US Leads Global Tech Innovation with Record Number of Profitable Firms

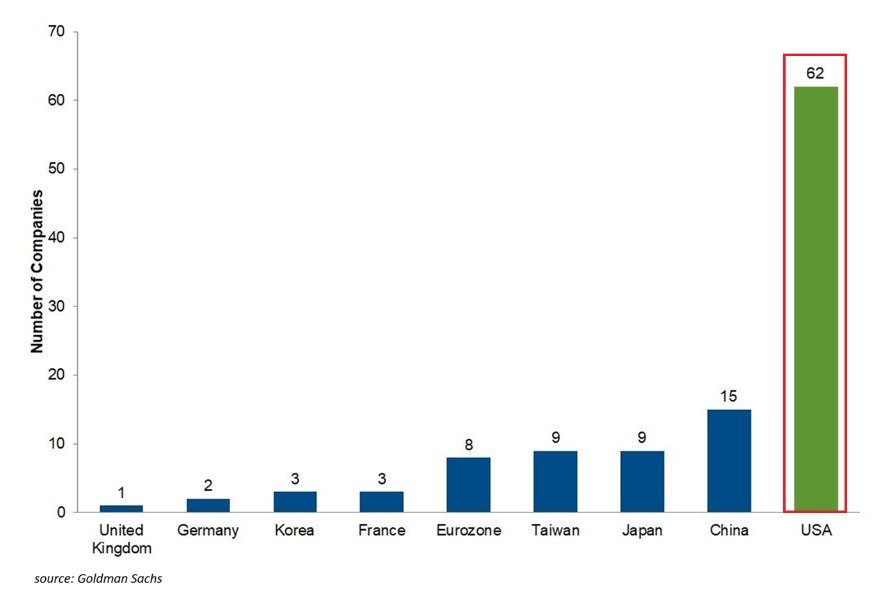

In a striking demonstration of economic resilience and technological leadership, the United States has reached a record milestone in the tech sector: 62 technology companies report net annual profits exceeding $1 billion. This milestone, which underscores the depth and breadth of American innovation, surpasses every other nation and signals a continued edge in software, semiconductors, cloud computing, artificial intelligence, and related fields. The figure represents not just a tally but a narrative about scale, capital markets, research ecosystems, and the capacity to monetize breakthrough ideas at a global scale.

Historical context: a decades-long arc of venture funding, university–industry collaboration, and policy stability The United States’ ascent in high-profit tech firms did not happen overnight. Its current landscape rests on a long arc that began in the late 20th century, when private capital, a robust patent regime, and a permissive regulatory environment interacted to accelerate innovation. The emergence of personal computing, the internet, and then cloud-enabled services created a virtuous cycle: successful firms attracted more investment, which funded further R&D, which in turn produced more profitable outcomes. American universities and research institutions have long supplied a pipeline of talent and ideas, while a mature market for corporate financing, mergers, and acquisitions enabled rapid scaling.

In this context, a record of 62 profitable firms reflects not only corporate performance but the vitality of the broader ecosystem. It demonstrates the capacity of American firms to monetize technology across multiple eras—from the early software and semiconductor waves to the current era of AI, cybersecurity, and advanced analytics. The breadth of profitability also highlights strategic diversification, enabling companies to hedge against sector-specific downturns and regulatory changes while maintaining sustained growth.

Economic impact: profitability as a proxy for investment, jobs, and productivity Profitable tech firms contribute to the economy in several interlocking ways. First, they generate capital returns that attract both domestic and international investors, fueling continued innovation and expansion. Second, they create high-skilled jobs across engineering, data science, product development, and support services, contributing to regional economic development and wage growth. Third, profitable tech companies often invest in complementary sectors—cloud infrastructure, cybersecurity, logistics, and digital platforms—creating a multiplier effect that extends beyond the tech industry itself.

The scale of profitability also has macroeconomic implications. Sustained profitability in technology often correlates with productivity improvements across industries, as firms deploy software automation, data-driven decision-making, and AI to optimize operations. That, in turn, can boost competitiveness for firms across the economy, from manufacturing to services, and support stronger gross domestic product (GDP) growth over time. Additionally, profitable tech firms tend to invest in research and development, further expanding the nation’s technological frontiers and sustaining its leadership position in global markets.

Regional comparisons: how the United States stacks up against other major technology hubs The United States’ lead in profitable tech firms stands out when viewed through a regional lens. China, the world’s second-largest economy, has a considerably smaller tally of tech firms reporting net profits above $1 billion, with 15 such companies. Several factors shape this divergence, including different corporate governance models, state involvement, market structure, and approaches to intellectual property. While China has achieved remarkable scale in areas like telecommunications hardware, e-commerce platforms, and AI development, the distribution of profitability across firms shows a different pattern than that observed in the United States.

Japan, Taiwan, and the Eurozone—traditionally important technology centers—also contribute to the global tech ecosystem, yet their combined counts fall short of the U.S. figure. This gap speaks to differences in market dynamics, venture capital ecosystems, and the tempo of commercialization. In the United States, the combination of a mature capital market, a large base of globally oriented firms, and a culture that rewards rapid scaling has translated into more companies achieving the profitability threshold.

