Minnesota Day Care Fraud Case Reopens Scrutiny of Subsidized Child Care Programs

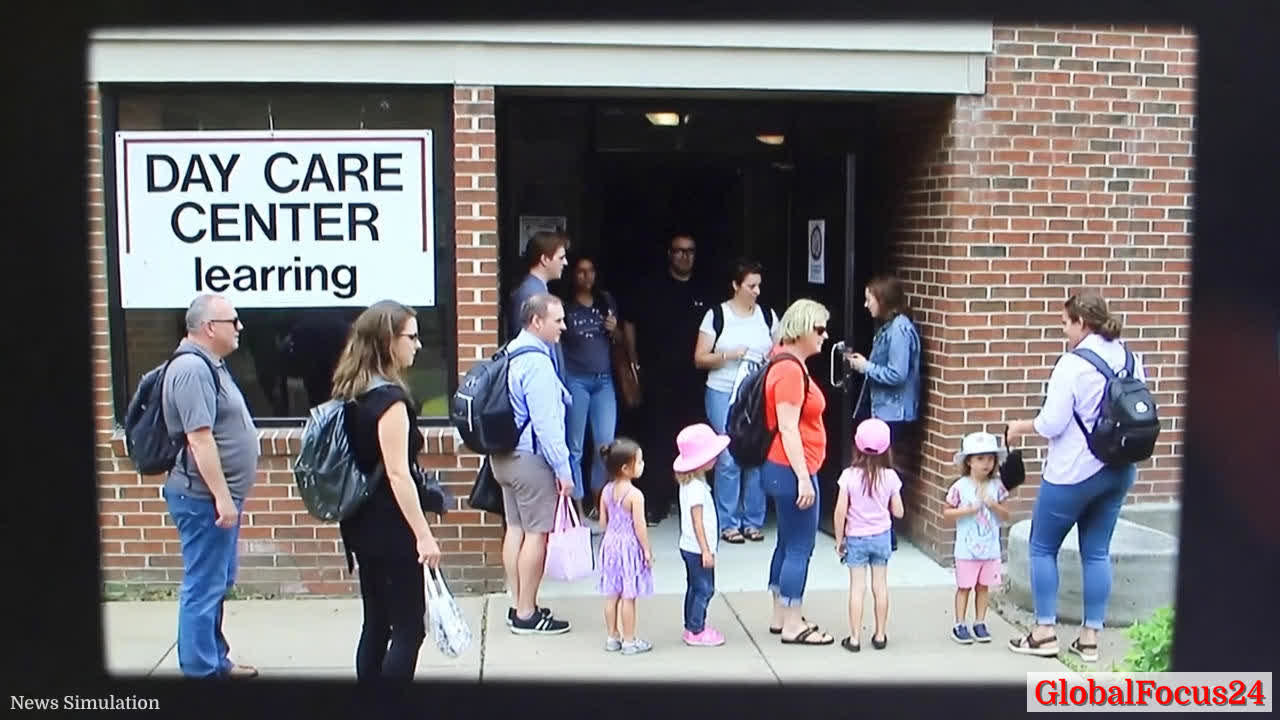

A long-dormant fraud case involving a Minneapolis-area day care center has resurfaced attention on the integrity and oversight of government-subsidized child care programs. Newly circulating footage from 2015 portrays parents signing in their children at a center and departing moments later, with state reimbursements claimed for full days of care that officials say were not delivered. The episode, tied to a broader pattern of alleged exploitation of public funds, underscores ongoing questions about program governance, monitoring, and safeguards designed to prevent misuse of taxpayer resources.

Historical Context: The Rise and Risk of Subsidized Child Care

Public subsidies for early childhood education and care have expanded in tandem with broader social policy goals—expanding access for working families, supporting children’s development, and stimulating local economies. Over the past two decades, governments across the United States have implemented funding streams to cover a substantial portion of child care costs, often routed through a mix of state-authorized programs and federal grants. The intention behind these programs is clear: reduce financial barriers for families while sustaining a stable, accessible care system for young children.

However, the expansion has also introduced complexities. Providers must navigate a patchwork of eligibility rules, reimbursement rates, and performance reporting. Where oversight is fragmented or outdated, vulnerabilities can emerge. The Minneapolis episode, if corroborated, would join a historical pattern in which some operators exploit loopholes or misrepresent services to secure funding. Such cases have prompted periodic reforms—from tighter auditing practices to enhanced data-sharing between agencies—yet observers caution that fraud risks persist whenever program integrity mechanisms lag behind evolving schemes.

Economic Impact: Measuring the Cost and Consequences

Public funds directed to child care subsidies carry weighty economic implications. On one hand, well-run subsidies reduce parental costs, enable workforce participation, and support early childhood development. On the other hand, fraudulent activities drain financial resources that could be allocated toward genuine services, staff development, and program improvements. When misappropriation occurs, it often triggers cascading effects: reduced confidence among families relying on subsidies, increased scrutiny that may slow legitimate providers’ access to funding, and heightened enforcement costs for government agencies.

