AI-Driven Demand Sparks Critical Shortage in Memory Chip Supplies

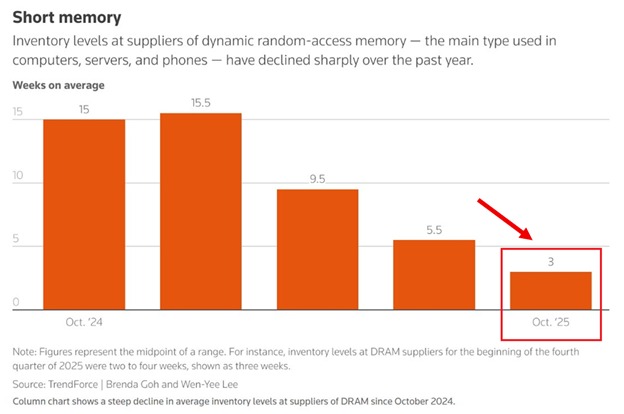

Global DRAM inventories shrink 80% year over year, winnowing stock to roughly three weeks as of October 2025, according to industry trackers. The sudden tightening follows a period of relative stability in 2024 and early 2025, but accelerated demand for AI infrastructure, data-center expansion, and consumer electronics has strained production capacity and reshaped the memory supply chain. The imbalance is reverberating across manufacturers, suppliers, and buyers, prompting price adjustments and strategic reevaluations that could influence pricing, availability, and technology cycles for years to come.

Historical context: a memory market built on cycles and resilience DRAM, or dynamic random-access memory, has long been the backbone of modern computing—storing active data for servers, PCs, smartphones, and embedded devices. The market has historically moved in multi-quarter to multi-year cycles driven by capex, capacity expansions, and shifts in application mix. After a late-2021 surge in demand as cloud adoption accelerated, memory producers expanded fabs and lines to meet anticipated growth. However, the abrupt pivot in late 2023 toward AI-oriented workloads created a new tier of demand that outpaced traditional channels.

In this cycle, suppliers faced a dual front: the rapid uptake of AI accelerators and high-bandwidth memory for data centers, coupled with persistent consumer electronics demand. The result has been a structural shortage of not only DRAM but also companion memory types such as high-bandwidth memory (HBM) used in AI systems, and consumer-grade flash chips used in USB drives and mobile devices. The combination of supply constraints and exploding demand created a rare moment when inventories compressed across the spectrum of memory technologies.

Current inventory reality and price signals Industry data show DRAM inventories at levels not seen in years, with a three-week supply by October 2025. This marks a dramatic drop from approximately 9.5 weeks in July 2025 and stands in sharp contrast to late-2024 levels exceeding 15 weeks. The pace of depletion indicates a market where orders for AI infrastructure, data-center upgrades, and premium consumer devices outstrip production capacity. Spot prices for DRAM have nearly tripled in recent months, signaling the intensity of the shortage and the risk premium buyers face to secure essential components.

HBM, a high-performance memory category designed for bandwidth-intensive workloads, has become a focal point for AI data-center builders. The enhanced memory interface offered by HBM supports rapid data movement between processors and memory. As AI model complexity grows and training cycles lengthen, demand for HBM and other advanced memory formats has surged, widening the gap between supply and demand. The scarcity of HBM compounds the overall supply crunch by limiting the ability of data centers to scale AI workloads efficiently.

Regional dynamics and supply-chain bottlenecks Geographic distribution adds another layer of complexity. Asia remains the center of memory production and supply, with major fabrication facilities in South Korea and Taiwan contributing a significant share of global output. Any disruption—whether due to energy constraints, logistics bottlenecks, or geopolitical factors—can reverberate through the entire supply chain. In 2025, manufacturers have reportedly shifted production lines toward high-margin AI applications, potentially at the expense of volume for traditional consumer devices such as PCs and smartphones. This reallocation has implications for regional pricing, supplier relationships, and downstream consumer markets in North America, Europe, and other regions.

Economic impact on manufacturers, integrators, and end markets The tighter memory market is having wide-ranging economic effects:

- Production costs and pricing: As DRAM and related memory components become scarcer, manufacturers and system integrators are passing increases to buyers. PC assemblers and smartphone makers have announced or implemented price adjustments to reflect higher component costs, and enterprises upgrading data centers face higher capital expenditure thresholds for memory-intensive workloads.

