Global Coal Demand Reaches Record Levels as Asia Drives Growth

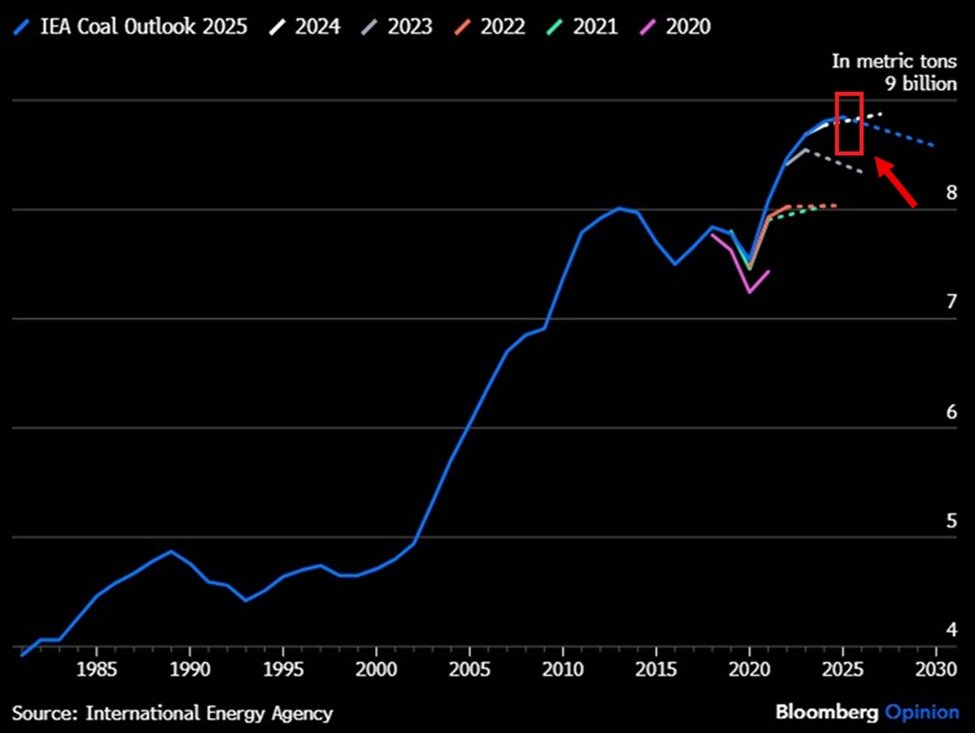

Global coal demand has surged to a unprecedented 8.85 billion metric tons annually, marking a new high in worldwide consumption and underscoring the persistent role of coal in global energy security. The latest figures, compiled by leading energy analysts, show a broad-based increase from 2020 levels, driven predominantly by Chinese demand and supported by industrial activity in other regions. This milestone arrives at a moment when energy markets are navigating a complex transition, balancing affordability, reliability, and the environmental implications of fossil fuel use.

Historical context: coal’s enduring footprint on energy systems

Coal has long served as a backbone for industrial economies, providing a dense, reliable source of power that can be scaled to meet large electricity demands. In the mid-20th century, coal was the primary driver of electricity generation in many developed economies. Over the decades, natural gas, renewables, and policy shifts gradually redistributed the energy mix, especially in Europe and North America. Yet in several parts of the world, coal remains a cost-effective option for base-load power and steel production, making it a stubborn staple even as clean-energy narratives gain traction.

The record consumption level reflects both enduring demand and structural realities in energy markets. While renewable energy capacity continues to grow and climate policies intensify, coal’s role persists in providing grid stability, especially under circumstances of weather-driven volatility, supply chain disruptions, and the need to maintain affordable electricity for households and industry. The new record therefore does not simply signal a triumph of one fuel over another; it highlights the complexity of transitioning energy systems where supply, price, and reliability intersect.

China: a dominant force in global coal usage

China accounts for approximately 56% of worldwide coal consumption, totaling about 4.95 billion metric tons. The scale of Chinese demand is a function of several intertwined factors: ongoing industrial expansion, urbanization, and the critical role of coal-fired generation in supporting electricity reliability across vast regional grids. In many provinces, coal remains a cornerstone for economic activity, particularly in energy-intensive sectors such as manufacturing, construction, and heavy industry. The country’s energy policy now seeks a gradual shift toward cleaner energy sources, yet the pace of transition is tempered by the need to sustain economic momentum and ensure stable energy prices for millions of citizens.

The surge in demand has broader regional ramifications. Countries with export-oriented coal industries have seen revenue upticks, while imports in neighboring regions provide a counterbalance to domestic production. This dynamic can influence global coal prices, shipping routes, and capital allocation within commodity markets. The emphasis on energy security means many governments will continue to evaluate storage strategies, diversification of supply sources, and the resilience of power networks against weather-related shocks and other systemic risks.

