable support to households in need.

The audit’s revelations serve as a clarion call for sustained investments in data accuracy, governance, and oversight. With the right reforms, HUD’s rental assistance programs can reinforce public trust, reduce waste, and reinforce the social safety net that belies the stresses of a shifting housing landscape. In the end, the goal remains clear: ensure that every dollar of federal rental support reaches the right renters at the right time, fostering stability in communities across the nation.