Minnesota Faces Allegations of Multimillion-Dollar Welfare Fraud Tunneling Through Child Care and Health Services

A high-profile request from a top House Republican leader has thrust Minnesota into the national spotlight as officials confront allegations that hundreds of millions, possibly billions, of taxpayer dollars earmarked for child care and health services were misused or siphoned off by operators tied to Somali immigrant communities. The communications signal a pivotal moment for state leadership, with questions about oversight, accountability, and the integrity of public assistance programs that serve some of the state's most vulnerable residents.

Historical context

Public welfare programs designed to support families—especially those with lower incomes—have long grappled with the twin pressures of delivering timely aid while safeguarding against abuse. In Minnesota, the Child Care Assistance Program (CCAP) has been a key instrument in enabling parents to work or pursue education by subsidizing child care costs. The program, like many in the United States, operates with a layered structure: state-administered funding, federal matching, licensed providers, annual audits, and periodic investigations when anomalies emerge.

The allegations at hand echo broader historical patterns in which fragmented oversight, rapid funding cycles, and complex billing systems create opportunities for fraudulent activity. During the COVID-19 pandemic, the expansion of certain nutrition and welfare programs, as well as emergency relief measures, brought heightened scrutiny to how funds flow through state and local networks. In several states, including Minnesota, investigators have since pursued cases that question the efficiency and integrity of how dollars reach providers and families, as well as the adequacy of background checks, licensing, and program compliance.

Economic impact and regional comparisons

If the figures referenced in the allegations hold true, the implications for Minnesota’s budget could be substantial. Misappropriated funds divert resources away from essential services and can constrain the ability of state agencies to serve providers, families, and healthcare customers. The financial ripple effects extend beyond the CCAP, potentially influencing Medicaid and other human services programs that rely on federal and state dollars, and potentially affecting grant allocations, provider reimbursements, and budget planning for the coming fiscal years.

Within the Upper Midwest, neighboring states have confronted related concerns about program integrity, provider licensing, and cross-border provider networks. While each state operates its own CCAP or equivalent program with distinctive rules, the underlying governance challenges—ensuring funds reach intended recipients, preventing duplicate transactions, and validating service delivery—are common themes. The Minnesota case, if substantiated, could prompt policy reviews in neighboring states and could drive broader discussions about standardizing licensing databases, cross-state data sharing, and more robust pre- and post-funding audits for early-learning centers and health-care facilities that participate in publicly funded programs.

Key figures and allegations

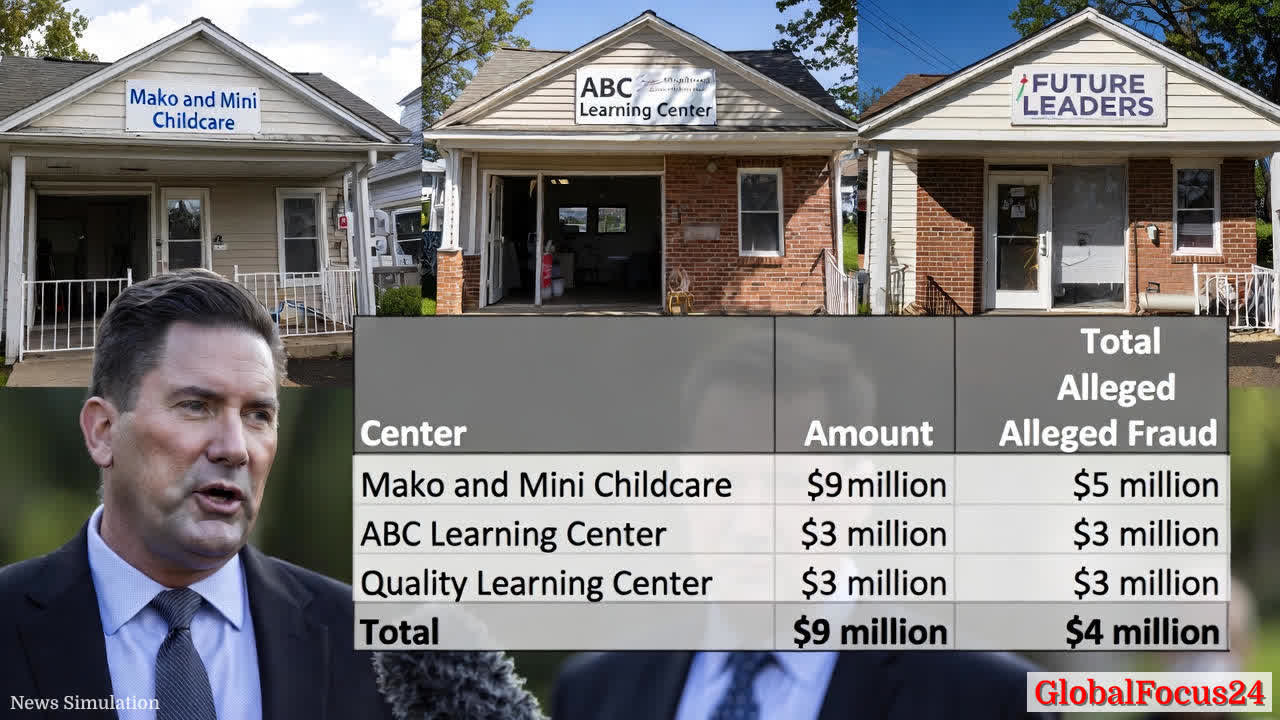

The core of the current discourse centers on an investigation that identifies several Somali-owned childcare centers and healthcare facilities as receiving substantial state and federal payments while allegedly failing to provide verifiable services. Among the named cases are facilities that reportedly received significant funding while operating from vacant or underutilized premises, or without consistent documentation of activity. The narratives describe patterns that include large annual disbursements for a small number of children, licensing irregularities, and rapid reemployment of closed entities under new names, which raised questions about oversight gaps and potential circumvention of licensing processes.

