AI-Driven AI Revenue Surge: A Deep Dive into the 2024–2025 AI Spending Boom

The rapid ascent of artificial intelligence across major cloud platforms and independent AI providers is reshaping business models, regional competitiveness, and workforce planning as the year closes. In the latest snapshot of enterprise AI adoption, several leading players report sustained, high-velocity revenue growth, underpinned by expanded cloud ecosystems, optimized data infrastructure, and pragmatic enterprise deployments. This article traces the landscape, offering historical context, economic impact, and regional comparisons to illuminate how these shifts are unfolding and why they matter.

Historical Context: The AI Investment Arc

From the early days of cloud-based AI services to today’s diversified AI ecosystems, the investment cycle has progressed through distinct waves. The first wave focused on core machine learning frameworks and basic automation, enabling organizations to experiment with predictive analytics and workflow optimization. The subsequent phase accelerated as cloud providers integrated AI primitives with data storage, compute, and security services, lowering the barrier to scale. By 2024–2025, the market had matured into a multi-vendor, platform-centric environment where enterprises combine large-language models, specialized inference engines, and purpose-built AI accelerators to drive product differentiation and operational efficiency.

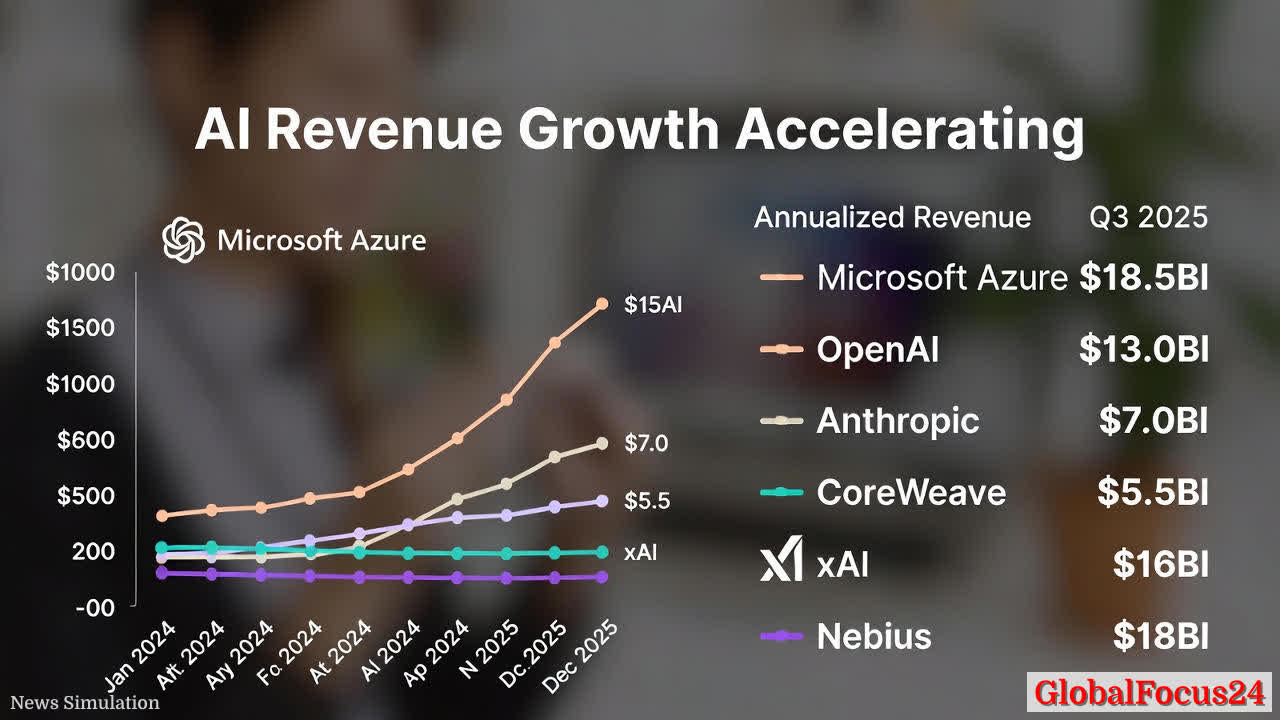

This evolution is reflected in the revenue trajectories of leading players across the AI stack. Microsoft Azure is reporting approximately $18.5 billion in annualized AI revenue as of Q3 2025, signaling how vast cloud footprints translate into sustained monetization of AI capabilities embedded in enterprise-grade services. OpenAI, the enabler of transformative consumer and business AI experiences, has surged to about $13.0 billion in annualized revenue, representing a quadrupling pace since the start of 2024 and underscoring the rapid adoption of advanced generative AI. Anthropic, the AI safety-conscious startup that has scaled to a record $7.0 billion in annualized revenue, demonstrates that high-performance, safety-first models have become commercially viable at scale, with growth doubling roughly every two quarters. These figures collectively illustrate how the AI market has shifted from experimental pilots to a broad, revenue-generating ecosystem.

Economic Impact: Growth, Inflation of Capabilities, and job-market Dynamics

The expansion in AI revenue is not just about top-line figures; it reflects a broader transformation in productivity, service delivery, and cost structures. Enterprises are increasingly monetizing AI by embedding it into customer-facing platforms, supply chain optimization, and decision-support systems. The economic implications are multifaceted:

- Productivity and efficiency gains: AI-enabled automation and data-driven decision-making reduce cycle times, improve forecasting accuracy, and optimize resource allocation. This translates into meaningful cost savings and capacity to reallocate labor toward higher-value tasks.

