AI Revolutionizes Manufacturing: The Dawn of Nimbler, Smarter Factories

The manufacturing sector stands at a pivotal inflection point as artificial intelligence, robotics, and digital-twin technology converge to redefine how, where, and why goods are produced. From the first tremors of automation in the late 20th century to today’s era of anticipatory maintenance and autonomous material handling, the industry is undergoing a transformation that promises greater speed, resilience, and customization. This article examines the current state, historical context, economic impact, and regional dynamics shaping the factory of the future.

Historical context: milestones that frame the present The roadmap of modern manufacturing is paved with both optimism and hard lessons. In the mid-1980s, an ambitious “factory of the future” project in Saginaw, Michigan, showcased the early allure of lights-out automation. Robots were positioned to operate with minimal human intervention, yet the endeavor revealed fundamental shortcomings: difficulty distinguishing product variants, precision challenges in assembly and painting, and an escalating cost profile that ultimately overran budgets. The episode highlighted a simple truth that remains relevant: automation success hinges not only on hardware but on adaptable processes, robust data, and agile control systems.

By the 1990s and 2000s, automation progressed in fits and starts. Conventional robotics found steady roles in high-volume, repetitive tasks, while sensors, controllers, and programmable logic controllers (PLCs) expanded the practical envelope. The real acceleration came with the integration of digital simulation tools, connectivity, and data analytics. The concept of digital twins—virtual replicas of physical plants—began to shift from theoretical promise to practical advantage, enabling engineers to test changes, anticipate failures, and optimize layouts without costly downtime.

The 2010s and 2020s saw a surge in robot installations as costs declined and capabilities expanded. Global deployments reached tens of millions of devices across sectors, with manufacturing automation growing more common in automotive, electronics, consumer goods, and logistics. The pandemic-era demand spike created a temporary surge in automation investments as firms sought to mitigate labor shortages and bolster supply chain resilience. Yet even as orders surged, the broader market experienced variability: Europe faced notably sluggish demand for automation equipment amid macroeconomic headwinds, while North America and parts of Asia maintained stronger investment momentum.