Analysts watch several indicators to gauge impact. Direct program disbursements are reviewed for anomalies such as “inactive” centers that continue to bill for full days, or facilities with signs of limited attendance. Audit results, reimbursement patterns, and cross-agency data matching help detect discrepancies. In cases where fraud is confirmed, financial losses can be substantial, and recovery of funds may require court action, civil penalties, and, in some instances, reparative measures for affected families.

Regional Comparisons: How Minnesota Fits into a Broader Picture

Minnesota’s experience sits within a broader national landscape of child care funding programs subject to scrutiny. Similar investigations in other states over the past decade have highlighted two recurring themes: the complexity of funding structures and the challenge of continuous, real-time oversight at scale. In regions with dense networks of licensed providers, the opportunity for misreporting increases if monitoring relies heavily on periodic audits rather than continuous data analytics.

Compared with states that have invested heavily in shared data systems and near-real-time payment monitoring, Minnesota’s response reflects a balance between maintaining accessible services and strengthening verification processes. Regions with higher administrative capacity and proactive fraud-prevention measures tend to report faster detection of irregular billing and swifter investigative action. The Minnesota case thus serves as a domestic reference point for evaluating how well child care subsidies align with program integrity goals, especially when fraud attempts cross jurisdictional boundaries or involve multiple stakeholders.

Investigation and Oversight: What’s Known and What’s Next

Public officials have framed the episode as part of a broader challenge: ensuring that every dollar designated for child care reaches its intended purpose and beneficiaries. The reported involvement of multiple parties—parents, centers, and intermediaries—suggests a coordinated effort that premiums on ease of access and reimbursement while circumventing service delivery standards. Authorities have indicated that federal resources are being applied to unravel the mechanics of the scheme, including potential charges related to fraud, conspiracy, or misuse of funds.

Ongoing investigations emphasize several accountability mechanisms. First, robust enrollment and attendance verification is essential to confirm that services billed were actually provided. Second, strengthening data-sharing protocols between state agencies, licensing boards, and law enforcement can help detect anomalies more rapidly. Third, transparent reporting and public disclosure of audit findings promote accountability and deter future wrongdoing. Finally, facilitating effective whistleblower channels and independent oversight bodies can uncover suspicious activity that might otherwise remain hidden.

Public Reaction: Community Response and Trust

When stories of misuse surface in publicly funded programs, reactions among families, providers, and taxpayers are often swift and multifaceted. Some communities express concern about access barriers, worried that heightened scrutiny could unintentionally disrupt legitimate services or lead to tighter eligibility criteria. Others advocate for stronger safeguards, arguing that the public must hold implementers accountable to protect scarce resources and ensure children receive reliable care.

Media coverage and official communications have a role in shaping public perception as investigations unfold. Clear, accurate reporting—focusing on what is known, what is under review, and what safeguards are being put in place—helps maintain trust in the system while acknowledging past failures. In times of heightened public interest, authorities may also explore interim measures such as targeted audits or temporary policy adjustments to prevent further losses while investigations proceed.

Policy Implications: Strengthening Safeguards Without Reducing Access

The intersection of child care funding, program integrity, and access to services presents policymakers with a delicate balancing act. Several policy options are often considered in the wake of fraud findings:

- Enhanced verification: Implement real-time or near-real-time attendance verification to ensure billed services align with actual care provided.

- Data interoperability: Create standardized data-sharing frameworks across licensing, welfare, and anti-fraud units to enable rapid cross-checking of enrollment, attendance, and payments.

- Independent audits: Institutionalize regular, independent audits of high-risk providers and subgrantees, with actionable recommendations and timely follow-through.

- Sanctions and recourse: Establish clear penalties for fraudulent actors and streamlined processes to recover misappropriated funds, with protections for legitimate providers who may be inadvertently affected.

- Accessibility safeguards: Design safeguards that maintain or improve access to care for families while ensuring that subsidies reach the intended recipients.

These policy levers aim to deter fraud, protect taxpayers, and preserve the core objective of subsidized child care: enabling families to work and children to thrive in stable learning environments.

Historical Lessons: From Missteps to Modern Safeguards

Historical casework across similar programs demonstrates that fraud often arises not simply from rogue individuals but from gaps in system design. Solutions that endure typically combine technology, governance, and community oversight. The lessons are consistent: when oversight is strong, even complex subsidy ecosystems can function with reduced risk of misuse; when oversight lags, vulnerabilities proliferate, inviting schemes that exploit the margins between authorized funding and actual services.

Conclusion: A Call for Vigilant, Purpose-Driven Reform

The resurfaced footage and related inquiries illuminate an overarching objective: protect the integrity of subsidized child care while preserving access for families who rely on these services. A measured, data-informed response—rooted in transparent investigations, rigorous verification, and principled policy reform—can help restore confidence in a system designed to support frontline workers, support families, and foster healthy early development for children.

As investigations proceed, stakeholders across government, providers, and communities can contribute to a more resilient framework. The ultimate measure of success will be not only the recovery of funds but the establishment of robust safeguards that deter future exploitation while ensuring that every child receives safe, reliable care and every eligible family maintains access to essential support. Public attention remains warranted, yet tempered by a commitment to factual reporting, careful analysis, and steady progress toward an accountable, high-performing child care subsidy system.