In addition to child care, the allegations extend to Somali-owned healthcare operations sharing addresses or facilities in Minneapolis, with investigators noting sizable sums routed through a single building. The scope described by the investigators paints a picture of a multi-layered scheme involving both early-childhood and health services, underscored by concerns about documentation, rate-setting, and the traceability of funds from state and federal sources to service delivery.

Response from elected leadership and agencies

The political and administrative response to these allegations has been swift and multifaceted. A prominent member of Congress has publicly criticized the administration for what is described as a breakdown in accountability, calling for an exhaustive and transparent accounting of funds, rigorous audits of centers before continuing funding, and decisive actions against entities that fail to meet program requirements. The tone of the public statements reflects a broader demand for accountability and a swift restoration of public trust.

Beyond partisan rhetoric, state agencies tasked with program integrity—together with inspector generals, auditors, and licensing boards—face pressure to deliver concrete findings. This includes clarifying what steps were taken to flag irregular activity, how investigations were conducted, whether centers previously investigated were allowed to reopen under new names, and what measures will be implemented to prevent recurrence. In parallel, lawmakers have pressed for policy changes that could include licensing revocations, intensified provider background checks, enhanced anti-fraud procedures, and potentially criminal investigations where evidence supports such action.

Legal and regulatory considerations

From a regulatory standpoint, the situation illuminates the delicate balance between rapid funding to support families in need and the necessity of robust verification mechanisms that deter fraud. The CCAP, by its design, requires providers to submit documentation, maintain licensing compliance, and adhere to established rates for reimbursement. When discrepancies arise—such as incongruent activity reports, mismatched addresses, or anomalies in service delivery—the natural response is a layered audit process, followed by corrective actions.

If investigations substantiate fraud on this scale, Minnesota could face a range of outcomes, including civil recoveries, license suspensions, and criminal prosecutions. The state may also reassess how it conducts provider audits, whether to require more frequent site visits, and how to implement data analytics that can detect unusual billing patterns earlier in the funding cycle. Any regulatory adjustments would be designed to minimize disruption to families who rely on licensed childcare and healthcare services while reducing the risk of misuse in the future.

Public reaction and societal context

Public sentiment around welfare programs often oscillates between concern for vulnerable families and skepticism about how funds are allocated and monitored. In Minnesota, stories of alleged fraud in publicly funded services can evoke strong emotions and shape broader debates about immigration, community safety, and the efficiency of government programs. It is essential to distinguish between allegations and proven facts, ensuring that reporting and policy discussions focus on verifiable evidence and due process.

Advocacy groups supporting immigrant communities may emphasize the importance of fair enforcement and the protection of legitimate providers who deliver essential services. They also underscore the need for robust fraud prevention without stigmatizing entire communities. Meanwhile, policymakers and taxpayers alike seek assurance that public dollars are used as intended, that vulnerable families are safeguarded, and that the program structure remains resilient against abuse.

Methodologies and investigative approaches

Advanced data analytics play a critical role in identifying patterns that signal potential misuse in large funding streams. Analysts can compare provider enrollment data, service delivery reports, licensing statuses, and billing records to flag inconsistencies. Cross-referencing with federal aid disbursements, licensing renewals, and workforce rosters helps build a comprehensive view of networked activity. Investigative methods typically combine documentary evidence with on-site reviews, interviews with stakeholders, and audits conducted by independent firms or state auditors.

Transparency remains a central objective in any such inquiry. Disclosing the scope of investigations, the criteria used to define “fraud,” and the timelines for findings helps maintain public trust. At the same time, investigators must safeguard sensitive information, particularly when allegations involve individuals or communities that could face stigmatization in the absence of verified conclusions.

Historical parallels in public accountability

Historical episodes where public funds were misused inspire both policy reforms and operational changes. In several instances, large-scale fraud investigations led to tighter licensing standards, the creation of centralized provider registries, and enhanced monitoring of reimbursements to prevent duplicate billing and phantom service delivery. While each case has unique attributes—ranging from healthcare to nutrition programs—the underlying imparted lesson is consistent: timely detection, decisive action, and systemic improvements are essential to maintaining program integrity.

Implications for the broader welfare landscape

The Minnesota case could have ripple effects across public assistance ecosystems. If proven, it may prompt intensified scrutiny of other publicly funded programs and encourage states to reassess procurement, licensing, and reimbursement processes. Lessons learned—such as the value of real-time data monitoring, the importance of independent audits, and the benefits of inter-agency cooperation—could influence federal guidance and best practices in program integrity.

Operational and administrative reforms that emerge from this inquiry might include standardized provider enrollment procedures, enhanced background screening for childcare operators, and improved oversight over multi-site operations that share addresses or corporate structures. Additionally, regional collaborations among state auditors and inspector generals could emerge to share insights and combat cross-border fraud more effectively.

Conclusion

The allegations of extensive welfare fraud tied to CCAP funds and Somali-operated facilities have set the stage for a defining moment in Minnesota’s administration of public aid. The coming weeks and months are likely to reveal the depth of the issue, the effectiveness of oversight mechanisms, and the steps the state will take to protect taxpayer money while ensuring that legitimate providers can continue to support working families. As authorities conduct their investigations, the core objective remains clear: to ensure accountability, safeguard essential services, and uphold the integrity of programs designed to help those in need. The public, stakeholders, and residents across Minnesota will be watching closely as more information becomes available and as policymakers translate findings into actionable reforms.