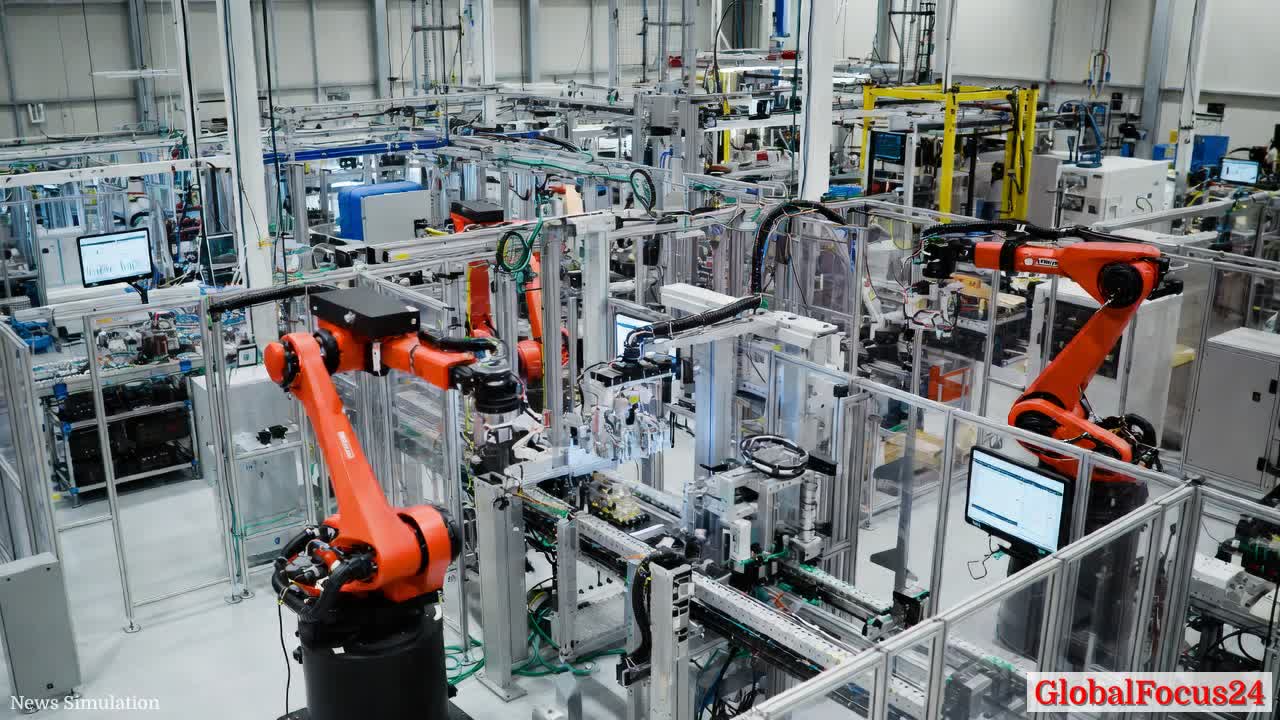

The present moment: a synthesis of AI, robotics, and digital twins Today, the landscape is defined by several complementary forces that reinforce one another. Hardware improvements—robots with multi-axis reach, advanced grippers, and high-precision sensors—combine with software breakthroughs that enable rapid reprogramming and flexible task execution. The cost curve for robotics has continued to bend downward, aided by competitive pressure from global manufacturers and a diversification of supplier ecosystems, including significant contributions from Chinese and other Asian producers.

Digital twins and 3D AI are not mere add-ons; they are central to how factories are planned, tested, and operated. Virtual models allow engineers to simulate production scenarios, validate process changes, and forecast performance under varying conditions. The integration of AI into these simulations—where machine vision, anomaly detection, and adaptive control respond to real-time sensor inputs—creates a feedback loop that continuously improves efficiency and quality.

Generative AI has emerged as a catalyst for bridging the gap between virtual testing and real-world deployment. By learning from telemetry data gathered by sensors and cameras, AI systems can predict bottlenecks, optimize process parameters, and adapt to variations in material quality or environmental conditions. Industry leaders have framed AI as the “brains” of the plant, with human operators providing oversight, strategic direction, and exception handling.

Economic impact: productivity gains, job market dynamics, and regional shifts The economic case for smarter factories rests on several pillars. First, productivity gains arise from higher throughput, reduced cycle times, and lower defect rates. When digital twins simulate processes before committing capital, plants can de-risk investments and avoid costly downtime. Second, the ability to reconfigure lines quickly supports mass customization, enabling manufacturers to offer a wider range of product variants without sacrificing efficiency. Third, predictive maintenance reduces unplanned outages, extending asset life and lowering total cost of ownership for critical machinery.

Labor market dynamics in this evolving environment are nuanced. On one hand, automation and AI can substitute routine, hazardous, or precision-based tasks, potentially reducing demand for certain low-skill roles. On the other hand, the integration of sophisticated robotics and AI creates demand for higher-skill positions in systems integration, data science, cybersecurity, and maintenance engineering. Training ecosystems that blend factory-floor experience with data analytics curricula are increasingly essential to ensure workers can supervise, troubleshoot, and continually improve automated systems.

Regional comparisons reveal a mosaic of adoption patterns. North America has tended to emphasize supply-chain resilience and advanced manufacturing initiatives, supported by favorable investment climates and public-sector incentives. Europe has focused on energy efficiency, precision engineering, and high-value product segments, though some markets have faced slower automation uptake due to cost considerations and structural economic challenges. Asia, with its diversified manufacturing base, continues to drive volume with rapid deployment in electronics, automotive, and consumer goods supply chains, aided by robust ecosystems of suppliers, partners, and research institutions. In many regions, the trend toward nearshoring or regionalized production—driven by risks from global disruptions, tariff regimes, and logistics efficiency—further accelerates investments in flexible, intelligent factories.

The potential displacement and creation of opportunities hinge on strategy and policy. For example, subsidies and tariffs designed to promote domestic production can tilt investment toward automation-ready facilities. Labor shortages driven by demographic shifts, such as aging workforces in advanced economies, also motivate firms to adopt autonomous systems that can operate with reduced human labor requirements. In practice, many manufacturers are pursuing a hybrid model: leveraging automation for repetitive, precision-based tasks while retaining human oversight for complex decisions, quality assurance, and optimization that requires nuanced judgment.

Technological breakthroughs driving the next wave Several converging technologies are accelerating the shift to nimble, smarter factories:

- Advanced robotics: Modern robotic systems feature six-axis or more configurations, precision end-effectors, and sophisticated sensing that expand the range of feasible tasks. Mass production pressures and competition from global suppliers have driven prices downward, making robotics accessible to broader segments of industry.

- Digital twins: Virtual replicas of physical plants enable rapid testing, scenario planning, and performance optimization. The integration of real-time data streams from sensors and devices enhances the fidelity of simulations, helping managers forecast failures and optimize throughput with greater confidence.