The United States: steady consumption within a global framework

The United States consumes about 410 million metric tons of coal annually, representing roughly 5% of global consumption. U.S. coal use has declined from its peak in previous decades, due in part to shifts toward natural gas, renewables, and stricter emissions standards. Nonetheless, coal remains a significant material for certain industries, including steel and cement production, and plays a role in maintaining grid resilience in some regions. The U.S. experience illustrates a broader global pattern: even as many economies diversify away from coal, the commodity continues to serve niche but critical purposes within a diversified energy portfolio.

Economic impact: from mines to markets

Elevated coal demand has multifaceted economic effects. For exporting nations, higher global consumption can boost mining livelihoods, labor markets, and regional development tied to transportation infrastructure such as rail and port facilities. It can also affect local government revenues and investment in coal-related technology, including safety improvements and emissions control. At the same time, rising coal consumption can influence energy pricing, industrial production costs, and competitiveness for energy-intensive sectors. Policymakers must weigh short-term economic gains against long-term environmental costs and the cost of transition to cleaner energy sources.

Global supply chains and price dynamics

The record-high demand interacts with supply chain realities, including mine capacity, transportation capacity, and geopolitical factors that influence coal availability. Shipping costs, port congestion, and trade policies can amplify price volatility, affecting end-user electricity prices and industrial input costs. For buyers, hedging strategies, stockpiling, and diversification of energy sources become critical tools for managing risk in an uncertain price environment. The interconnected nature of global markets means shifts in one region reverberate worldwide, shaping investment decisions across energy, manufacturing, and infrastructure sectors.

Regional comparisons: resilience, affordability, and transition

- Europe: The region continues to integrate more renewables and improve energy efficiency, but it remains attentive to energy affordability and supply security, particularly during periods of low wind or solar generation. Coal remains a transitional bridge in some markets, though policy trajectories emphasize decarbonization and market reforms.

- Asia-Pacific: Beyond China, other economies in the region rely on coal for reliability and cost-effective energy. As these nations expand electrification and industrial output, coal demand can sustain elevated levels even as jurisdictions pursue cleaner technologies.

- Americas: With evolving regulatory landscapes and natural gas abundance, several markets have reduced coal dependency. Yet regional variations persist, with some jurisdictions maintaining coal-fired capacity for grid stability or industrial purposes.

- Africa: Emerging markets in Africa face power shortages and rising demand for reliable electricity. Coal, alongside hydro and gas, remains part of a broader strategy to expand access to energy, though financing and environmental considerations shape deployment.

Environmental and policy considerations

The sustained prominence of coal in global energy mixes raises important questions about climate policy, air quality, and public health. Governments are balancing the immediate needs for affordable electricity and industrial capability with long-term commitments to reduce greenhouse gas emissions. Investments in carbon capture, utilization, and storage (CCUS) and other emission-reduction technologies are part of ongoing conversations among policymakers, industry players, and researchers. The pace of decarbonization varies by country and region, reflecting factors such as resource endowments, technology readiness, public acceptance, and fiscal capacity.

Public reaction and market sentiment

Communities near mining operations and power plants often experience a mix of concerns and resilience. Job security, environmental stewardship, and the tangible benefits of local investment shape public sentiment. In industrial hubs dependent on coal, workers and unions frequently advocate for a just transition that preserves livelihoods while embracing cleaner energy pathways. Investors watch price movements, regulatory signals, and the evolution of technology with keen attention, weighing potential returns against environmental, social, and governance (ESG) considerations.

Outlook: what comes next for global coal demand

Forecasts from respected energy agencies suggest a gradual reduction in demand over the next five years, projecting a decline to around 8.60 billion metric tons by 2030. However, historical patterns show that peak coal predictions have often missed the mark, with consumption continuing to grow in some years due to economic expansion, industrial activity, or shifts in policy. The outlook depends on a constellation of factors: macroeconomic growth in developing economies, technological breakthroughs in clean energy and CCUS, policy incentives for energy efficiency, and the price dynamics of competing fuels. The longer-term trajectory will hinge on how rapidly and effectively societies can decarbonize while maintaining affordable, reliable energy for all.

Conclusion: a pivotal moment for energy strategy

The record coal consumption underscores the ongoing complexity of securing affordable, reliable energy in a world facing climate imperatives. It highlights the divergent paths of nations as they navigate growth, energy access, and environmental stewardship. As policymakers, industry leaders, and citizens grapple with these realities, the next several years will be decisive in shaping how the global energy system evolves—balancing the immediate needs of today with the climate commitments of tomorrow. The global community stands at a crossroads where the past’s energy skeleton informs tomorrow’s ambitions, and where the outcome will influence economic resilience, public welfare, and the health of the planet for generations to come.