- Supply-chain discipline: The shortage is forcing buyers to rethink procurement strategies, including longer-term contracts, strategic stockpiling, and multi-sourcing of suppliers to reduce single-point failure risk. Some enterprises are exploring temporary memory tiering strategies, using cache and tiered storage, to mitigate immediate bottlenecks.

- Innovation pacing: While AI demands push for denser memory and faster interconnects, supply limitations could temper the speed at which new AI models and data-center architectures scale. Equipment makers and software developers may need to optimize algorithms for more memory-efficient training and inference to align with available hardware.

- Financial implications: Memory-equipment suppliers and memory-chip producers could see volatility in earnings as price swings, production rerouting, and capex adjustments ripple through quarterly results. Investors are weighing the durability of the AI memory demand curve against the risk of prolonged shortages.

- Consumer affordability and device availability: For everyday devices, shortages and price increases in DRAM and flash components can translate into higher sale prices or delayed product launches. Consumers may observe shorter device lifecycles, slower refresh cycles, or pivoted product roadmaps as manufacturers prioritize AI-relevant components.

Industry responses and strategic pivots To address the constraint, industry players are pursuing several parallel strategies:

- Capacity expansion and optimization: Chipmakers are evaluating the viability of expanding existing fabs or reconfiguring lines to increase DRAM and HBM output. The challenge lies in the substantial capital expenditure, lead times, and the high-stakes nature of wafer fabrication.

- Allocation and prioritization: Producers are allocating wafer-time and production to higher-margin AI applications. This prioritization helps maintain profitability but may widen gaps in supply for traditional consumer products in the near term.

- Material and process innovations: Research into new memory architectures, improved yield, and better process nodes continues. While breakthroughs can take years, even iterative improvements can influence the long-term balance of supply and demand.

- Strategic stockpiling: Some buyers and national programs are evaluating larger stockpiles of memory components to hedge against volatility. These moves can have broader macroeconomic implications, including shifts in inventory carrying costs and supplier negotiations.

- Collaborative supply-chain arrangements: Joint ventures, long-term supply agreements, and collaboration across the ecosystem are being explored to stabilize throughput and pricing. Such arrangements can provide more predictable access to memory resources for data centers, enterprises, and device makers.

Regional comparisons and implications

- North America: Enterprise data centers and cloud providers are the primary drivers of AI-driven memory demand. The region may see accelerated investment in AI-ready architectures, while consumer electronics prices might experience modest pressure as supply tightness persists.

- Europe: The memory shortage could influence the pace of industrial digitization and cloud migration. European firms may seek diversified supplier networks and regional data-center expansion to reduce reliance on singular production hubs.

- Asia-Pacific: The memory market remains most exposed here, given the concentration of manufacturing. Policy actions, energy reliability, and regional logistics will play critical roles in shaping output and pricing in the near term.

Public reaction and market sentiment Public-facing expectations around AI-enabled devices, data processing capabilities, and cloud performance contribute to a sense of urgency among businesses and consumers. Tech sector commentators note that memory shortages underline the need for more resilient supply chains and diversified sourcing. Suppliers and buyers alike are publicly communicating timelines and expectations to manage demand and avoid overpromising on release schedules for memory-intensive products.

Conclusion: a pivotal moment for memory supply in the AI era The 80% year-over-year drop in DRAM inventories, with only three weeks of stock remaining as of October 2025, marks a defining moment for the semiconductor industry. The crisis is not simply about scarce chips; it reflects a broader transformation in computing demands driven by AI, data-center modernization, and consumer technology trends. While industry players respond with capacity plans, allocation strategies, and collaborative solutions, the path to normalization remains uncertain through late 2027, according to major producers’ outlooks.

As the AI economy expands, memory will remain a critical bottleneck shaping product design, pricing, and technological progress. For businesses reliant on high-performance computing and AI workloads, proactive supply-chain management, diversified sourcing, and forward-looking procurement will be essential to navigating this period of heightened volatility. Consumers, too, may feel the ripple effects in product announcements, pricing, and availability as memory components continue to command heightened attention in the global technology ecosystem.