- AI and machine learning: Generative AI, computer vision, and reinforcement learning empower machines to perceive, reason, and adapt to changing conditions. AI-enabled optimization can tune parameters on the fly, improving yield, energy efficiency, and throughput.

- Collaborative automation: Human-robot collaboration (cobots) combines the strengths of humans and machines, enabling flexible production lines that can be reprogrammed for new products without significant downtime.

- Edge-to-cloud architectures: Distributed computing architectures enable real-time processing on the factory floor while preserving the scalability and data-archive capabilities of cloud platforms. This balance supports low-latency control and broader analytics initiatives.

- Digital résumés and data pooling: The consolidation of datasets from multiple sites and partners enhances model training and cross-factory optimization. Shared data pools enable faster learning and more robust AI models, while raising considerations around data governance and security.

What this shift means for the factory layout and supply chains The factory of the near future is likely to be more modular, adaptable, and closer to demand centers. Instead of single, sprawling megafactories, manufacturers may operate distributed networks of smaller, highly automated facilities that can pivot to changing product mixes. This modular approach reduces exposure to tariffs and logistics risks, enabling closer proximity to workers and customers. In practice, these changes could redefine industrial real estate, with companies prioritizing flexible, scalable footprints that can be repurposed as markets evolve.

Supply chains stand to gain resilience through diversification and localization. Real-time visibility, AI-driven demand sensing, and autonomous logistics on the shop floor and in surrounding networks can shorten lead times and minimize stockouts. However, the economic calculus will hinge on the relative costs of automation, energy, and talent across regions, as well as the availability of resilient energy and connectivity infrastructure.

Public reaction and societal considerations As factories become smarter and more autonomous, communities may experience shifts in employment patterns, urban planning, and environmental footprints. Policymakers and industry groups are increasingly focused on ensuring safe integration of autonomous systems, protecting data privacy, and providing retraining opportunities for workers affected by automation. Public communication emphasizes the benefits of increased efficiency, lower costs, and the potential for high-skilled jobs in design, programming, and maintenance.

Case studies and regional examples illustrate the trajectory:

- A pilot in Southeast Asia demonstrates autonomous material handling and self-optimizing production lines that adjust to demand signals with minimal human intervention. The project highlights how near-real-time data fusion across multiple facilities can coordinate production and logistics with unprecedented fluency.

- In Europe, manufacturers are leveraging digital twins to optimize energy consumption and reduce waste in high-precision sectors such as aerospace and automotive component manufacturing. The environmental benefits align with broader decarbonization goals while supporting competitive performance in global markets.

- North American plants are integrating AI-driven quality control, leveraging machine vision to detect defects at the earliest stage and dynamically reallocate resources to minimize scrap. This approach improves yield while maintaining rigorous safety and compliance standards.

The road ahead: expectations for 2026 and beyond Analysts anticipate that the automation market will continue to expand, with annual robot installations projected to rise as adoption accelerates, particularly in sectors facing persistent labor shortages and high variability in demand. The broader automation ecosystem is expected to grow as suppliers refine integrated solutions that blend hardware, software, and services into cohesive, scalable packages. Government policies that encourage domestic production, supply-chain resilience, and workforce retraining will further shape investment decisions and deployment timelines.

In this evolving landscape, the “factory of the future” is less a single, monumental project and more a networked set of capability upgrades. The emphasis is on modularity, adaptability, and data-driven decision-making. Firms that combine flexible automation with robust digital twins and AI-driven optimization position themselves to meet shifting consumer preferences, contend with geopolitical and economic risks, and capture efficiencies across the entire production lifecycle.

Conclusion: a balanced, forward-looking view The integration of artificial intelligence, robotics, and digital twins marks a turning point for manufacturing. History shows that early automation efforts faced technical and economic headwinds, but modern systems leverage data, connectivity, and advanced analytics to achieve goals once deemed unattainable. As factories become nimbler, more intelligent, and closer to markets, the potential for significant productivity gains grows alongside opportunities for high-skilled employment in design, programming, and maintenance. The regional dynamics—each with its strengths and challenges—will define which economies emerge as leaders in the next wave of industrial innovation. Investors, policymakers, and industry leaders will watch closely as pilot programs mature, standards evolve, and the global economy adapts to a manufacturing paradigm defined not by the size of a single megafactory, but by the resilience and adaptability of a distributed, intelligent network of facilities.