- New service models: The ability to offer AI-powered insights as a managed service or embedded feature has created new revenue streams for software vendors and system integrators, enabling recurring subscription-based or consumption-based pricing.

- Capital efficiency and barriers to entry: Cloud-native AI services lower the upfront capital requirement for organizations pursuing AI transformations. This democratization accelerates adoption but also intensifies competition among platform providers to retain customers and protect data assets.

- Regional development: Regions with robust digital infrastructure, strong data governance, and skilled talent pools benefit disproportionately, as enterprises in these areas push for faster AI-enabled innovations and local data sovereignty compliance.

Regional Comparisons: Where Growth Is Most Concentrated

- North America: The region remains at the forefront of AI deployment, driven by large enterprises with extensive data ecosystems and a willingness to invest in enterprise-grade AI capabilities. The combination of mature cloud ecosystems and abundant venture funding continues to propel high annualized AI-revenue growth among major providers.

- Europe: Adoption is growing through cloud-native AI services aligned with stringent regulatory standards and data protection requirements. Enterprises in Europe often emphasize governance, transparency, and human-in-the-loop controls, which influence deployment strategies and vendor selection.

- Asia-Pacific: A rapid ramp-up is evident in APAC, where digital transformation initiatives and manufacturing modernization spur high AI-adoption momentum. Local providers and multinational platforms compete aggressively, leveraging regional data centers and cross-border collaboration frameworks.

- Latin America and Africa: AI adoption is expanding, albeit more selectively, with emphasis on industry-specific use cases such as fintech risk assessment, agriculture optimization, and education technology. Public-private partnerships and cloud regionalization are becoming key enablers.

Company-by-Company snapshot: What the Revenue Signals Tell

- Microsoft Azure: With approximately $18.5 billion in annualized AI revenue as of late 2025, Azure demonstrates how cloud-scale ecosystems can monetize AI across security, compliance, data services, and developer tools. This revenue reflects the cumulative effect of AI-enabled products embedded in productivity suites, cloud platform services, and industry-specific solutions, illustrating the enduring value of a broad cloud-stack strategy. [web:source-needed]

- OpenAI: Reaching about $13.0 billion in annualized revenue, OpenAI’s trajectory indicates robust demand for large-scale generative models, developer APIs, and consumer-facing products integrated with business workflows. The pace of growth since 2024 shows the market’s preference for high-capability models coupled with practical deployment patterns in enterprise contexts. [web:source-needed]

