AI Stocks Reach New Milestone: Global AI-Driven Firms Close in on 23% of Market Capitalization

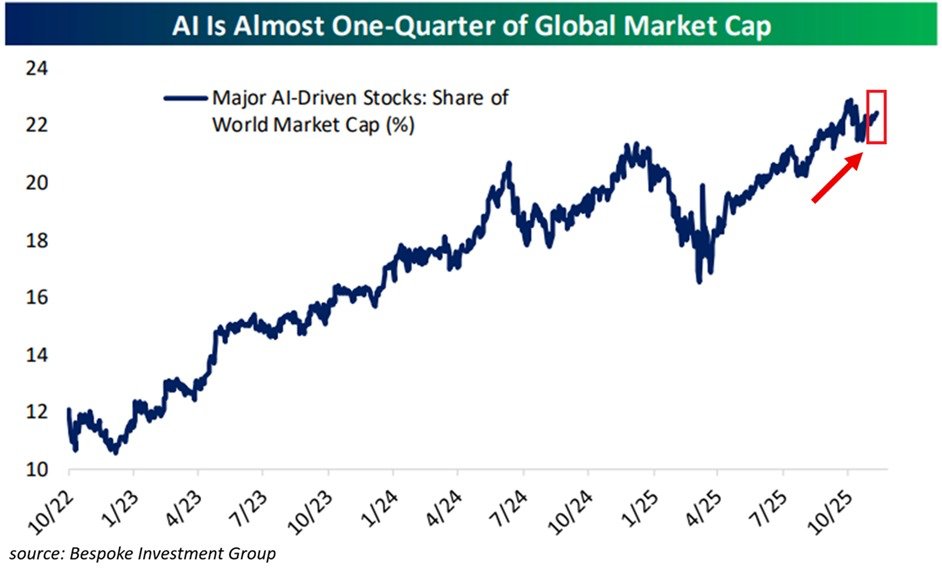

In a striking signal of the AI era’s momentum, major AI-driven companies now account for roughly 23% of the world’s total stock market capitalization, edging toward an all-time high. The surge underscores how artificial intelligence has migrated from the fringes of technology to a central pillar of global investing, with ripple effects across industries, labor markets, and regional economies.

Historical Context: The AI Market’s Ascent The ascent of AI-focused equities began to accelerate in the early 2020s, but the most rapid acceleration occurred after the launch of advanced language models and automation platforms in late 2022. The release of ChatGPT in November 2022 marked a turning point, catalyzing widespread interest in AI capabilities—from customer service automation and predictive analytics to enterprise-grade AI workflows. Since that moment, the share of AI-related firms in global equity markets has expanded dramatically, moving from a niche segment to a dominant strategic asset class for many institutional and retail investors.

Industry leaders, ranging from cloud providers to software developers and semiconductor makers, have benefited as AI applications moved from experimental pilots to mission-critical infrastructure. The result has been a sustained rally in AI stocks, supported by strong earnings growth, expanding total addressable markets, and continued investments in data centers, chip innovation, and AI safety and governance.

Global Market Impact: A $42 Trillion Shift Over the past three years, investors have witnessed a remarkable reallocation of capital toward AI-enabled businesses. The broader market value added more than $42 trillion in aggregate, a testament to the breadth of AI’s influence across sectors such as healthcare, finance, manufacturing, and retail. This broad-based appreciation has contributed to a robust global bull market, with AI as a principal engine of price appreciation and investor optimism.

Regional Comparisons: The United States as a Benchmark Across major markets, the United States stands as a key benchmark for AI stock exposure. AI-related companies now represent a record 46% of the S&P 500’s market capitalization, up from 27% in November 2022. The shift reflects the concentration of large, high-quality AI platforms and services within U.S.-listed firms, alongside a steady inflow of capital into AI-focused exchange-traded funds and sector funds. The U.S. experience has also highlighted the importance of corporate investment in AI research and development, workforce retraining, and strategic partnerships with cloud providers and hardware makers.

Elsewhere, regional dynamics vary based on regulatory environments, capital markets maturity, and domestic AI ecosystems. Europe has seen increasing penetration of AI in enterprise software and public services, supported by forward-looking data privacy standards and EU funding programs that aim to accelerate responsible AI adoption. Asia-Pacific, led by China, Japan, and South Korea, has demonstrated rapid progress in hardware acceleration, large-scale AI deployments in manufacturing, and consumer-facing AI services, even as geopolitical considerations shape investment flows and cross-border collaborations. The evolving regional mix highlights how AI is reshaping competitiveness in different economic contexts.

Economic Implications: Productivity, Jobs, and Growth The AI stock surge aligns with broader questions about productivity gains and long-term economic growth. Proponents argue that AI-driven automation can raise labor productivity, compress cycle times, and unlock new business models. Analysts point to AI-enabled processes that reduce operational costs, enhance decision-making in real time, and enable firms to scale capabilities without a linear increase in headcount.

However, observers caution that rapid AI adoption may disrupt certain job categories, necessitating retraining programs and social safety nets to ease transitions for workers. Policymakers in various regions are weighing how to balance the economic benefits of AI with considerations for labor markets, education systems, and cybersecurity safeguards. In this context, private-sector investments in AI talent development, alongside public investments in STEM education, data infrastructure, and secure AI governance, are expected to shape the trajectory of AI’s economic impact.