A closer look at market leaders reveals a concentration of successful American technology firms across several subsectors. Software-as-a-Service (SaaS), cloud infrastructure, semiconductors, cybersecurity, fintech, and AI platforms collectively drive the profitability mix. The relative strength of these sectors in the United States—bolstered by robust venture funding, large domestic demand, and prolific research institutions—helps explain why a large number of firms reach the $1 billion profitability milestone.

Emerging themes: innovation, resilience, and the evolving competitive landscape Several contemporary themes help explain why the United States maintains its edge in profitable tech firms. First, constant innovation—driven by substantial private R&D investment—continues to fuel new product categories and service models. Second, scale advantages persist: large customer bases, global distribution networks, and prominent brand recognition enable faster revenue growth and profitability. Third, the consumerization of enterprise technology creates durable demand for software and services that can be monetized at multiple price points and through diverse business models.

Resilience in the face of macroeconomic headwinds is another hallmark. The tech sector has navigated cycles of interest-rate adjustments, supply chain disruptions, and geopolitical tensions by leaning on diversified revenue streams, strategic partnerships, and a focus on high-margin products. This adaptability helps firms weather volatility and maintain profitability trajectories even when operating conditions change.

Public reaction and policy environment: optimism tempered by caution Public perception of the technology sector’s profitability and growth remains generally positive, reflecting the sector’s contribution to consumer convenience, business productivity, and global competitiveness. At the same time, stakeholders—employees, policymakers, and the broader public—are attentive to issues such as data privacy, cybersecurity, labor market impacts, and the long-term implications of automation. The optimal policy environment—one that supports innovation while safeguarding consumer interests—often emphasizes robust competition, transparent data practices, and incentives for foundational research. The United States continues to balance these priorities as firms push forward with new generations of technology.

Industry dynamics: funding, talent, and global supply chains A key driver behind the record number of profitable tech firms is access to capital. Venture capital and private equity funding have remained active, enabling early-stage startups to reach scale more quickly and mature companies to pursue strategic acquisitions. This funding environment, coupled with a mature public market for tech listings and follow-on offerings, sustains growth trajectories and profitability.

Talent pools across the United States—anchored by major tech hubs such as Silicon Valley, New England, the Pacific Northwest, and expanding centers in the Southeast and Midwest—support a continuous influx of skilled engineers, data scientists, and product managers. The result is a highly productive workforce that can sustain innovation over the long term. Global supply chains, meanwhile, provide the necessary components, platforms, and specialized services that underpin sophisticated tech products. Shortages or disruptions in these networks can influence profitability, but diversified sourcing and multi-region operations help mitigate risk.

Sectoral insights: where profitability is concentrated Within the landscape of profitable tech firms, certain subsectors exhibit strong profitability momentum. Cloud computing and enterprise software remain foundational, offering recurring revenue models that contribute to steady margins. Semiconductors and hardware firms that successfully scale production and manage supply chain costs also demonstrate robust profitability. AI-enabled platforms, cybersecurity solutions, and data analytics services are increasingly profitable as demand for sophisticated, scalable tech solutions accelerates across industries.

Regional comparisons extended: the Asia-Pacific and Europe Beyond the United States, Asia-Pacific markets continue to invest heavily in AI, 5G, and cloud infrastructure. Countries and regions with advanced manufacturing capabilities and strong software ecosystems show significant profitability in tech firms, though the relative concentration and scale differ from the U.S. model. In Europe, digital innovation remains strong but often emphasizes regulatory compliance, data privacy, and interoperability. The mix of public research funding, private investment, and industrial policy shapes profitability outcomes differently across European nations, creating a diverse but less centralized profit-elite landscape compared with the United States.

Implications for investors and policymakers: sustaining momentum while managing risk For investors, the record number of profitable tech firms signals a favorable risk-return profile in the technology sector. Diversified portfolios that blend established high-margin software businesses with growth-oriented AI and hardware ventures can offer resilience and upside potential. For policymakers, the challenge lies in maintaining a competitive edge while ensuring fair competition, consumer protection, and a well-functioning labor market. Strategic priorities include incentivizing foundational research, safeguarding intellectual property rights, and supporting talent development to sustain long-term profitability and innovation.

Looking ahead: what the profitability milestone suggests for the next decade If the current trajectory continues, the United States could see continued expansion in the number of profitable technology firms, driven by advances in artificial intelligence, quantum computing, edge processing, and next-generation networking. The resilience of the innovation ecosystem—supported by capital markets, research institutions, and market-driven incentives—indicates that profitability will remain a central gauge of success for tech companies. Regional leadership is likely to evolve as other economies accelerate their own innovation agendas, but the United States’ integrated approach to funding, talent, and scale positions it to maintain a commanding role in global tech leadership for years to come.

Conclusion: a defining moment for a dynamic, global sector The record count of profitable tech firms in the United States reflects a broader story about how innovation, capital, and markets interact to create enduring value. It highlights a mature ecosystem capable of translating groundbreaking ideas into profitable, scalable products and services. As regional players speed up their own innovation programs, the global tech landscape may become more competitive, yet the American model—characterized by breadth, capital access, and a culture of rapid execution—remains a powerful template for sustained profitability and technological impact.