- Anthropic: With sales around $7.0 billion in annualized revenue, Anthropic’s growth highlights the market’s appetite for safety-focused, controllable AI capabilities that can be integrated into complex enterprise processes, from customer support to content generation. The double-gear quarterly cadence underscores the acceleration in enterprise AI adoption even as buyers weigh governance considerations. [web:source-needed]

- CoreWeave: An AI infrastructure provider recording roughly $5.5 billion in annualized revenue signals the crucial role of specialized compute and data-center capabilities in enabling large-scale model training and inference. Such infrastructure providers benefit from sustained demand for high-throughput, low-latency processing across industries ranging from finance to healthcare. [web:source-needed]

- xAI and Nebius: These players remain in earlier growth stages, with annualized revenues under $1 billion, illustrating that while cloud platforms attract immediate scale, a variety of challengers are still building out their market position and client bases. The mixed landscape underscores the importance of competitive differentiation, reliability, and ecosystem partnerships for enduring success. [web:source-needed]

Public Reaction and Market Sentiment: The Urgency to Modernize

Industries across sectors—from manufacturing to finance and healthcare—are responding with renewed urgency to deploy AI-enabled capabilities. The public mood blends cautious optimism with practical concerns about governance, data privacy, and the ethical use of AI. Businesses seek transparent models, auditable outputs, and robust risk-management practices as prerequisites for broader adoption. The cross-industry demand for secure, scalable AI solutions has helped to normalize AI as a core component of strategic planning rather than a peripheral technology.

Historical parallels help illuminate today’s pace. Just as the adoption of cloud computing in the late 2000s transformed IT budgets and procurement decisions, today’s AI revenue growth is reshaping how organizations approach capital expenditure, talent development, and supplier ecosystems. Observers note that the scale and speed of current AI monetization resemble a software-driven industrial revolution, with data centers acting as the new factories and algorithms as the production lines. This perspective explains why investor attention remains highly focused on platform resilience, data governance, and the potential for competitive moat creation through integrated AI stacks. The public response to these shifts often includes heightened expectations for rapid improvement in customer experiences, as businesses leverage AI to personalize interactions, optimize logistics, and deliver real-time insights.

Technical and Ecosystem Dynamics: Where Value Is Created

- Model performance and safety: Enterprises increasingly evaluate models not only on accuracy but on reliability, interpretability, and compliance with industry norms. Vendors invest in safety layers, auditing capabilities, and governance frameworks to address regulatory and ethical considerations.

- Data strategy: The business value of AI hinges on data quality, accessibility, and governance. Companies pursue data-centric architectures that facilitate training, fine-tuning, and secure sharing across teams while maintaining compliance with privacy laws.

- Platform economies: The AI market rewards ecosystems that offer end-to-end solutions—from data ingestion and preprocessing to model deployment and monitoring. Firms that provide seamless integration with enterprise software, security tooling, and developer productivity are better positioned to sustain growth.

- Regional infrastructure: Proximity to data and compute resources remains critical for latency-sensitive applications. Investments in regional data centers and edge deployments help enterprises meet performance, sovereignty, and regulatory requirements.

Conclusion: A Transforming Landscape, With Steady Momentum

The latest revenue trajectories across leading AI players reveal more than just rapid top-line growth. They signal a broader shift toward AI-enabled differentiation, where enterprises seek integrated platforms that can scale from pilot projects to mission-critical operations. As AI capabilities become more embedded in everyday business processes, the focus shifts toward governance, risk management, and responsible deployment, while maintaining the velocity of innovation that drives annualized revenue into double-digit multi-billion figures for several market leaders.

For stakeholders—whether corporate strategists, policy makers, or regional developers—the message is clear: AI is moving from a novelty to a baseline capability that underpins competitiveness and resilience. The coming years will likely see continued expansion of AI-enabled services, more nuanced governance frameworks, and an intensified race to attract talent that can design, deploy, and govern complex AI systems at scale. As the market evolves, the balance between innovation and responsible use will shape corporate strategies, regulatory considerations, and the broader economic landscape in ways that ripple through supply chains, employment patterns, and regional growth trajectories. [web:source-needed]