Technological Trends: The Architecture Behind the Surge Several technological trends underpin the AI stock surge. First, advances in large language models and generative AI platforms have broadened the set of practical applications across industries, driving revenue growth for software and cloud providers. Second, the continued expansion of data center capacity and energy-efficient hardware accelerators has improved the economics of AI workloads, reducing marginal costs and expanding margins for leading AI firms. Third, the integration of AI into enterprise software—ranging from CRM and ERP systems to cybersecurity and supply chain management—has created sticky, recurring revenue streams that traders value for resilience and visibility.

Additionally, the AI ecosystem has benefited from the proliferation of “AI-as-a-service” offerings, which lower barriers to adoption for businesses of all sizes. This democratization of AI tools has translated into broader market participation, with smaller firms leveraging AI capabilities to compete more effectively against larger incumbents. The interplay between software innovation, hardware efficiency, and data-network effects has created a reinforcing cycle that sustains growth expectations for AI-oriented companies.

Public Reaction: Optimism, Caution, and Market Sentiment Public reaction to the AI stock surge has been a mix of excitement and caution. Investors point to the transformative potential of AI to shift competitive dynamics and unlock new revenue streams, while analysts emphasize the importance of sustainable profitability and robust governance frameworks to mitigate risk. Consumers are watching as AI features become more embedded in everyday products and services, from personalized recommendations to enhanced customer support experiences. Regulators, meanwhile, are grappling with the need to balance innovation with privacy, security, and antitrust considerations, signaling that policy developments could influence AI investment trajectories in the near term.

Company Spotlight: What Is Fueling the Momentum

- Platform leaders with broad AI ecosystems continue to post strong earnings, with recurring revenue models underpinning stable long-term growth.

- Semiconductors and cloud infrastructure firms are benefiting from sustained demand for AI-ready hardware, data center capacity, and high-throughput networking capabilities.

- Enterprise software providers are embedding AI across product suites, creating cross-sell opportunities and expanding total contract values.

These dynamics have translated into a market environment where AI is no longer a niche sector but a pervasive theme across many stock-valuations. As investors reassess risk, a closer look at balance sheets, cash flow stability, and capital expenditure plans remains essential for understanding how sustainable the elevated valuations may be.

Global Supply Chains, Energy Use, and Sustainability Considerations The acceleration of AI-enabled production and logistics optimization has implications for supply chains and energy consumption. Data centers—consuming substantial electricity and cooling resources—are a focal point for energy efficiency initiatives and renewable energy integration. Companies at the forefront of AI infrastructure efficiency are increasingly investing in green technologies and negotiating power purchase agreements to mitigate environmental impact. This trend resonates with investors who are mindful of environmental, social, and governance (ESG) criteria and the long-term sustainability of AI-driven growth.

Competitive Landscape: Beyond the Leading Names While a small cluster of globally recognized AI champions drives much of the market narrative, a broader constellation of software, hardware, and services firms stands to benefit. Startups and mid-cap companies working on novel AI safety, explainability, and governance tools are drawing attention from venture capitalists and public markets alike. The broader ecosystem includes data providers, integration platforms, and managed services that help organizations deploy AI responsibly and at scale.

What This Means for Investors and Markets For investors, the current landscape offers a mix of opportunity and risk. The AI sector’s outsized share of market capitalization signals strong confidence in AI-driven productivity gains and revenue expansion. Yet it also implies higher sensitivity to regulatory shifts, technological disruption, and macroeconomic headwinds that could reprice risk assets. Diversification across AI subsectors—ranging from application software and cloud infrastructure to hardware and specialized chips—remains a prudent strategy for managing exposure.

Regional Economic Outlook: AI as a Growth Lever In regions with advanced digital infrastructure, AI adoption is closely tied to productivity improvements in manufacturing, services, and logistics. Economies that nurture AI talent pipelines, foster data-sharing ecosystems, and support responsible AI development are likely to experience more robust productivity gains and competitive advantages. Conversely, regions facing digital infrastructure gaps or talent shortages may experience uneven uptake, which could influence local equity markets and investment patterns.

Conclusion: An Era Defined by AI-Driven Valuations As AI continues to reshape the global investment landscape, the fact that AI-related companies account for nearly a quarter of global market capitalization signals a paradigm shift in how markets price innovation. The next chapters will hinge on how well firms translate AI capabilities into durable earnings, how policymakers balance innovation with safeguards, and how regional markets adapt to a rapidly evolving digital economy.

Public and Market Reaction: Immediate Takeaways

- Investors are watching AI earnings guidance closely, seeking signs of sustainable profit growth beyond hype.

- Regulators’ forthcoming guidelines on data use, privacy, and AI accountability will likely influence investor sentiment and corporate strategies.

- Consumers can anticipate more AI-powered features that enhance personalization, efficiency, and service quality across sectors, from healthcare to retail.

In the months ahead, analysts expect continued volatility as market participants reassess valuations in light of evolving AI fundamentals, regulatory developments, and macroeconomic conditions. Yet the underlying trajectory remains clear: AI-driven innovation is not a temporary fad but a structural shift reshaping global markets, corporate strategy, and everyday life.